Our client is a startup that can deliver broadband internet aboard commercial flights.The company owns a patent on a necessary technology. They want to know whether their current business model is valid.

Case Prompt:

1. How big is the market for inflight broadband in long-distance?

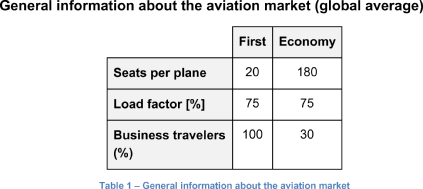

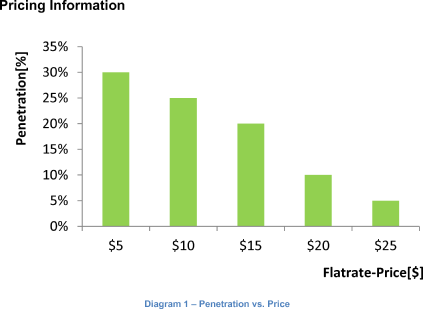

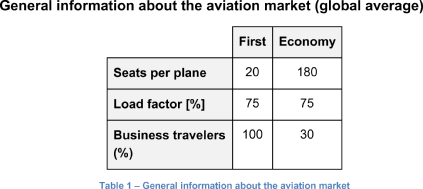

Share Table 1 and Diagram 1 (market information) to help the interviewee.

In the beginning, only business travelers are viewed as potential clients

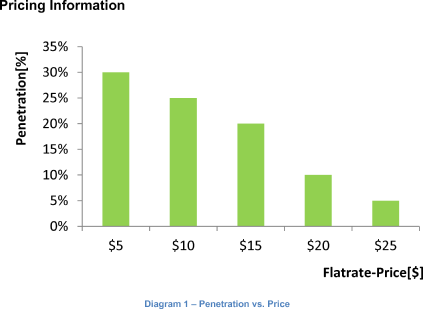

Penetration for flat-rate Internet vs. price (i.e.: % of business passangers expected to use the service on any given flight.)

Information that can be shared:

- The airline industry is interested in in-flight broadband.

- The startup charges customers per flight.

- The end-customers are the passengers, not the airlines.

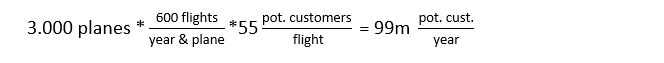

- Each airplane flies 600 long-distance flights per year. 3000 commercial airplanes worldwide.

Additional Information

- We assume that the average client uses 100 MB per flight

Before sharing this information, let the interviewee estimate the average data used per customer!

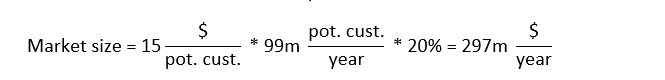

The total revenue per customer is set at $15. This is independent of the amount of data each customer uses.

First Economy Seats per plane 20 180 * load factor 0.75 0.75 = 15 135 * Business travellers (%) 100 30 = potential customers per plane 15 40.5

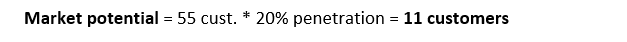

The interviewee should round down to 55 potential customers per flight.

Key Insight: There are 99m potential customers per year.

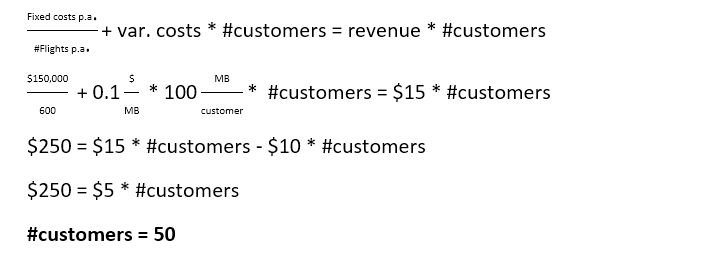

Using the survey’s price elasticity information (for an arbitrary number of 100 potential customers):

30 users at $5 = $150/flight 25 users at $10 = $250/flight 20 users at $15 = $300/flight 10 users at $20 = $200/flight 5 users at $25 = $125/flight

Key Insight: Total revenue is maximized at $15.

