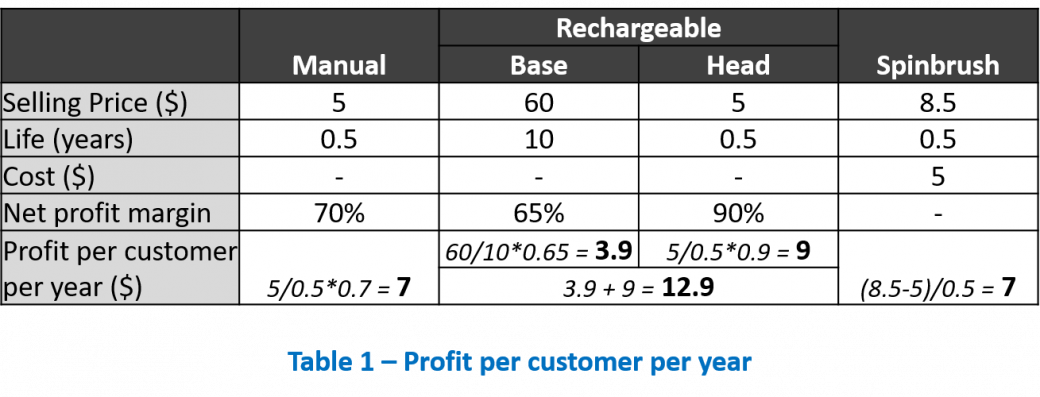

We are a global toothbrush producing company. Our portfolio consists of two kinds of toothbrushes - 'manual' that sells for $5 and an electric 'rechargeable' that sells for $60.

Last year, a competitor introduced a battery-powered electric “spinbrush” that sells for $8.5 and now has 2% of the toothbrush market.

We don't have a similar offering and would like you to tell us whether we should develop a similar product or not.

Toothbrush disruption

i