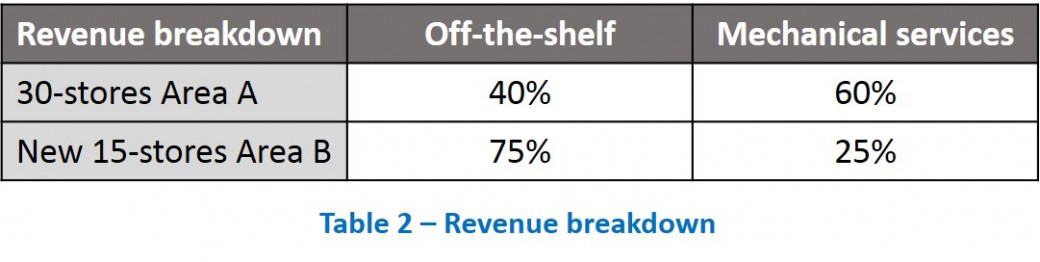

Our client, Superfix, is a mid-size chain of auto-service garages that has been doing well for the past ten years with 30 stores. However, since management felt that the business was saturating, they expanded with an additional 15 stores in other geographical areas. However, the expansion came with negative effects and falling profits.

You're hired to figure out why the company is losing profit despite its 15-branch growth over the past few years.

Superfix

i