Incos is a global manufacturer of writing products with divisions in North America, Europe and South-East Asia. Their global sales are $60 m and their profits amounted to around $30 m. Their European division who manufactures and sells disposable pens is experiencing flattening sales and a decreasing profit.

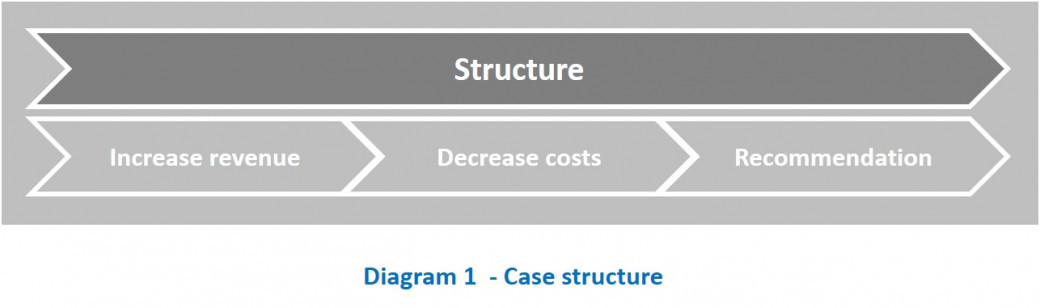

The client hired you to help him come up with suggestions to get profits back on track.

Incos Pens

i