Your client, Convo Telco, is a leading national telecommunications player in a developing country. They offer both mobile and fixed (e.g. broadband, internet) products across the country. Over the past few years, they have been facing declining profitability and have asked you to help them identify what is the problem

Case Prompt:

Sample Structure

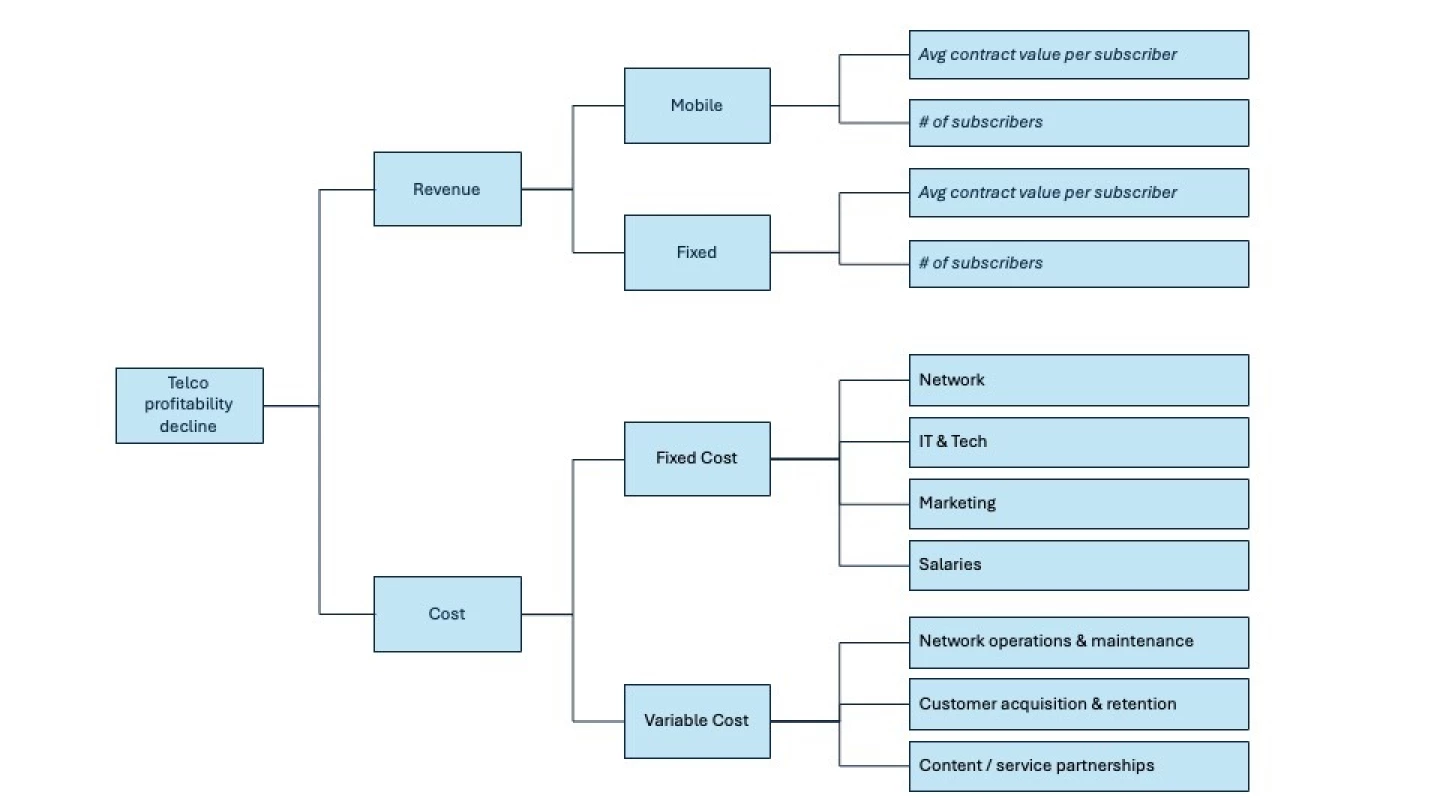

- The candidate should breakdown the profitability of the Telco client in an insightful and relevant way

- While terminology is important, it is more important to acknowledge 'common sense' and business judgment - i.e. a candidate may refer to the towers etc. as "Infrastructure" instead of "Network", that is perfectly acceptable

- A strong candidate should not just describe the driver tree, but also share hypotheses (e.g. our client could have potentially faced a fall in # of subscribers due to increased churn and shift towards competitors

- A strong candidate should also talk about next steps. In this case, this would mean where they would start the analysis. A strong candidate should realize the most intuitive data to ask for first is the current financials to understand how the profitability has changed

Additional clarifying information if the candidate asks for it before frameworking:

- Client operates in a fairly large developing country

- The market structure is typical of the telecommunications industry with only 5-6 (oligopoly) players

