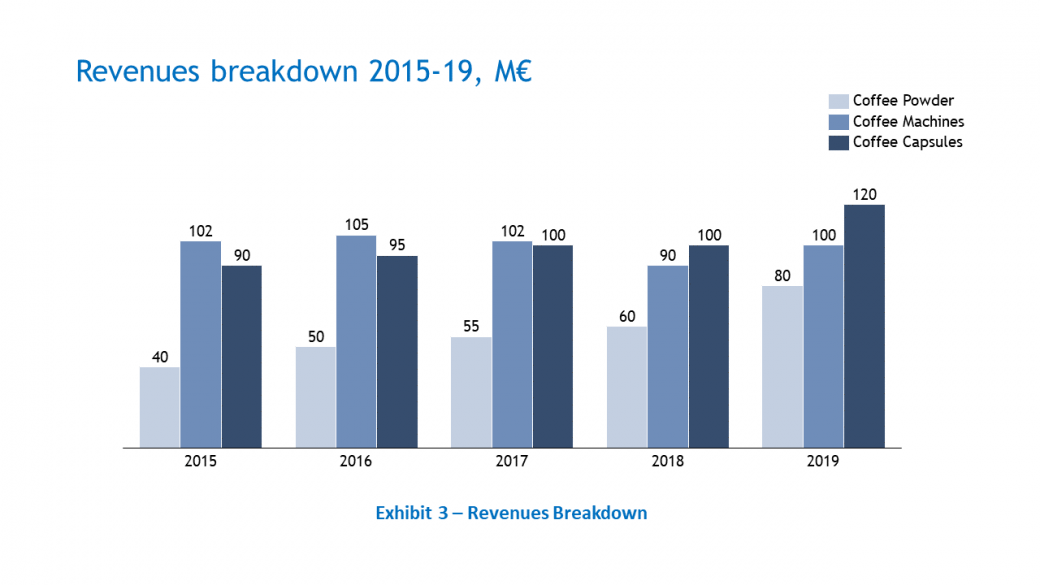

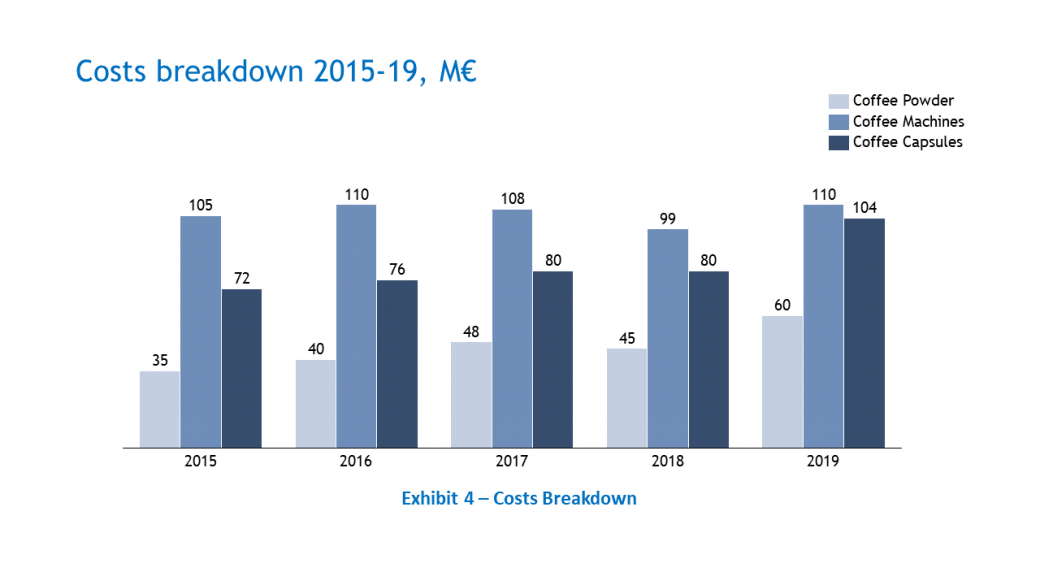

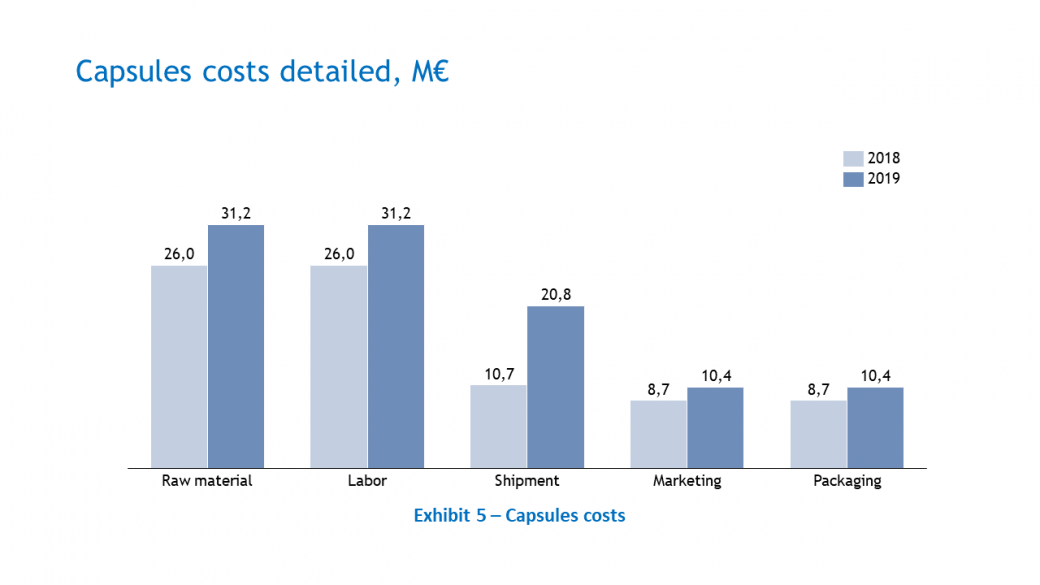

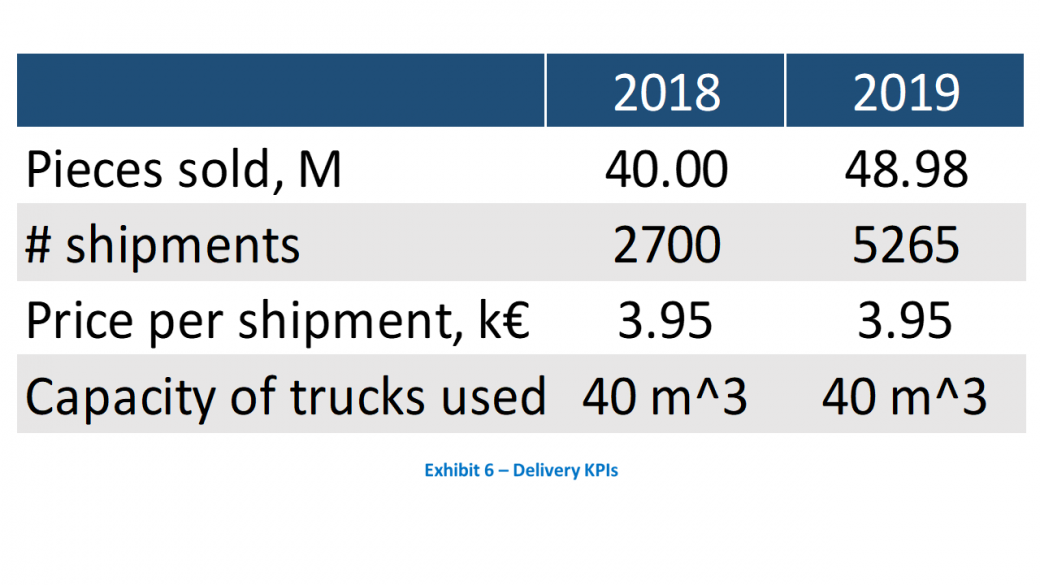

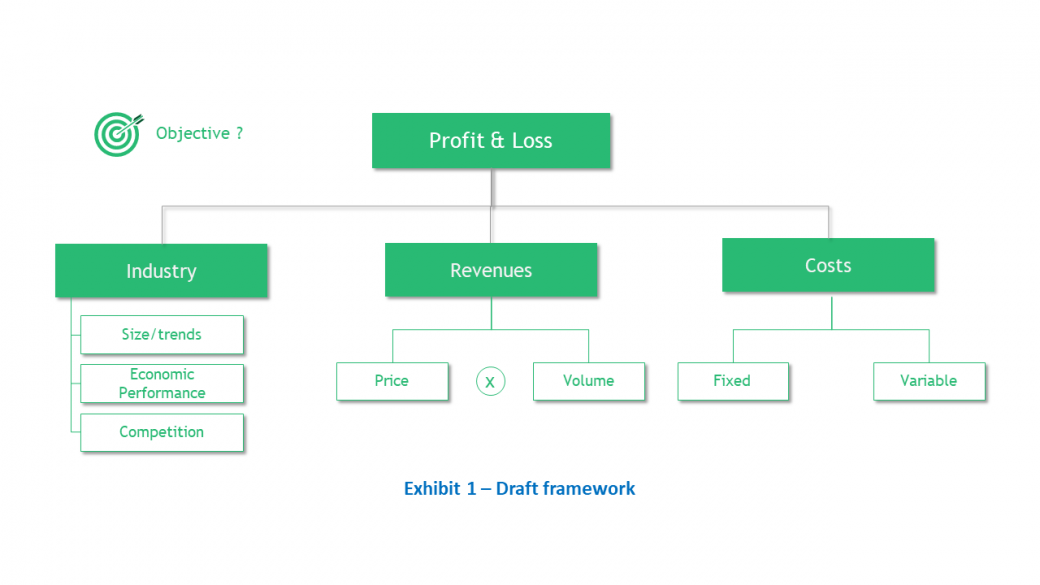

