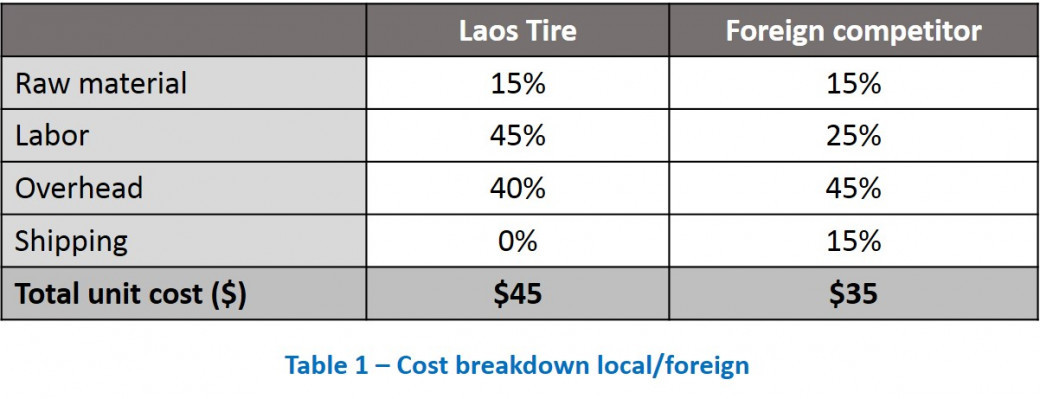

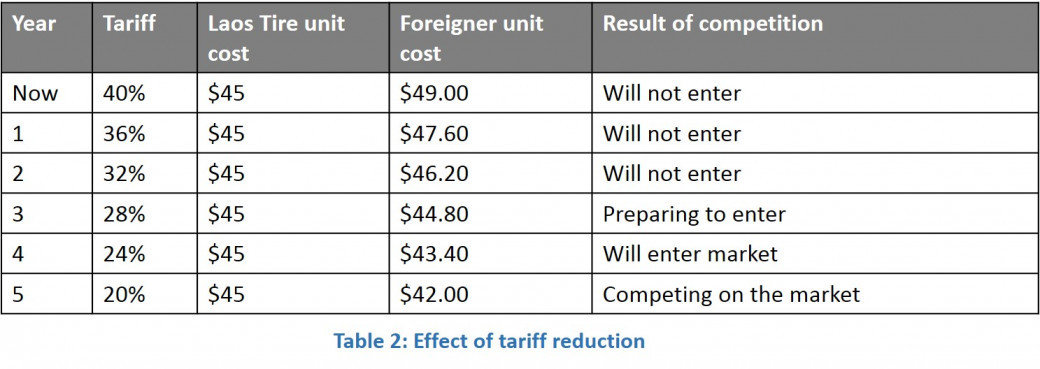

A manufacturer of tires in Laos has had a monopoly in the market for years due to high tariff on imports. If foreign producers wanted to import tires, they would have to pay a high import tariff which makes up 40% of the total cost to produce and ship to Laos. The Laotian government has now decided to lower the tariffs by 4% each year for the next ten years to open up the market to foreign companies and achieve lower consumer prices.

Our client is concerned this move will affect their market position and hired us to investigate the effects and help them decide what to do.

Laos Tire

i