- Client's goal is to stop the loss in profit and reverse the trend

- Profit has fallen by about ~2B (local currency) or ~3% over the past few years

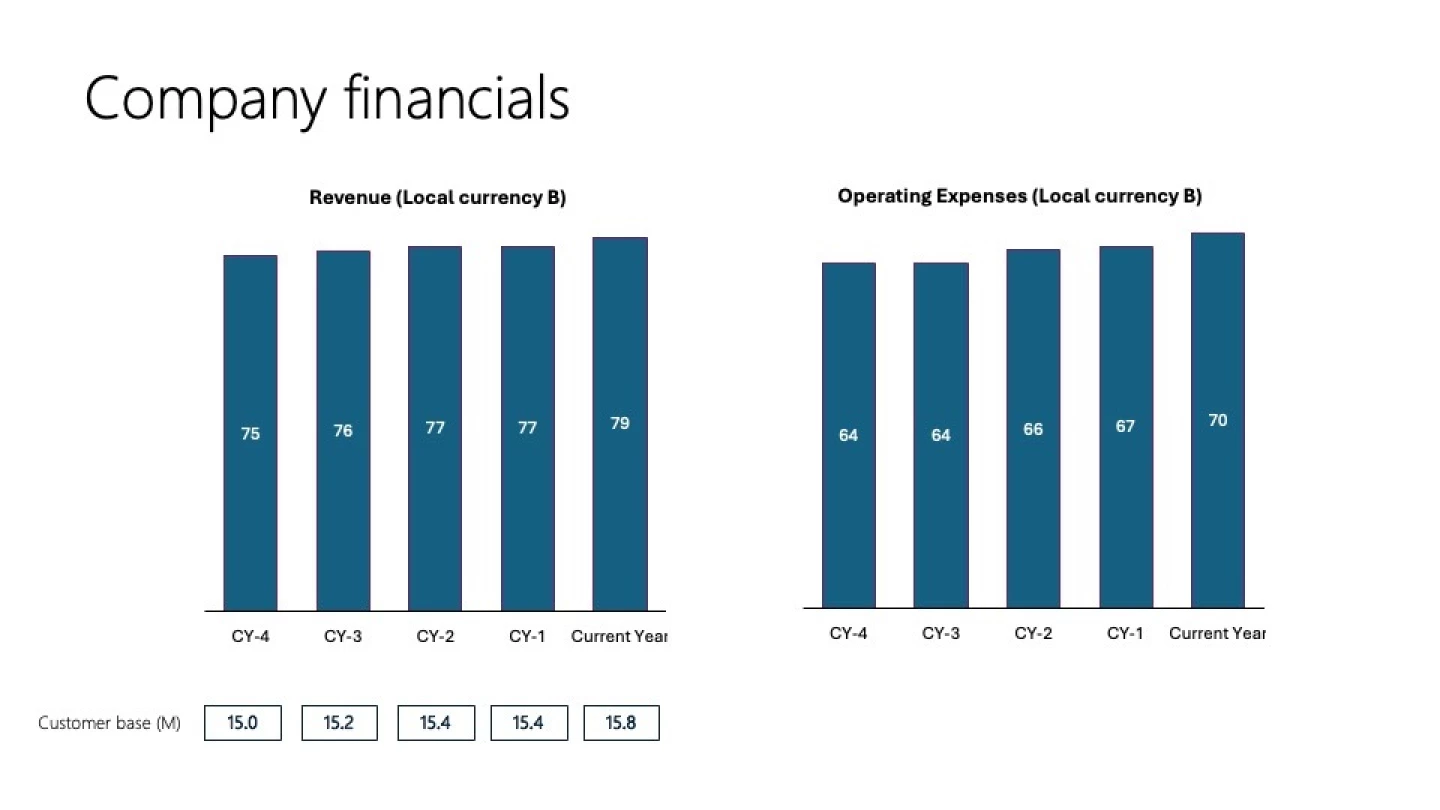

Data Exhibit #1

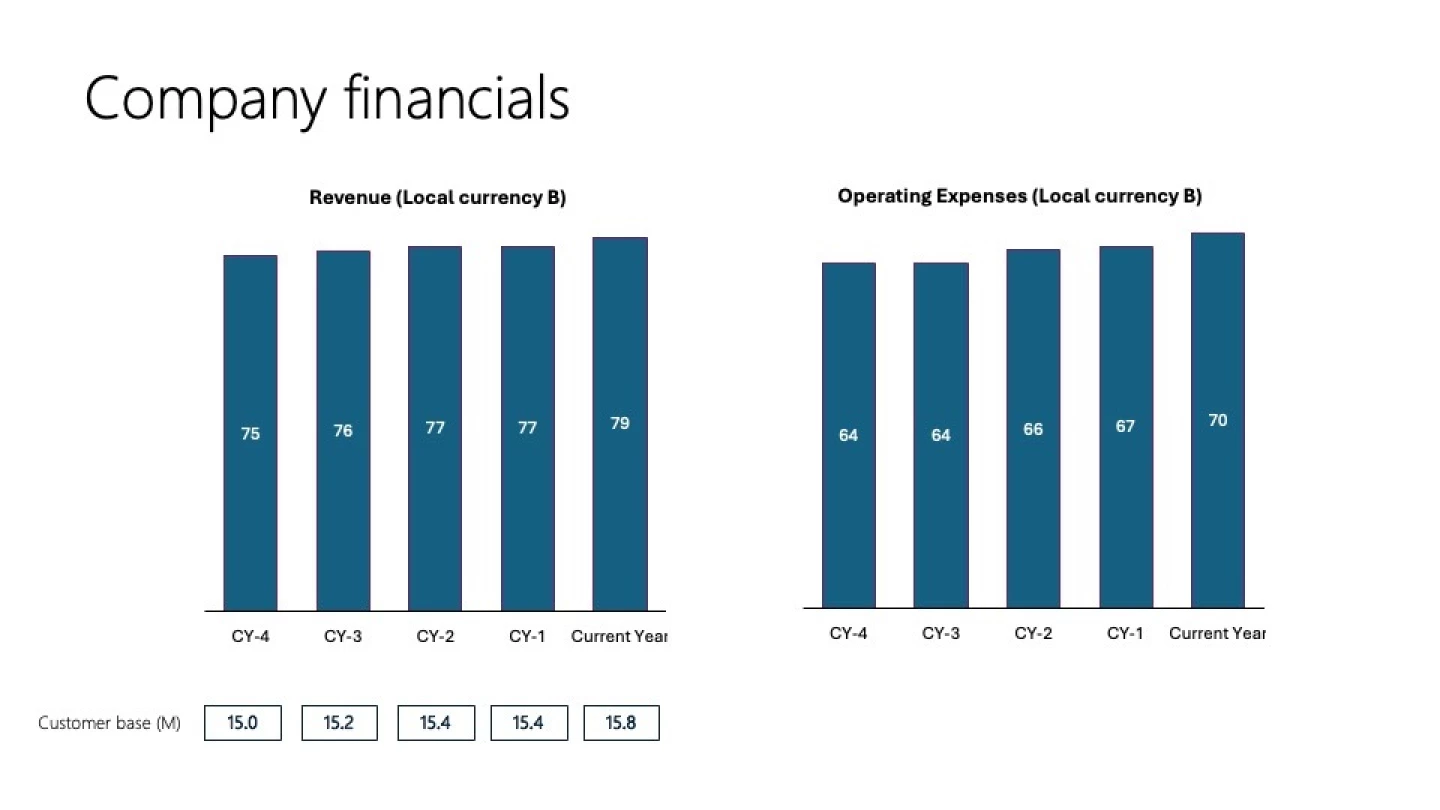

Candidates should interpret this graph to understand where the problem could lie, whether in the revenue side or cost side

First, candidates can calculate the profit and note that it is decreasing from ~11M in CY-4 to ~9M in Current Year

Next, candidates should identify that revenue does not seem to be the problem, this is because the customer base and revenue been increasing.

- A strong candidate will note that the average revenue per customer actually stays flat throughout the time period, which from a business judgment POV is not great but definitely not causing the drop in profit.

Candidates should now explicitly call out that Cost is the problem.

Given this is a candidate led case, a strong candidate should push for the next logical step to investigate the cost breakdown further to identify what exactly is the problem, rather than just jumping to solutioning at this stage

Given this is a candidate led case, a strong candidate should naturally ask for the financials of the client to determine whether this is a revenue or cost problem. If the candidate goes in a different tangent, ask them "what piece of information would be most helpful for you now to identify what is causing the problem for our client?"

