A large fast food chain has hired us to improve the company’s profitability by cutting costs. Before engaging in the initial brainstorming session about your client’s options with your team, you first want to collect your thoughts.

Case Prompt:

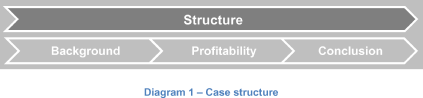

Sample Structure

Suggested case structure:

I. Brainstorming – Question 1: Can you identify major segments for variable costs?

A good interviewee will identify these 2 main segments:

- Raw material

- Packaging

Variable costs are a function of price and volume. Thus, the client should reduce the volume purchased and/or negotiate lower per-unit prices.

Raw material

- Negotiate lower food prices with our suppliers (consolidate purchasing, etc.).

- Look for cheaper ingredients. This is risky because it could lower the quality of the food that we sell.

- Reduce the volume used. This is also risky because it would change our recipes. They are one of our competitive advantages.

Packaging

- Negotiate lower per-unit prices with our suppliers or look for cheaper alternatives.

- Reduce the volume used.

Some good creative answers include (but are not limited to):

- Change the shape or size of food containers

- Consolidate packaging for families

- Reduce the weight of the packaging while still protecting the food

- Reduce other qualities of the packaging (e.g. degree of color or logo prevalence) without sacrificing their brand

- Lock bathrooms so that non-customers cannot use toilet paper and towels

- Charge for extra condiments

- Reduce the size or the number of napkins purchased

II. Profitability Analysis – Question 2: If our client uses the new napkin dispenser in all their outlets, how much money can they save every year?

There is a new napkin dispensing technology on the market. Since you think it could save the client money, you decide to investigate.

Information to be shared if inquired by the interviewee:

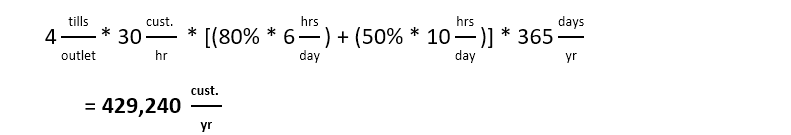

- Our client pays $28 for a case of 6,000 napkins. Thus, each napkin costs about $0.005.

- Our client has about 12,000 outlets in the US.

- Currently, each customer takes 5 napkins per visit.

- With the new dispenser each customer will only take 2 napkins per visit.

Information that can be shared if inquired by the interviewee:

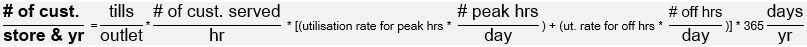

- On average each outlet has 4 tills.

- Each till takes 2 minutes to serve a customer. Thus, each till can serve 30 customers per hour.

- Outlets are open from 7 am – 11pm. Peak hours: 7am – 9 am, 12pm – 2 pm, and 7pm – 9 pm.

- Tills are at 80% capacity during peak hours and at 50% capacity during normal hours.

The interviewee should identify the following information:

- # of restaurants

- # of customer visits per store per year

- # of napkins used per customer now

- # of napkins used per customer after the switch

- Price per napkin

II. Profitability Analysis – Question 3: At what price per dispenser would the investment not be worth doing?

Information that can be shared if inquired by the interviewee:

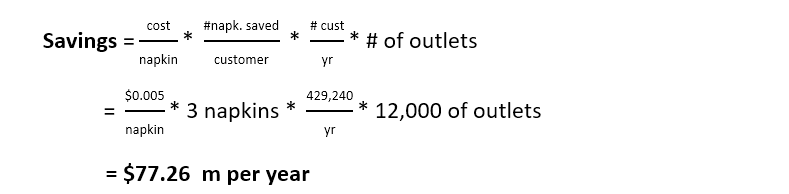

- We need 10 dispensers per store.

- Napkins used in these dispensers cost $0.01 per napkin (remember that the paper companies make the new dispensers).

Tell the interviewee that the cost of the dispenser is actually $70, and then ask him/her to conclude the case.

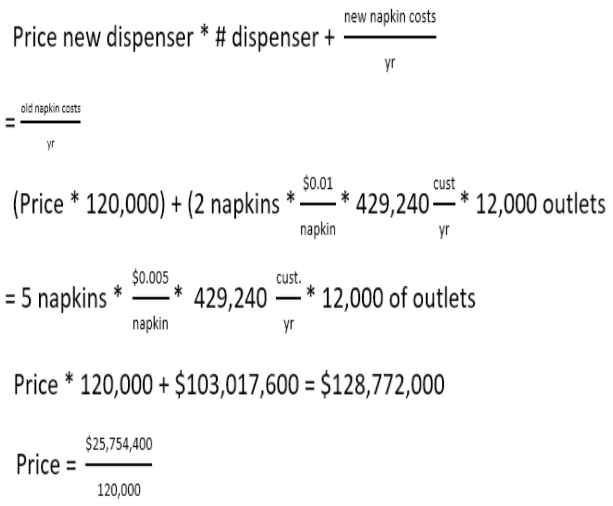

Here, the interviewee must calculate the highest price the company is willing to pay for the dispenser (the breakeven point).

Costs of using new dispensers = Costs of using old dispensers

The new dispensers will save the fast-food chain $77.26 m per year. However, this investment will only be worth doing if the costs are lower than $215 per dispenser.

III. Conclusion

To cut costs, the fast-food chain should consider investing in a napkin dispenser with new technology. There are 2 reasons:

1) It can save the client $77.26 m per year in napkin cost.

2) It is currently priced at ~33% of what we are willing to pay.

However, there are a few factors to consider before purchasing the dispensers. These factors include customers’ reactions to the new dispensers and future pricing of the napkins. We need to gauge customers’ reactions, we should run pilot programs and conduct customer research. We should also negotiate a good pricing contract with our suppliers.

Further Questions

What are the advantages and disadvantages of implementing these new dispensers?

What are the advantages and disadvantages of implementing these new dispensers?

Possible answer:

Advantages:

- Fewer napkins used results in less stocking and may lower labor costs

- Can project a greener customer image.

- Can potentially negotiate better prices with paper manufacturers.

Disadvantages:

- Customers may not like the new dispensers (e.g. have difficulties using it). This can result in customer dissatisfaction and loss.

- The new dispensers might have limited napkin suppliers. This reduces our client's buying power. In the future, the suppliers might increase the price per napkin.

More questions to be added by you, the interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

McBurger

i