A printing company is planning to take over another printing company with similar technology and printing machines. The candidate is supposed to evaluate the acquisition by answering a line of questions that are presented in the “suggested approach” section.

Case Prompt:

Sample Structure

The general process for solving the case is as follows:

I. Analysis – Question 1: What are the benefits in concentration of production? What related risks have to be taken into consideration?

The two companies „Tyrolia Print“ and „Paper Print“ have one production site each and are specialized on rotogravure printing technology (a technology for printing large batches). Overlap of customers is approximately 75%, i.e. 3 out of 4 customers of one company are also customers of the other company. All production machines of both companies are similar and can replace each other. Due to the harsh competitive situation in the industry, excess capacity and small profit margins, Paper Print plans to take over Tyrolia Print. The Tyrolia Print production site would be shut down after the merger and integrated into the Paper Print site.

Directly after clarifying the basic situation above with the candidate, the interviewer should go through question by question with the candidate.

The discussion with the candidate should focus on these issues.

The candidate may bring up different or related issues as well, therefore the interviewer needs to have a good general understanding of the situation as well.

- Economies of scope

- Economies of scale

- Downsizing of overhead

- Reduction of labor headcount

- Better utilization of production resources

- Planning Higher negotiation power

- Higher risk for customers if there is only 1 production site (major natural impacts, etc.)

- Bad image due to closing of one production site

- Risk of transaction

- Risk of post-transaction integration

I. Analysis – Question 2: Which one time earnings and expenditures occur in closing a production site?

- Sale of production assets

- Real assets incl. land

- Sale of licenses and patents

- Payments for social plans for layoffs

- Shut-down costs of the production site

- Legal and tax advisory costs

- Supplier payments if fixed contracts are terminated preliminarily

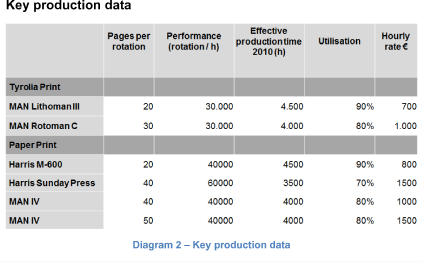

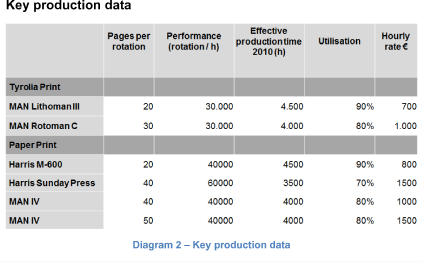

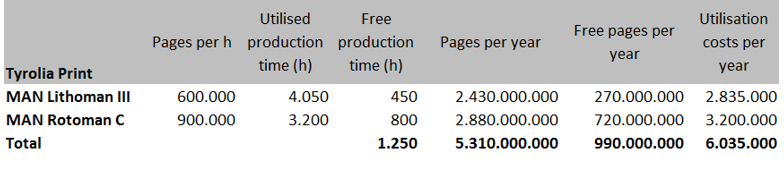

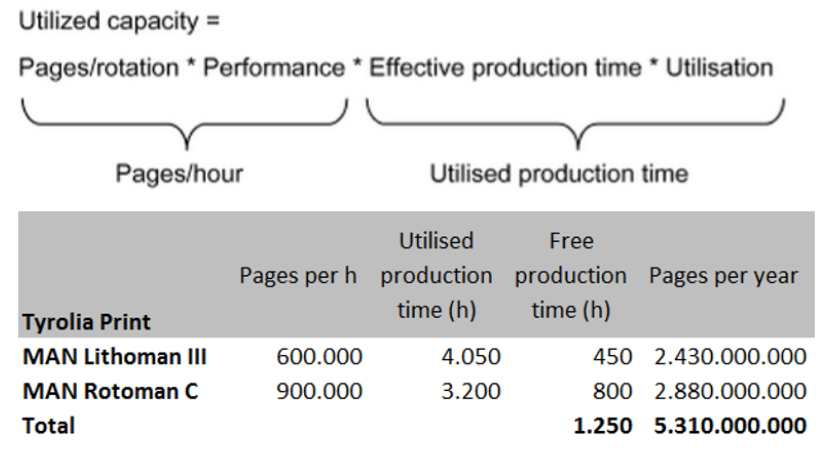

II. Calculation – Question 3: Can Paper Print fully integrate the entire Tyrolia Print production in its factory?

Share Diagram 2 without prompting by the candidate.

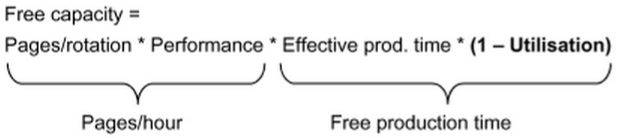

To speed the calculation up, the resulting free capacity can be shared. It is 5.76 billion pages.

Two steps are required:

1. The utilized capacity of Tyrolia Print has to be calculated. The utilized capacity is 5.31 billion pages.

2. The free capacity of Paper Print has to be calculated

As there is more free capacity in the Paper Print production site than needed, full integration is possible.

Assumption:

The specific types of machines are irrelevant, so the prints done with MAN machines can also be printed with Harris machines.

II. Calculation – Question 4: How much more or less expensive will the integrated production be?

Mention the following:

- In the integrated production process, all machines except Harris Sunday Press run at fully capacity.

- The hourly machine rates reflect only the actual costs per production hour for any amount of productive machine hours.

Two steps are required:

1. The utilization costs of the old Tyrolia Print production site.

The utilization costs are €6.035m

Utilization cost per year = Utilized production time * hourly rate

2. The additional utilization cost of the integrated production

It can be concluded that Harris Sunday Press has the remaining free capacity of the merged company which is 5.76 – 5.31 = 0.45b pages.

As the full capacity of Harris Sunday is 8.4b pages the machine has a utilization rate of about 95 %

New utilization cost per year = Additional production time * hourly rate

Harris M-600: 0.36 m = 4500 * 10% * 800

Harris Sunday Press: 1.31 m = 3500 * 25% * 1500

MAN IV: 0.8 m = 400 * 20% * 1000

MAN IV: 1.2 m = 400 * 20% * 1500

Total: €3.67m

III. Discussion – Question 5: Why did costs decrease, although hourly rates are higher? Will any other cost reductions occur? What would you recommend concerning the merger?

Assuming that no other effects (like economies of scale) are coming into effect, the costs are reduced by €6.035m – €3.67m = €2.365m

The Paper Print machines are able to print more pages per hour and need less time to print the amount of former Tyrolia Print. This has a higher effect on the production costs than the increasing hourly rates.

Economies of scale will reduce the average hourly rates. Due to higher utilization, fixed costs will be spread over a longer running time.

An overall recommendation is difficult, as most production topics are discussed. However, based on future production costs, synergies are possible and a merger can be recommended.

Further Questions

Suppose Tyrolia Print was already bought. What would be the most important steps in post-merger integration?

Suppose Tyrolia Print was already bought. What would be the most important steps in post-merger integration?

Typical discussion points:

- Prioritization of issues and definition of time frame

- Definition and concentration of new strategy

- Clear definition and careful implementation of new organization structure

- Ensuring communication flow within the new entity

- Standardization of reporting

- Enabling technological integration

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

Paper Print

i