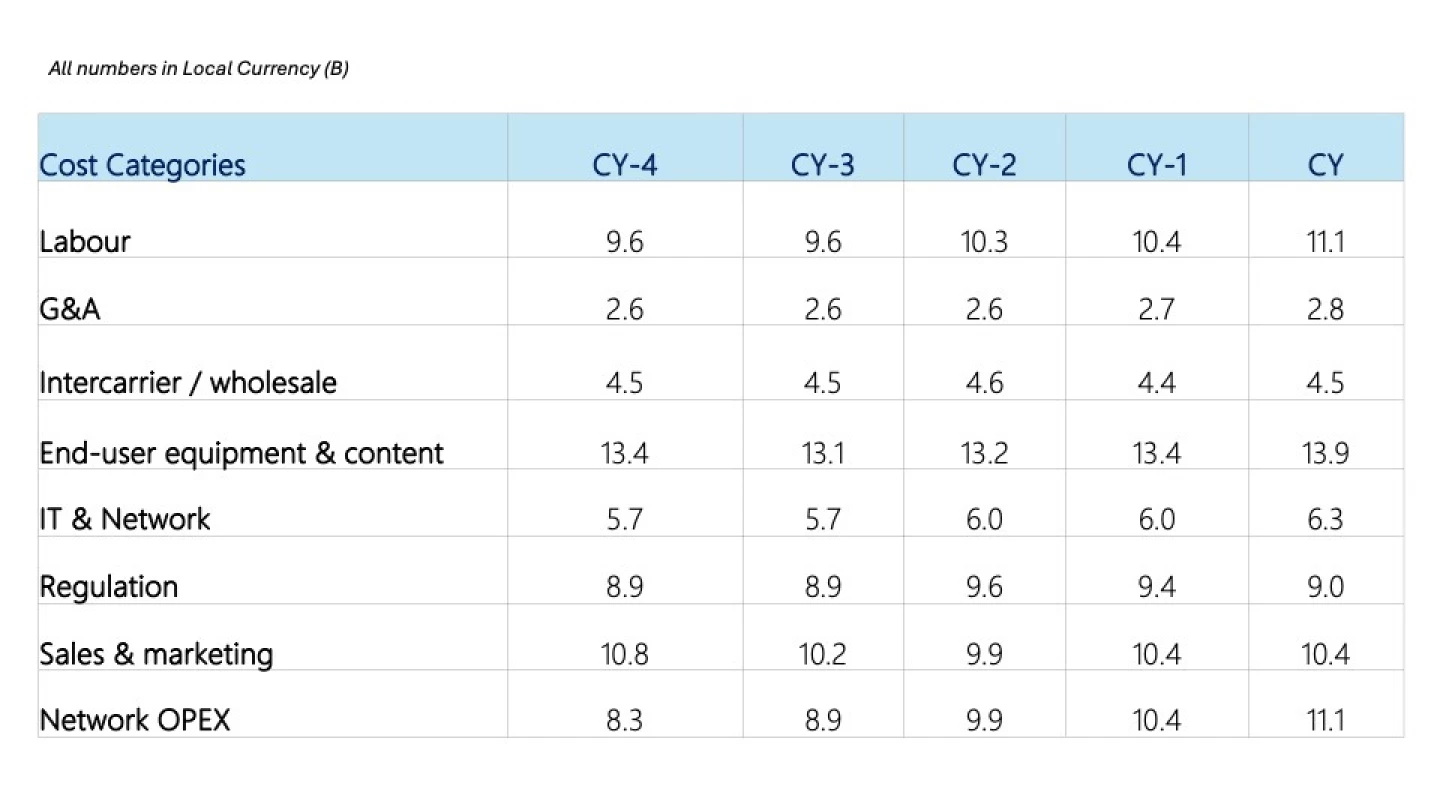

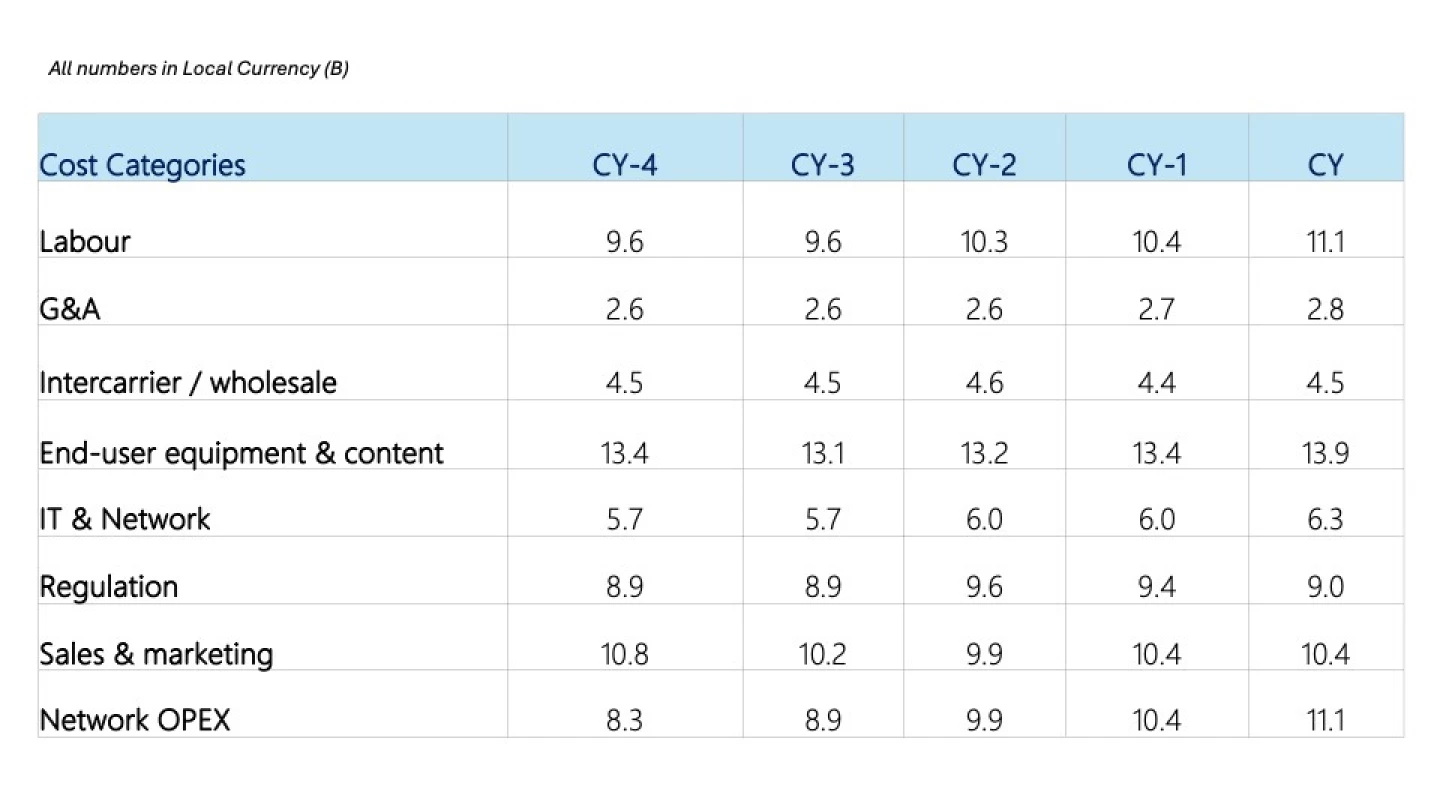

Data Exhibit #2

Here we have a detailed breakdown of the cost categories that have some terms that you or the candidate may not be familiar with. Note that in an actual interview, the interviewer may show the candidate industry specific data with industry specific terms. Do not expect the candidate to know these terms but expect the candidate to clarify terms that they are unfamiliar with.

