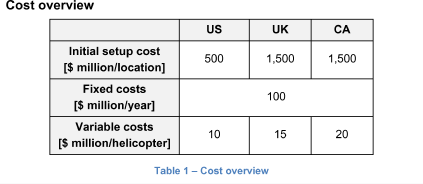

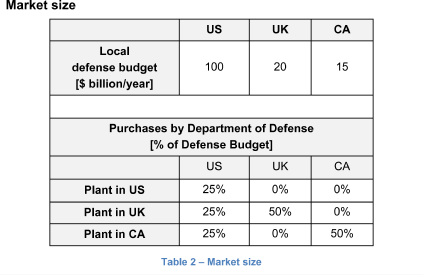

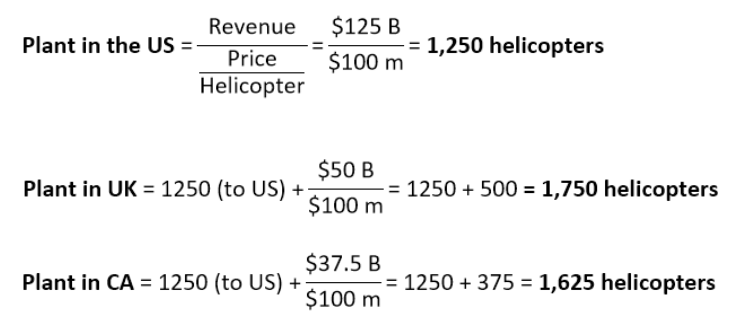

Your client is BS Systems, a defence contractor situated in the US.

They have contacted our company to advise them in the selection of the location for a new plant, producing Apache helicopters. Three sites are in consideration: Canada, UK and US.

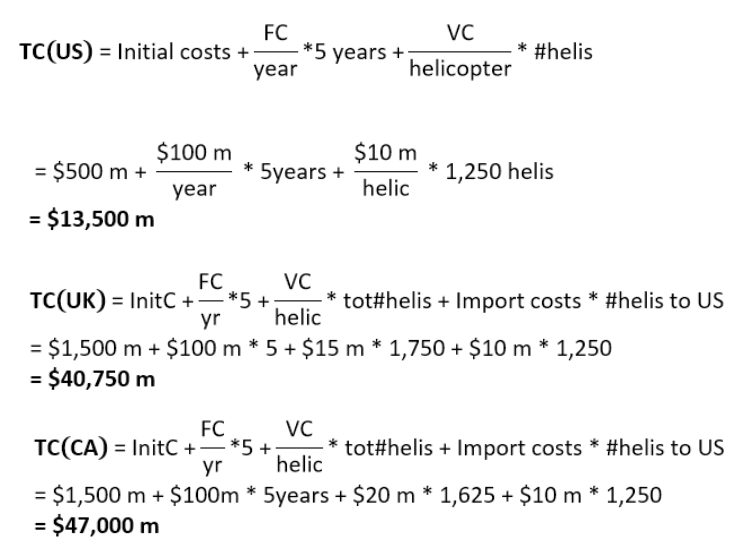

The profits for each plant location over the next 5 years should be calculated.

Military helicopters

i