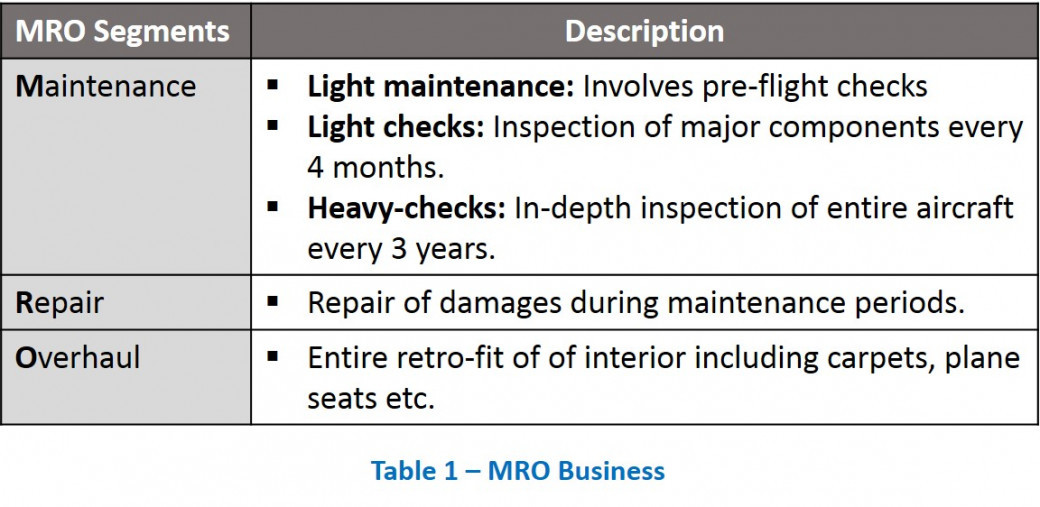

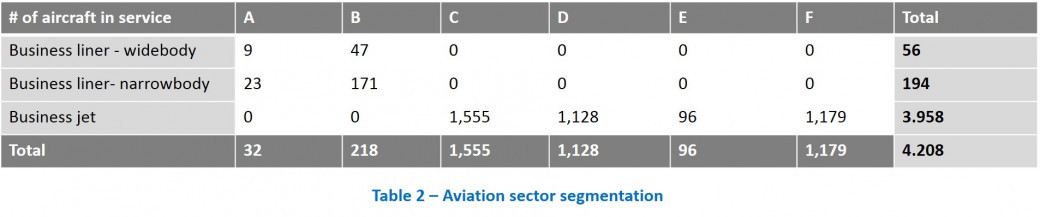

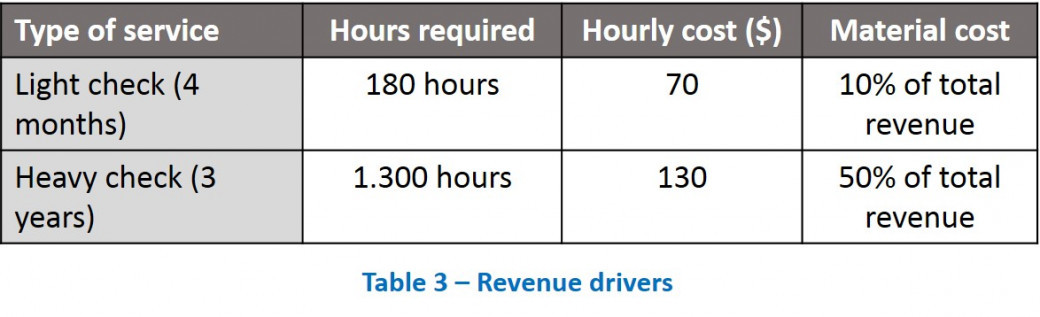

Our client is Universal Airlines that offers regular passenger flights in economy, business & first class. They have been doing quite well and profits were strong so they build up cash reserves that they are now looking to invest. The company is thinking about investing in the MRO business (Maintenance, Repair & Overhaul) for global business jets.

The client has asked us to help him size up the market.

Universal Airlines

i