For the interviewer's reference, here is an explanation of the more 'technical' cost categories:

- G&A: General & Administrative cost which includes salaries & benefits for administrative and executive staff, office rental, office equipment, professional services, insurance etc

- Intercarrier / Wholesale: Cost that our client pays to other telecommunications carriers / companies for the use of their networks and infrastructure

- End-user equipment & content: Refers to the hardware that is sold/used for B2C and B2B customers including mobile devices, modems etc

- IT & Network: Network here refers to the infrastructure of the Telco

- Network OPEX: Any maintenance of the network (wired and wireless), including the leases of land that the telco pays to landowners so they can install their network towers

Candidates should be able to sift through the numbers and apply 2 lines of logic here:

- Which cost categories are increasing over the years?

- Out of the cost categories that are increasing, which are the biggest (causing the most problems)?

Based on the line of reasoning above, candidates should note that network OPEX has increased the most.

A strong candidate should naturally then push to investigate and hypothesize on potential reasons for this increase

Brainstorming

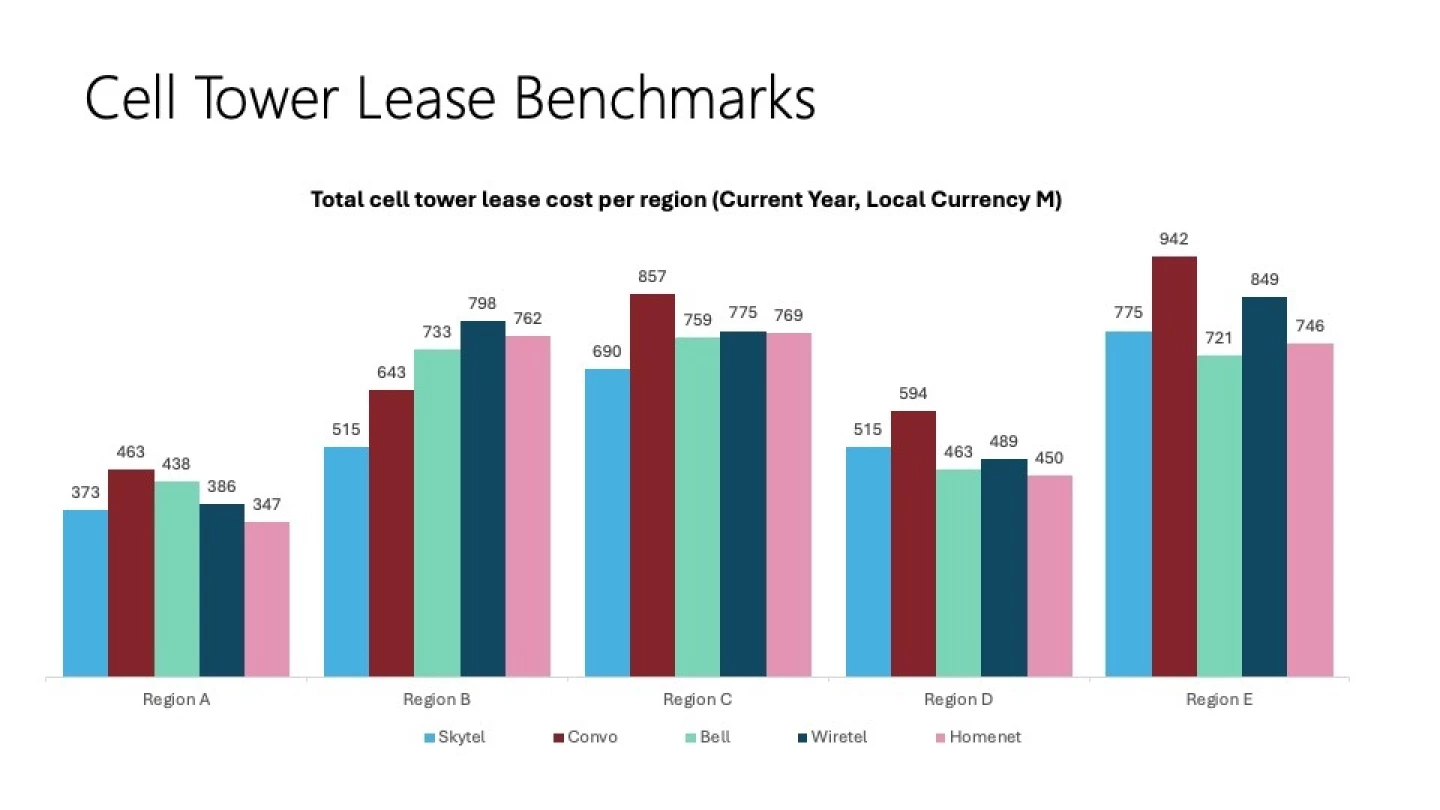

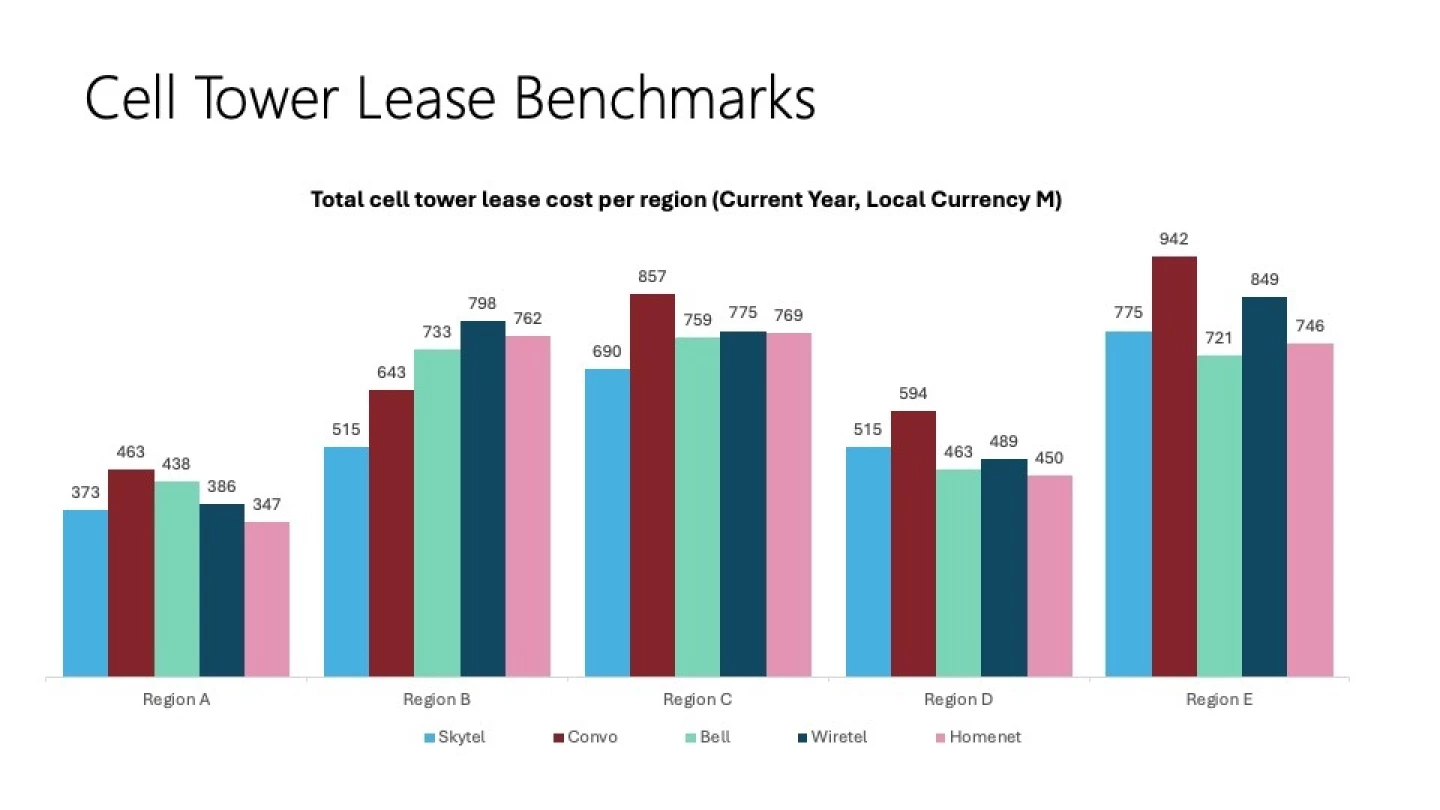

If the candidate asks, this is the explanation of what Cell Tower Leases are.

- Telecommunications companies use network towers (physical structures) to transmit mobile / network signals

- They need to place these towers on land, however not all land is owned by the telecommunications company

- Therefore, the telco company pays landowners some money (through a lease) in order to install or setup a tower on their land

- This process is done through negotiation by individual negotiators

For this part of the case, first ask the candidate to share what observations they have, but don't spend too much time on it and quickly ask them the brainstorming question

What do you think drives the cost variability of the cell tower leases between the different players in the market?

Data Interpretation

The key observation from the graph is that our client (Convo Telco) has a higher total cost for their cell tower leases versus competition.

A good candidate will calculate the total cost (~3.5B) and link place it in context of the Network Opex -> it is about ~30% of Network OPEX and it is a sizeable amount.

Brainstorming

The potential reasons for driving cost variability of the tower leases could be structured as follows:

- # of towers (or leases): Because the graph only shows an absolute amount of cost, we do not know how many towers each company has and therefore this could be a key driver of the difference in cost (e.g. a larger telco would have higher cost because they will have more towers).