The potential market size is $297m/year.

2. How many customers does the startup need to break-even?

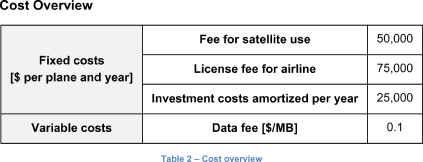

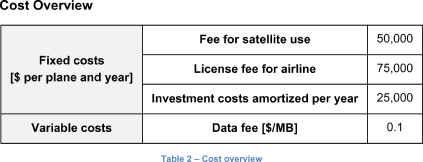

Share Table 2 with an overview of the costs, if inquired.

Information concerning the costs that should be shared on demand:

- The startup must pay satellite operators an annual satellite fee.

- In addition, the startup must pay the operator for every megabyte downloaded in-flight.

- The airline charges a yearly licensing fee.

- The investment costs include amortized acquisition and installation costs.

The interviewee can brainstorm cost segments.

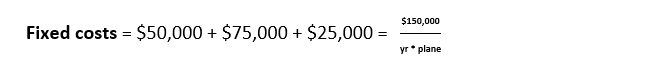

Calculated from Table 2 the fixed costs account for $150,000 per annum per plane:

We can use the following structure to calculate the breakeven number of customers per flight:

Costs = Total revenue

To break-even the startup needs 50 customers per flight.

3. What are the main risks involved?

This open-ended question is intended to analyze the candidate’s creativity.

Possible answers:

- Competitors could enter the market with a newer technology that provides faster connection speeds.

- To compete, the startup must invest in the newer technology, thus increasing fixed costs. If these costs are passed on to customers, the startup is at a competitive disadvantage.

- If airlines agree to work with the startup, licensing fees will probably be proportional to the startup’s revenue. Thus, as revenue rises, licensing fees also rise.

- When renegotiating the contract, the satellite company could demand higher fees due to reasons such as higher utilization of capacity. This would also decrease the startup’s competitive advantage.

- If the initial service does not work well due to severe connection problems or network failures, the startup could gain a bad reputation and lose customers. The airline could also argue that since the startup failed to provide service as promised, the airline can cancel the contract and search for another in-flight broadband partner.

- Since this service relies on cutting-edge technology, the hardware probably needs to be frequently replaced in order to keep up with market trends. Old hardware could lead to competitive disadvantages that can reduce the startup’s market share.

4. What would you advise the startup?

Possible answer:

- The business model does NOT seem promising because the number of customers required to break even is above the current market potential.

The startup should try to limit fixed costs increases because such increases will negatively affect their current business model.

- If the startup could request that the airline be responsible for investing in, operating and maintaining the equipment, the startup reduces their risk of forced unplanned hardware investments.

- To test the calculated market size and current business model, the startup should roll out the business on a small scale.

Further Questions

In the future, how can your client defend against competition from other in-flight broadband providers?

In the future, how can your client defend against competition from other in-flight broadband providers?

Suggested answers:

- Examples of market barriers to entry include economies of scale, technology patents, and government regulations. The startup’s patented technology could be a good barrier to entry.

- As soon as the startup has reached a certain size, the startup could use economies of scale to obtain discounts from Internet providers or satellite companies. They can also reduce hardware costs by ordering in bulk.

- The startup could also invest in R&D to develop new technologies that render the use of satellites unnecessary.

- The startup has first-mover advantage.

- To increase customer loyalty, it could provide incentives such as long-term subscriptions for frequent flyers.

- It could also provide perks for loyal clients such as faster connection speeds.

- Branding and advertising can help increase customer loyalty. This might allow the company to charge higher prices without losing customers.

Without your consent we cannot embed YouTube videos. Click the button below and accept the marketing cookies to allow YouTube videos to be embedded.

By allowing this service, you consent, in accordance with article 49 paragraph 1 sentence 1 lit. a GDPR, to your data being processed in the USA. The USA is not considered to have adequate data protection legislation. Your data could be accessed by law enforcement without prior public trial in court. You can change your settings regarding consent to external services at any time in our Cookie and Privacy Settings.

In-flight Broadband

i