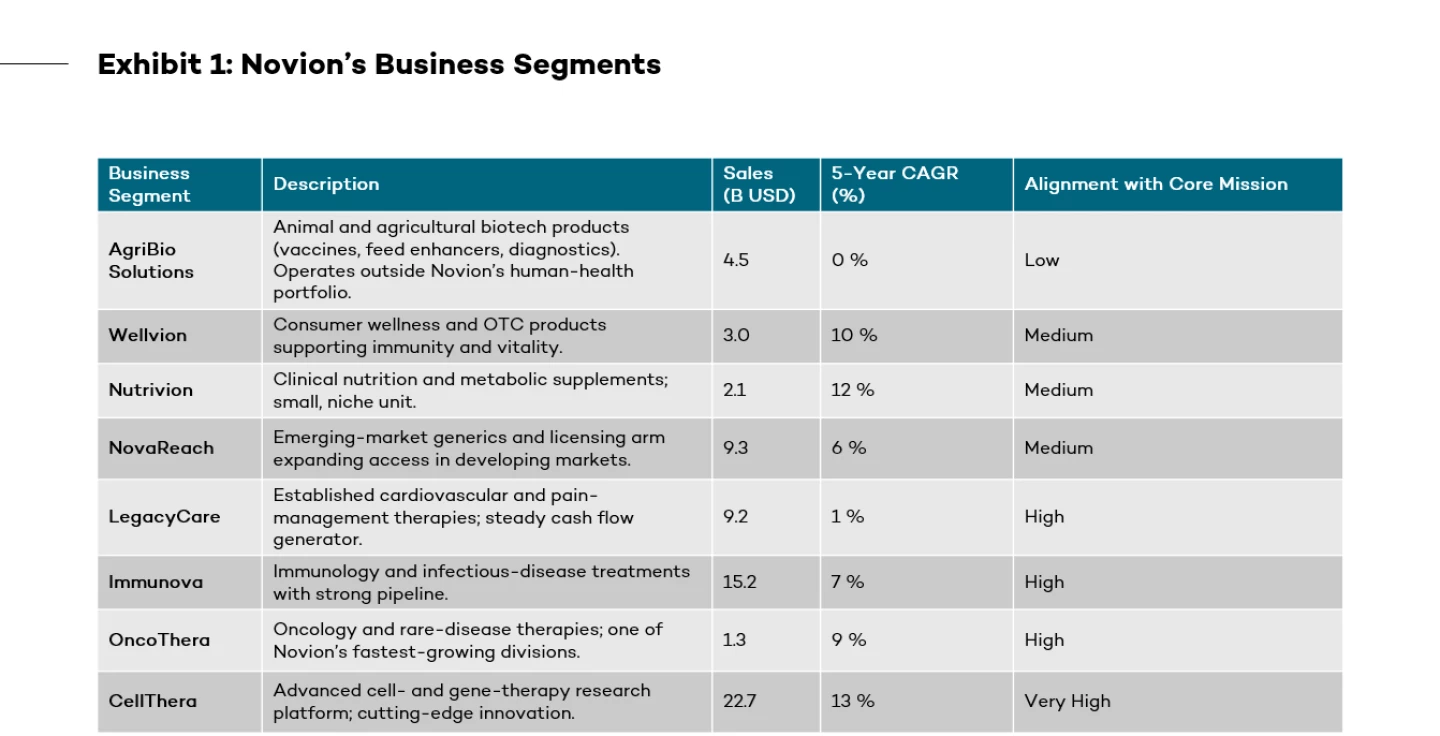

Your client is Novion Therapeutics, a leading American biotech company focused on gene and cell therapies. With a market capitalization of around $120 billion, Novion is recognized for its innovations in rare disease treatments and its mission to advance human health through breakthrough biotechnologies in immunology, oncology, and genetic medicine.

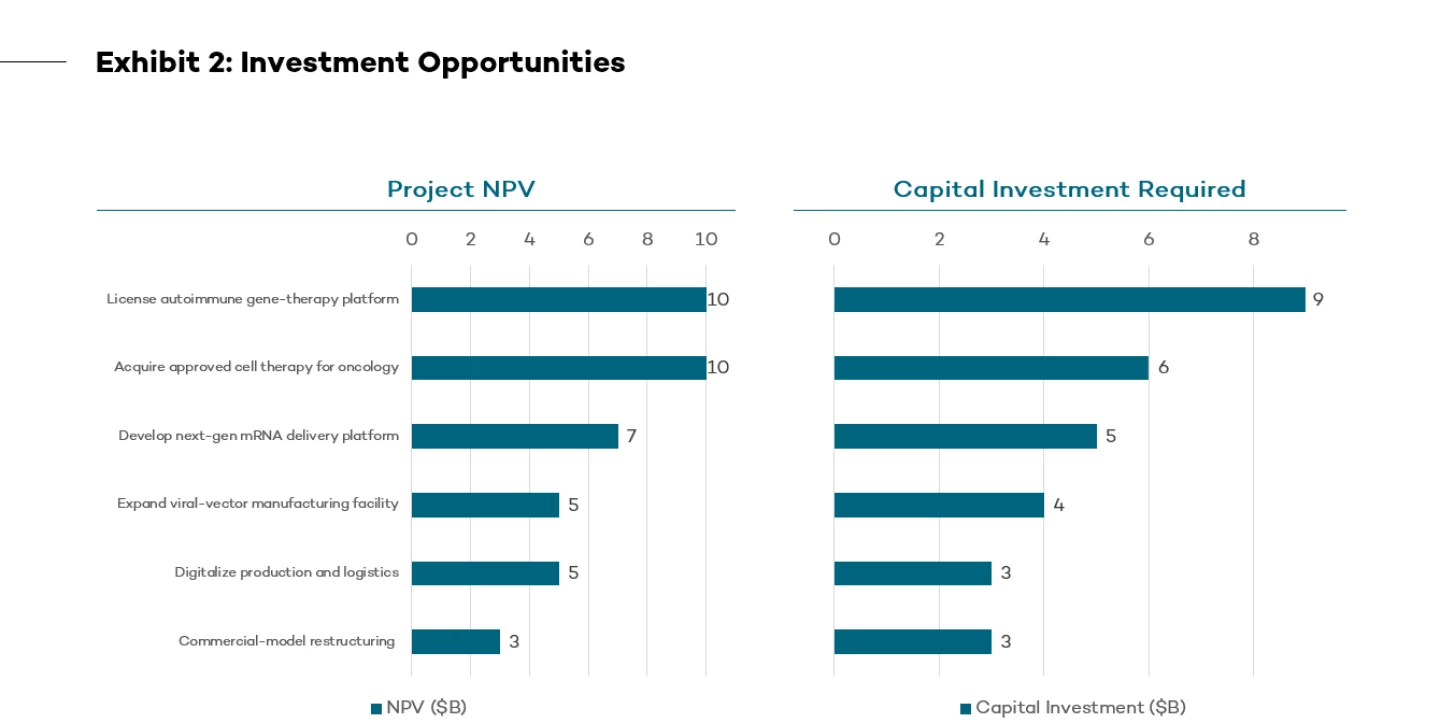

Recently, the company has faced growing investor pressure. Despite strong products, its firm-value growth has stagnated, and investors are expecting a visible strategic move within the next quarter. The CFO has identified several high-growth, capital-intensive R&D and acquisition projects, but Novion lacks sufficient cash reserves to fund them. What should the CFO do next?

Novion Therapeutics