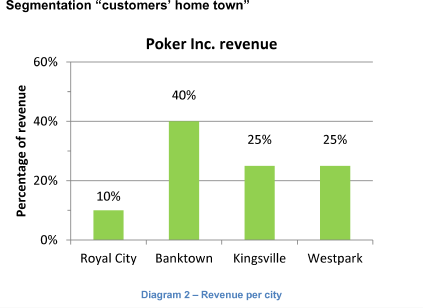

Poker Inc. is currently operating four casinos in Royal City. Competitors are right now planning to open up a rival casino in Kingsville.

Poker Inc. has hired our company in order to assess the consequences of the possible competitor opening and what strategies Poker Inc. should follow.

Gambling Business

i