Case Math

When preparing for case interviews, you'll quickly find that "fixed costs" and "variable costs" always come up. These concepts are important not only for financial analysis but also for strategic decision-making in companies. Let’s explore what these costs are and how you can skillfully use them in your cases. ✨

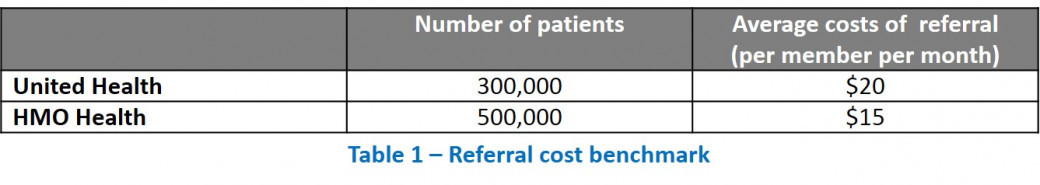

Unified Health

i