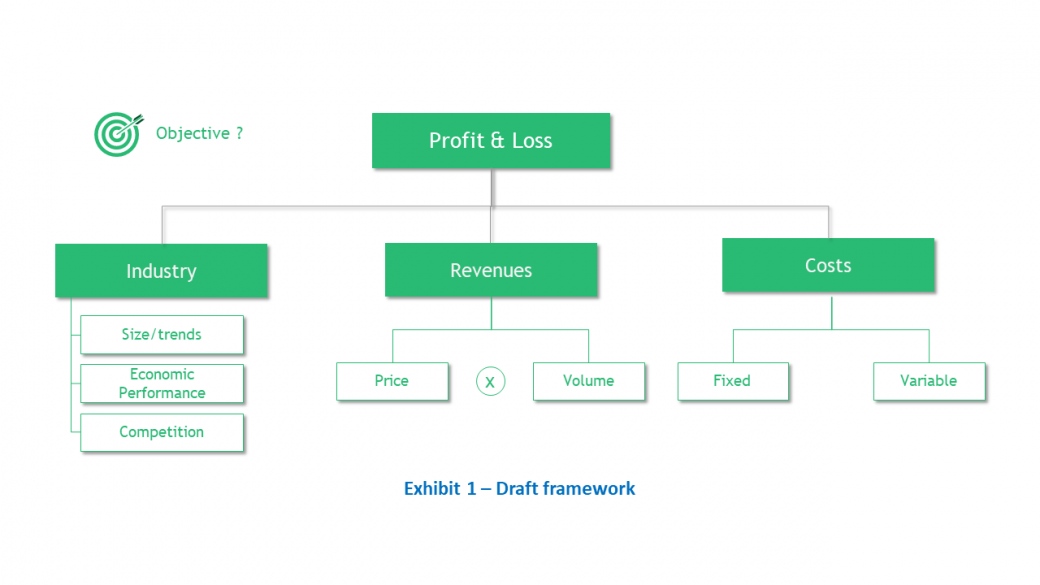

Espresso Whatelse is an Italian company that produces coffee and espresso machines since 1908. It is the Italian market leader and has a strong presence overall in Europe. In 2019, Espresso Whatelse has increased its revenues but it has seen declining profit margin.

Your client wants to understand the root causes of this 2019 trend and how to increase its profit margin again.

Espresso, Whatelse?

i