- Cost per lease

- External

- Location: Prime real estate, commercial areas would cost higher than rural reas

- Regulation: There may be regulatory costs or taxes that are specific to certain zones or types of towers

- Tower features: Maybe certain towers take up more space or command a higher cost due to increase complexity and burden on the landowner (e.g. maintenance)

- Internal

- Negotiation process: Given this is a negotiation process (which a candidate could have found out by clarifying questions), maybe some companies are better at negotiating than others

- External

Math

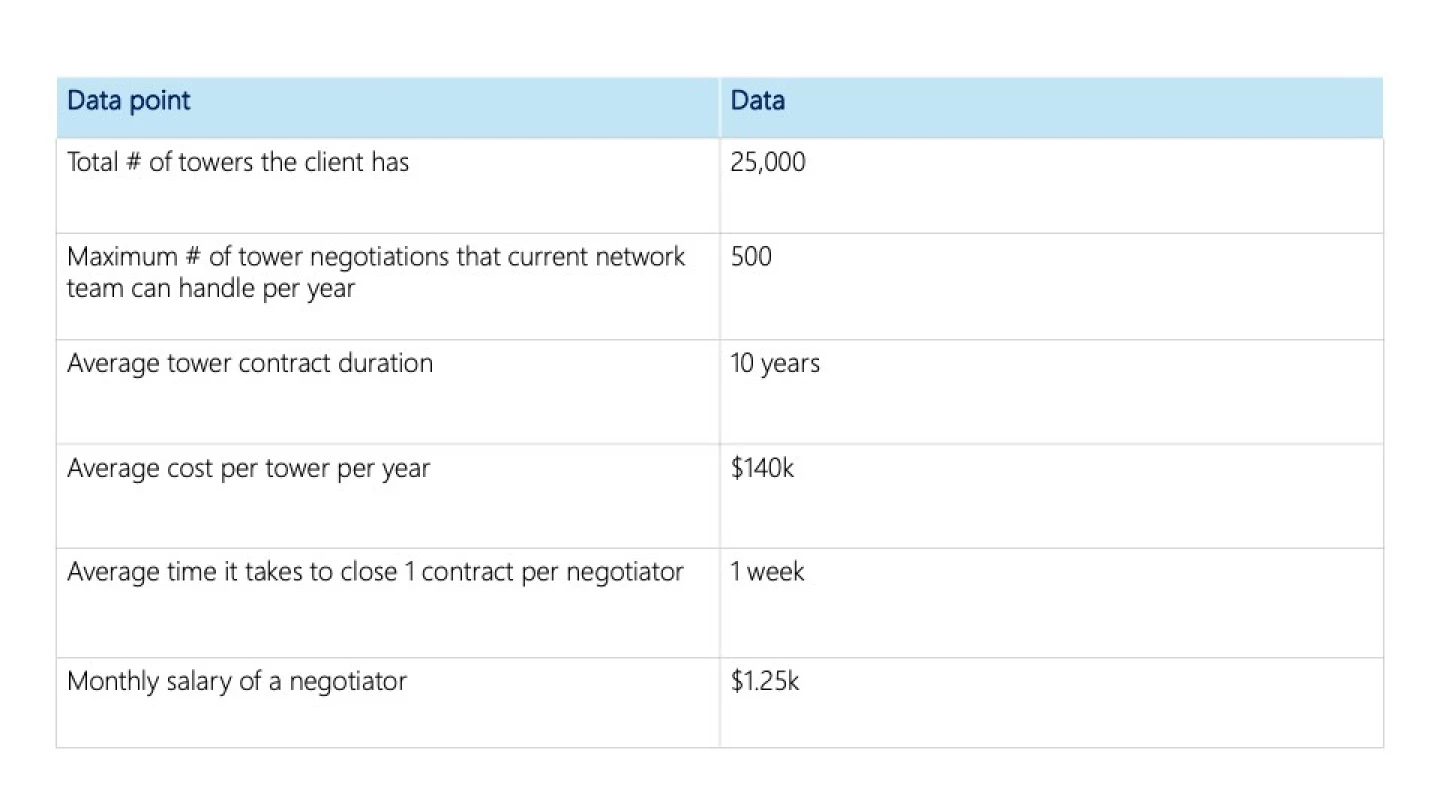

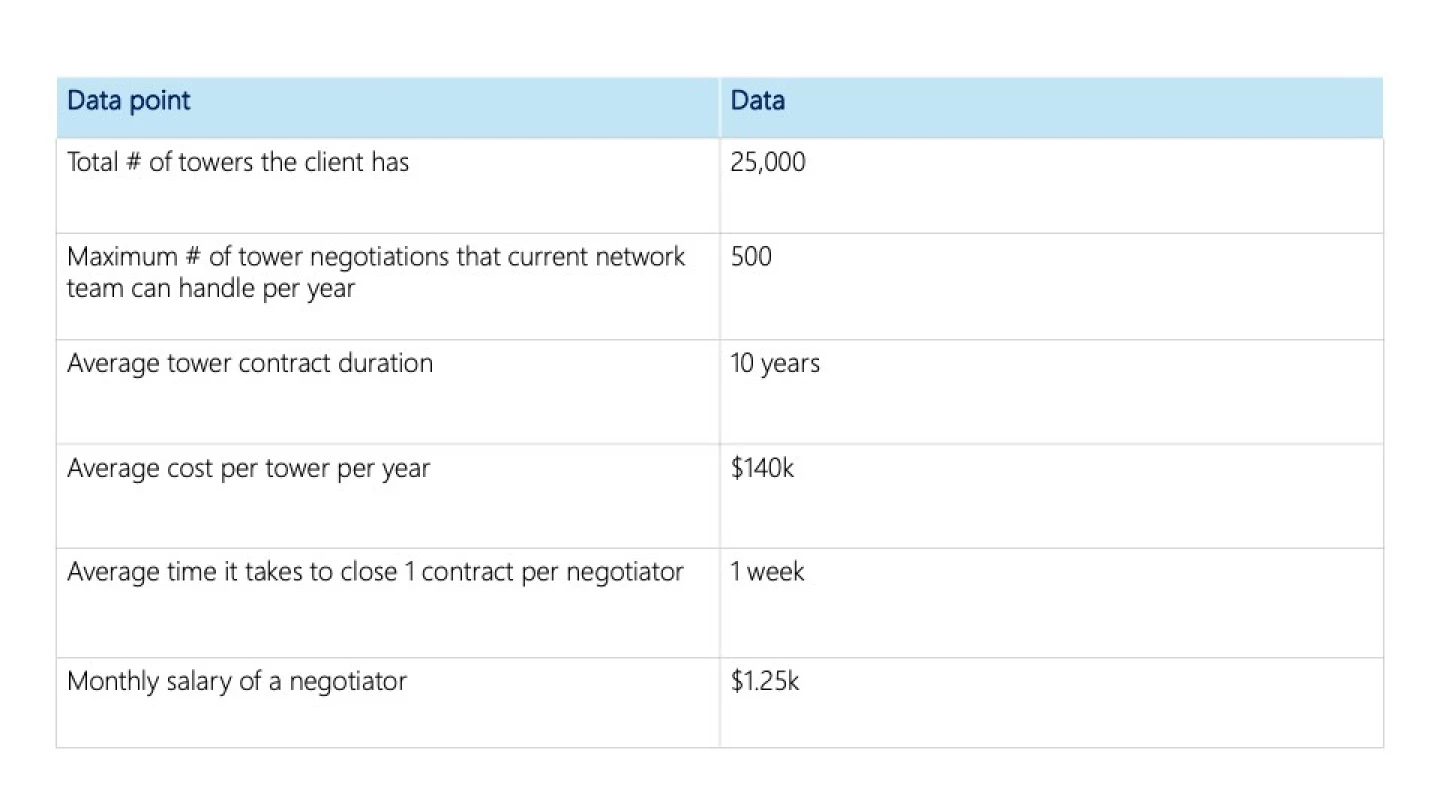

The client tells you that indeed their key problem now is high cell tower lease rates, due to a lack of negotiation capacity to conduct proper negotiations. The client wants to add new negotiators to help the current network negotiating team in negotiating contracts. How many new negotiators would he need and how much would it cost him? Please refer to the following assumptions

This calculation requires the candidate to sift through the information and sort out information that is not critical (i.e. average cost per tower per year), and to make sense of the other information.

Maximum # of tower negotiations that current network team can handle per year: this refers to the number of negotiations the current network team can handle in a proper way (e.g. following the right process, ensuring the quality of the negotiation)

Average tower contract duration: The right to setup a tower on a landowners land is based on a contract, so the contract will eventually expire and the telco has to renew the contract to continue putting up the tower there

In terms of the the "Average cost per tower per year", this piece of data is not relevant at this stage of the case because the calculation is solely focused on identifying the workload (negotiations) that needs to be done and therefore how many negotiators are needed to do that workload

High level formula

# of new negotiators needed per year = [total number of negotiations required per year] / [avg # of negotiations done per negotiator per year]

Solve for the variables in the High Level Formula

