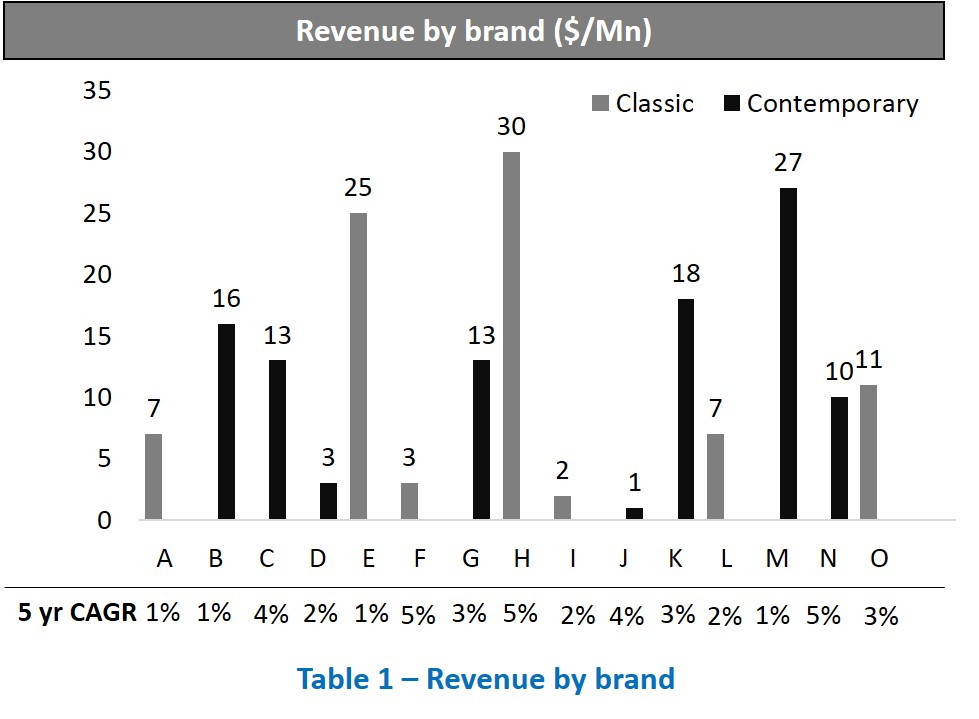

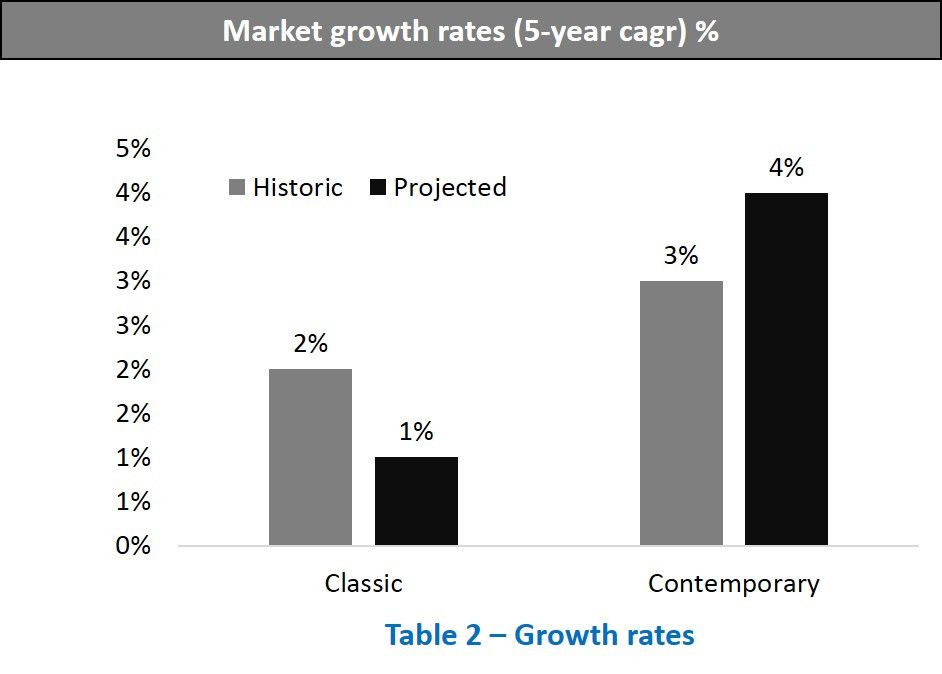

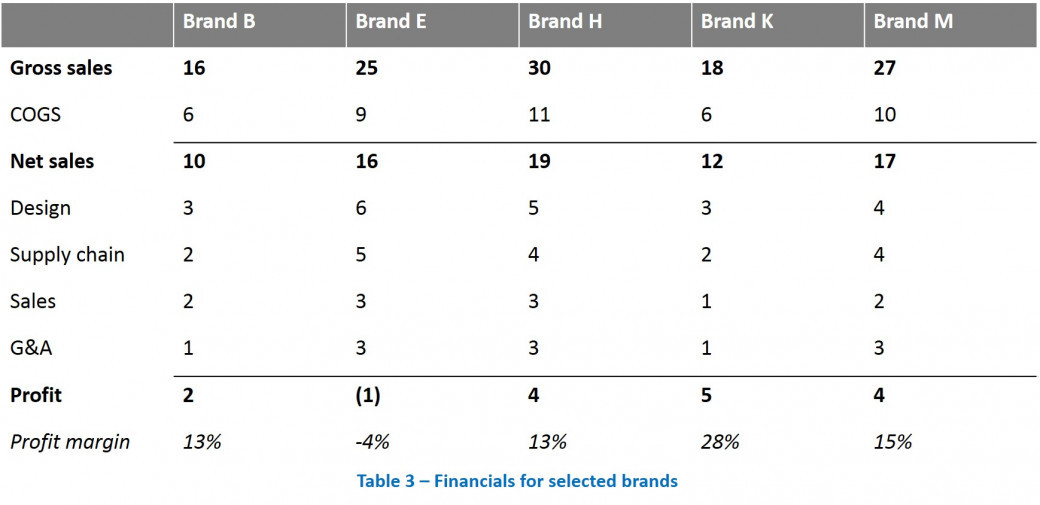

Our client is Top Apparel. They own a portfolio of 15 brands of fashion. Historic growth has been in line with the market and the company is making good profits. Now management wants to invest money to grow the portfolio, but they are unsure on how to prioritize investment.

The client has asked us to help them determine which brands should get investments for future growth.

Top Apparel

i