We are a warehouser (B2B) and have been facing a decline in profits since past 2 years. We would like you to figure out why this is happening and provide recommendations to reverse this trend.

Case Prompt:

Sample Structure

I. Background

As a warehouser, we purchase telephony technologies from manufacturers and then sell them to a group of resellers, who in turn sell them to end consumers.

We are the largest company in the industry. Apart from one competitor who is almost as large as us, there are several small players in the market. In recent years we have not seen any new market entrants and all firms sell at industry-wide prices.

The reseller market can be divided into Value-Added (largest), Corporate (medium), and E-tailer (smallest) segments.

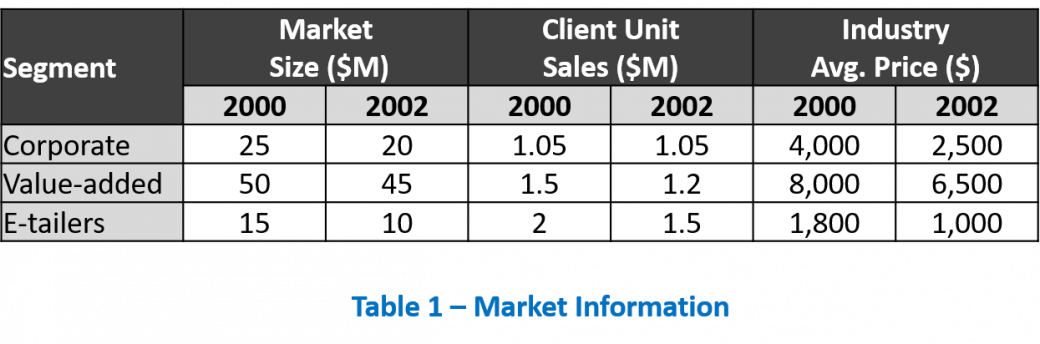

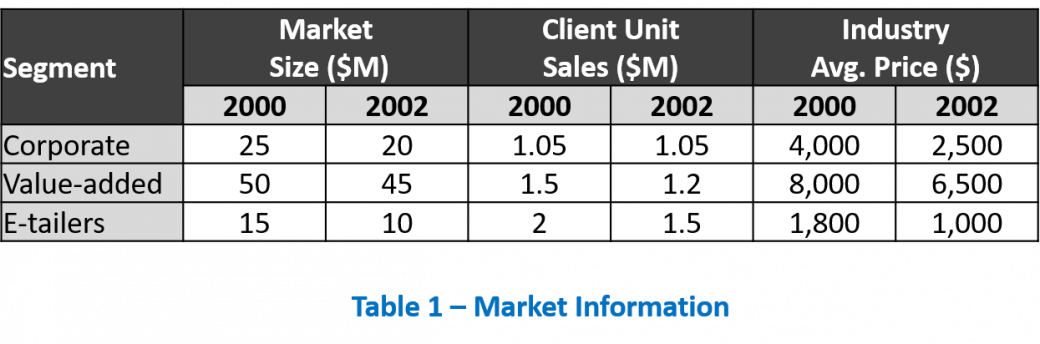

Please share Table 1 with the candidate.

The candidate should ask for more market information. The interviewer should provide all available information & data to the candidate and it is up to the candidate to define the issues that should be looked into based on the data/info provided.

II. Solution

After looking at the table, the candidate should be able to come up with the following observations:

- The overall industry has shrunk

- The client's overall market share has declined

- Value-added is the largest segment and the firm has lost market share in this segment as well

From the above observations, the candidate should be able to make the following conclusion:

- It is a bad business to be in as the overall industry has shrunk, both on a price and volume basis

Since the overall volume has decreased, it could mean that the client and competitors are getting cut out from the value chain - the manufacturers may be directly selling to the resellers or to the end consumers.

Falling prices can be a result of the price wars which are happening because of the shrinkage of the industry. We can see that the industry is rapidly aging. Since there are no opportunities for product differentiation, there is little the firm can do to increase profitability. The firm should recognize this and look for options for exiting the industry.

III. Concluding Observations

The industry looks mature and is rapidly approaching obsolescence. There is little the firm can do to increase profitability. The firm should recognize this and look for options for exiting the industry.

Further Questions

What kind of options could the firm consider for exiting the industry?

What kind of options could the firm consider for exiting the industry?

- Diversify into another industry

- Sell the firm

- Close the firm

Telephony Technology Warehouser

i