Your client, ChemInt, is a global chemicals company that manufactures Ponsulene in some locations around the world.

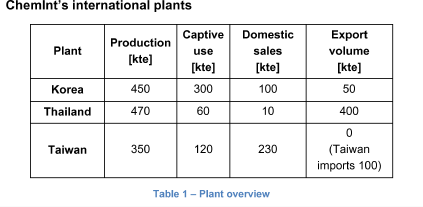

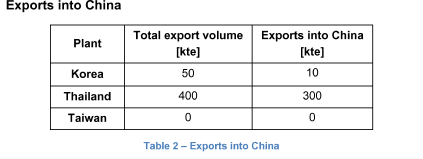

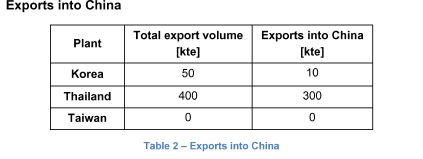

It has several joint ventures (JV) in Asian markets and in total 5 plants in China, Korea, Thailand, and Taiwan, all of which serve the local markets as well as neighboring markets including China.

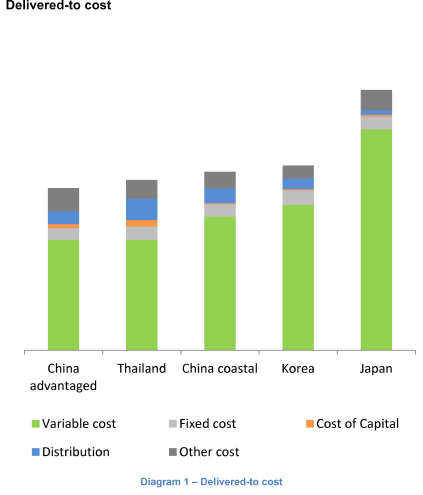

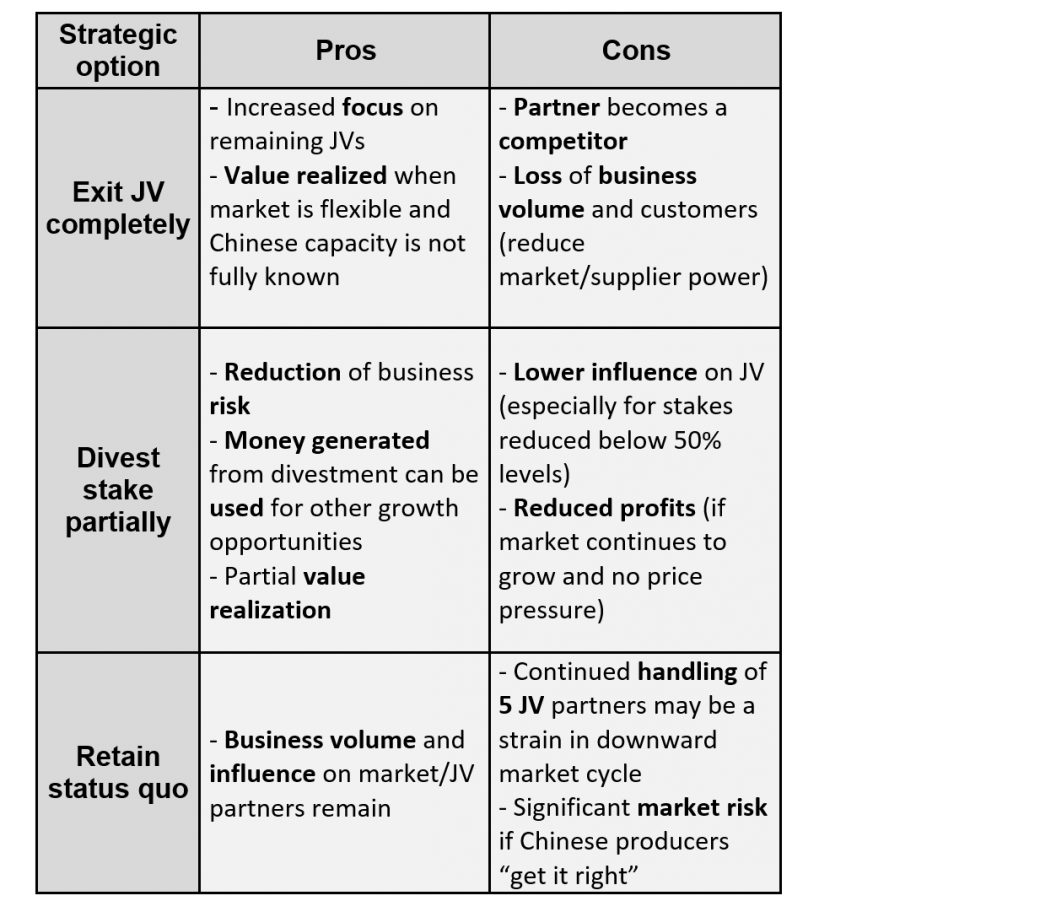

Due to the strong demand for Ponsulene and profitable margins in China, a number of new Chinese players are entering the market in China as well as in the neighboring countries.

ChemInt has called in your company to estimate the influences on their business by these happenings.

ChemInt

i