Your client, Wall Inc., is a dry wall manufacturer. A new competitor has just entered the market and is charging a lower price. Wall Inc. is considering reducing its own price by 20% in response. The client wants us to evaluate whether this is a good idea.

Case Prompt:

Sample Structure

The following framework would be a good approach:

I. Impact analysis - Part 1

How will a 20% price reduction impact Wall Inc.’s profit?

Information to provide if asked:

- Wall Inc. produces only one product.

- Sales volume will remain unchanged after the price cut.

- Wall Inc.’s and the competitor’s products are very similar.

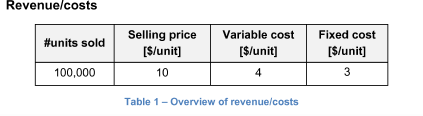

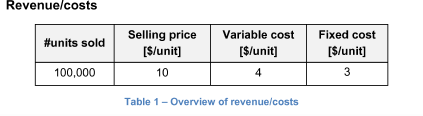

Share Table 1 (revenues and cost overview) if inquired by the interviewee.

Before performing calculations, the interviewee should have asked about any potential changes in sales volume.

Profit = Revenue - Costs

Revenue = 100k units sold * $10 per unit = $1,000k

Variable costs = 100k units sold * $4 per unit = $400k

Fixed costs = 100k units sold * $3 per unit = $300k

Profit = $1,000k - $400k - $300k = $3,000k

New price = Current selling price * 0.8 = $10 x 0.8 = $0.8

New revenue = 100k units sold * $8 per unit = $800k

Since the number of units sold does not change, costs remain the same.

New profit = $800k - $700k = $100k

Step 3: Interpretation

- The 20% price reduction reduces profit by two-thirds (from 300k to 100k).

- Profit margin falls from 30% (300k / 1,000k) to just 12.5% (100k / 800k).

- If sales volume stays constant, this strategy makes the company far less profitable.

I. Impact analysis - Part 2

How much market share can the client lose before reducing the price by 20% becomes an option?

We want to know: At the current price ($10), how much sales volume does Wall Inc. need to make the same $100k profit that it would earn after the 20% price cut?

So we’re comparing:

- Scenario A (price cut): Profit = $100k

- Scenario B (keep price but lose volume): How much volume can drop until profit = $100k

Currently, at $10 price:

- Revenue per unit = 10

- Variable cost per unit = 4

- Contribution margin per unit = 10 – 4 = $6

- From this $6, Wall Inc. pays fixed costs of $300k.

So every unit sold contributes $6 toward covering fixed costs and then to profit.

Let’s work backwards.

- Fixed costs = 300k (must always be paid).

- Target profit = 100k.

- So Wall Inc. needs to earn 400k total contribution (= 300k + 100k).

Since each unit contributes $6:

Required units = $400k/$6 = 66,667 units

Step 3: Compare with the current volume.

- Current units sold = 100,000

- Break-even units to match price-cut profit = 66,667

So Wall Inc. could sell only two-thirds of its current volume and still do as well as with the price cut.

That means it can afford to lose about 33% of its market share.

II. Competitors / Market / Customers

What additional information do you need before you can give a solid recommendation?

Information that can be shared on the interviewee’s inquiry:

- The competitor is a small company.

- Our main customers are contractors and small business owners. They buy products directly from us.

- Customers usually buy based on their relationship with the suppliers.

- They prefer certain brands.

- There is no information about price sensitivity.

- We do NOT have no long term contracts with customers.

- There is not much information about the competitor.

- The client has a strong brand presence.

- The client has been in the market for a long time.

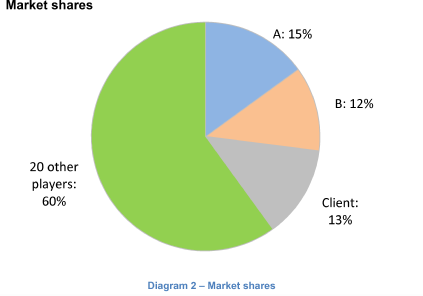

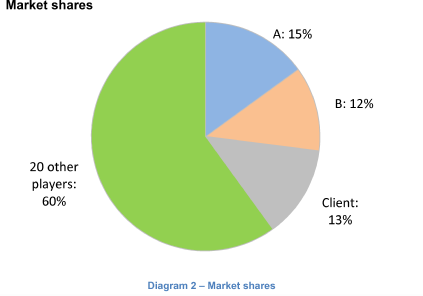

Share Diagram 2 (market share overview) if inquired by the interviewee.

The interviewee should find the main factors for solving the problem.

A well-structured plan would include:

- Market (number of competitors and their market share)

- Customer (preferences and price sensitivity)

- New competitor (size, advantages, disadvantages)

- Client (position in market, time in the market, brand)

Main conclusions

- The client is a relatively big player in a very fragmented market.

- The competitor seems to be only a small player.

- On average the new competitors market share will be around 60/21 = 2.85%

- The new competitor may take 2.85% of our client’s volume or compete with the other small-sized companies.

III. Conclusion

The interviewee should sum up his/her findings.

The client should NOT reduce the price because it will lead to a loss in profit that is equivalent to losing 33% of market share.

So far, it seems that the new competitor will take a maximum of 3% of the client’s market share.

There are two possible risks though:

- We could have underestimated the size of the new competitor.

- One of our bigger competitors could reduce their price in response to the new competitor’s low prices.

Further Questions

After the new competitor has entered the market, how can our client retain market share?

After the new competitor has entered the market, how can our client retain market share?

There are several possible solutions:

- Strengthen its client base

- Create barriers of entry (long term contracts, …)

- Maintain the current price but provide extra services

- Reduce the price to some extent (less than the 20%)

More questions to be added by you, interviewer!

If the interviewee solves the case very quickly, you can come up with more challenging questions to ask them.

More questions to be added by you, interviewer!

If the interviewee solves the case very quickly, you can come up with more challenging questions to ask them.

Without your consent we cannot embed YouTube videos. Click the button below and accept the marketing cookies to allow YouTube videos to be embedded.

By allowing this service, you consent, in accordance with article 49 paragraph 1 sentence 1 lit. a GDPR, to your data being processed in the USA. The USA is not considered to have adequate data protection legislation. Your data could be accessed by law enforcement without prior public trial in court. You can change your settings regarding consent to external services at any time in our Cookie and Privacy Settings.

Wall Inc.

i