Our client is a global fast-food restaurant that offers a wide range of breakfast and rest of day products including burgers, salads, fries, and beverages, and offers combo bundles. Over the last ~5 years in the US, our client has seen a relatively flat guest count, but a decline in profitability.

They have launched several

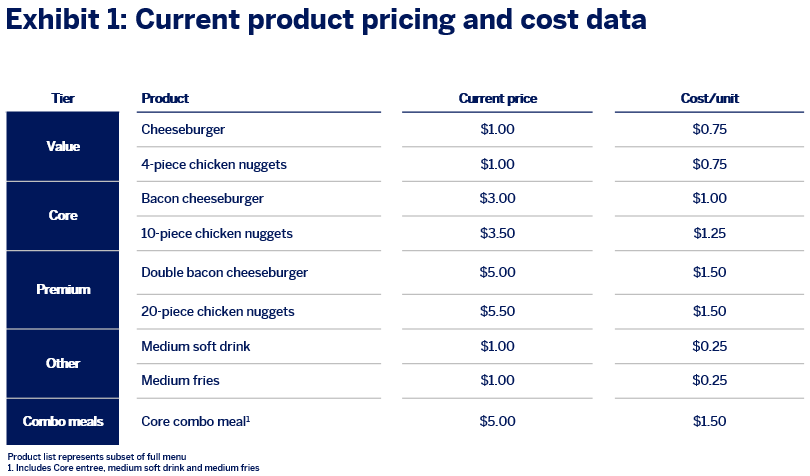

large national advertising campaigns focused on highlighting their "value" products which have not turned around profits the way they had hoped. The head of the US business has asked us to help him understand why gross margin is decreasing, and specifically to take a look at his menu's pricing.

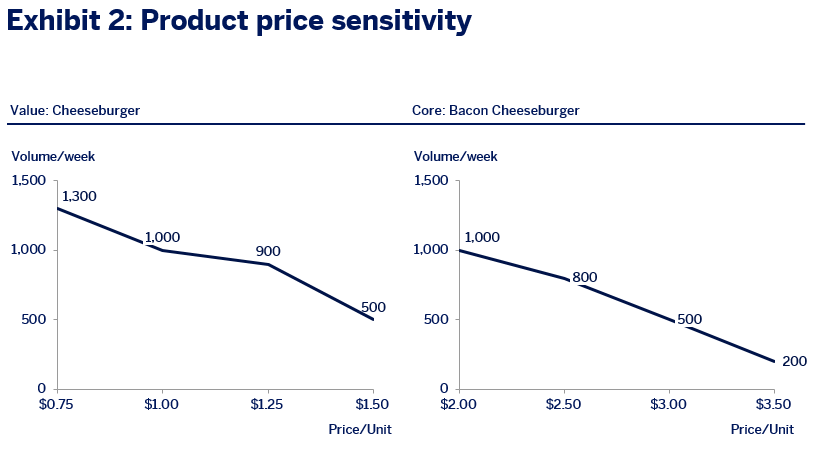

- Is there an issue with the menu pricing structure? If so, what would you recommend to restructure the pricing?

- What is the overall implications to volume and gross margin with a revised pricing structure?

Fast Food Pricing