Our client is a college that plans to add an inter-collegiate football team to its athletic program.

They have approached us in order to determine if that is a good idea.

Our client is a college that plans to add an inter-collegiate football team to its athletic program.

They have approached us in order to determine if that is a good idea.

The following framework/structure provides an overview of the case:

Information that should be shared with the interviewee:

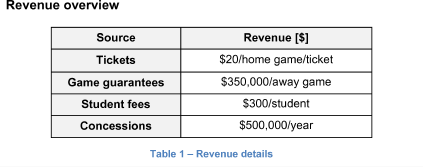

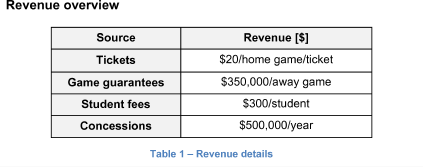

You should share table 1 with an overview of the revenue.

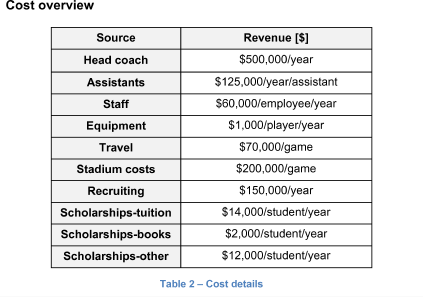

Information that should be shared with the interviewee. Here the focus should be on the operational costs (not capital):

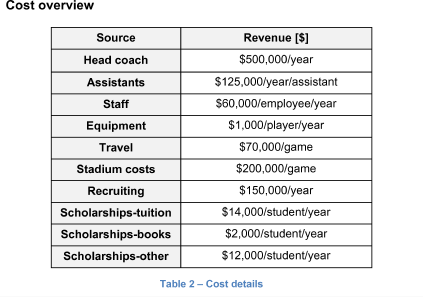

You should share table 2 with an overview of the costs.

The program is able to break even under the given assumptions.

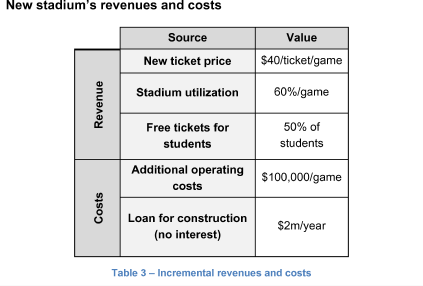

Information that should be shared with the interviewee:

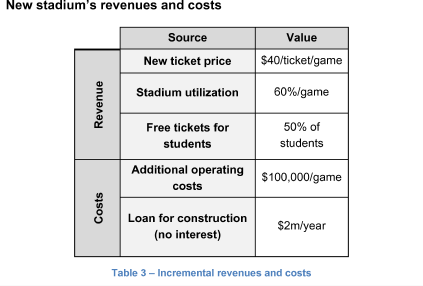

Share table 3 with an overview of the new revenues and costs.

There would be an incremental revenue of $0.4m.

Therefore the new stadium needed to enter the better league seems feasible.

Next tasks:

What other ways are possible to increase the football program profits?

What other ways are possible to increase the football program profits?

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

College Football

i