Total number of new negotiations required per year = [number of towers expiring towers per year] - [# of towers current team can handle]

Number of towers expiring per year = 25k / 10 = 2.5k

Given that each tower contract lasts 10 years, we have assumed here that the distribution of expiration is equal and therefore on average 2.5K towers need to be renewed every year

# of towers that current team can handle = 500

Maximum share of tower base the current team can handle is 500

# of towers expiring need negotiators = 2.5K -500 = 2K

Avg # of negotiations done per negotiator per year = 4 x 12 = 48

Therefore # of negotiators needed per year = 2k / 48 = 2k / ~50 = 40

Additional cost = [number of negotiators needed per year] * [salary per negotiator per year]

Additional cost = 40 * [$1.25k * 12] = 40 * 15k = $0.6M

A strong candidate would state that this additional cost would need to be weighed against the potential benefits or cost savings that could be achieved by having a bigger negotiating them

Recommendation

We were brought in to help identify what are the potential causes of the drop in profitability for you.

Based on the current analysis, the key cause of the fall in profitability lies in your cost

- Network OPEX is the key driver which has risen the most over the past couple of years from 8.3B to 11.1B

- Further analysis showed that we have higher cell tower lease costs compared to the competition due to a lack of negotiation capacity which could be a likely culprit of the increase in the cost

We suggest hiring an additional ~40 negotiators (at an annual cost of 0.6M) that could help to improve the negotiation process and potentially reduce our cell tower lease costs.

As a next step, we would suggest quantifying the potential benefits of having these new negotiators, and also to look into the next largest cost buckets that have increased (e.g. Labour)

The recommendation should be as concise as possible. A strong candidate should answer the question and present a POV on what the next steps are

BCG Round 1 Case: Telecommunication Troubles

i