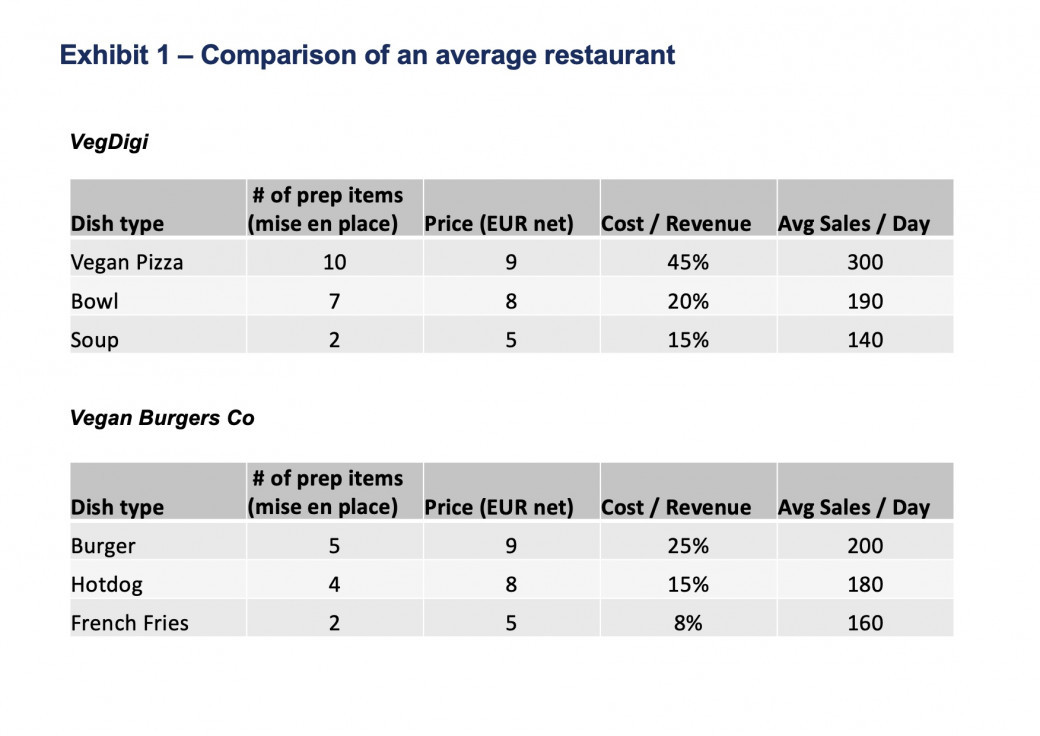

Our client is a European venture capital firm. They are potentially interested in investing into a new restaurant franchise player from Austria, called “VegDigi”. VegDigi has just 3 corporate restaurants in Vienna and no franchisees, yet, but their business model is considered innovative for a restaurant industry, and is based on 3 pillars:

- Proprietary IT system – VegDigi’s team has developed their own IT system (which manages all restaurant processes – from cashier desk and employee schedules to inventory management and delivery).

- Innovative vegan menu – VegDigi offers fresh, whole-foods vegan menu, which differentiates itself from the rest of the fast food offering in taste and quality. VegDigi puts a lot of focus on its foods being healthy.

- Transparent business practices and processes – VegDigi prouds itself to be a transparent business, meaning they publish all their data and talk about their success and failures openly online.

Our client has engaged us to help them to determine whether or not to make an investment into the VegDigi.

McKinsey Case: Digital & Vegan Restaurant Franchise

i