Your client is the CEO of a Europe-based mobile Telco operator, SuperMovil.

Their business model is very unique: they are a “virtual Telco”. They differ from traditional mobile operators (e.g. Vodafone, T-Mobile, Telefónica/O2, etc.) in that they do not own optic fiber, antennas and satellites, but instead partner with the cited traditional Telcos and rent capacity in order to offer their services. Hence, they differ from the classical Telco, since they don't make big CAPEX investments.

Your client has expressed interest in expanding her company’s operations to a new country.

Which are all the factors you would take into consideration to orchestrate this geographical expansion?

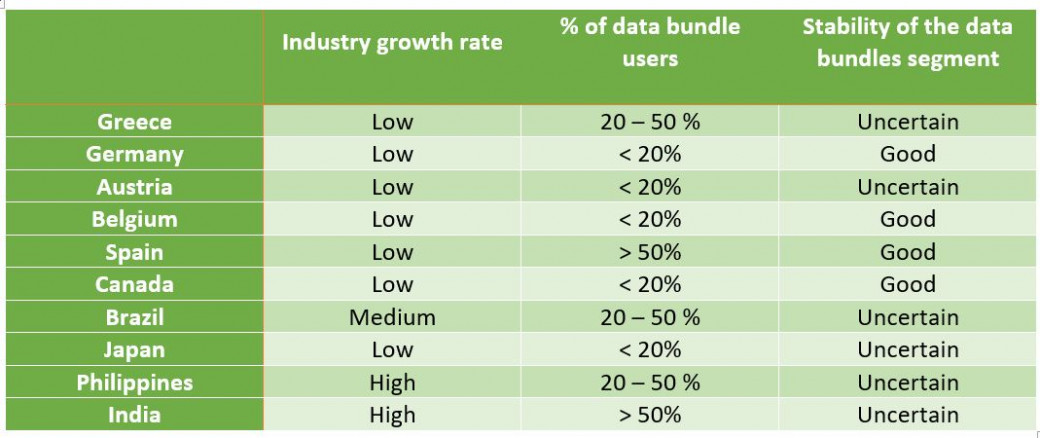

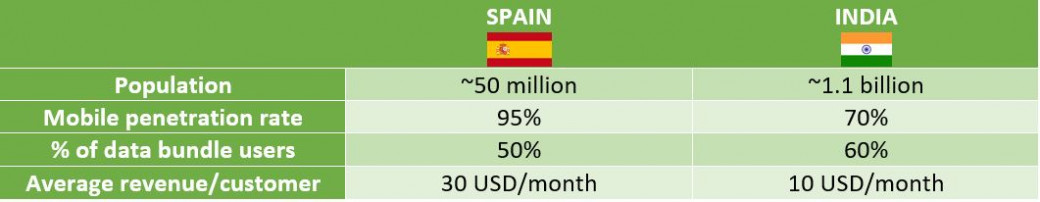

*Note: The M&A department has shortlisted 10 countries as top candidates, but this info will be provided and worked on later on in the case.

SuperMovil - Telco startup market expansion

i