Cruise company German Sea Tours (GST) is a successful operator of international cruises. GST currently offers several cruise trips, lasting between 5 and 24 days. Additional services can be booked on board (e.g. excursions at each destination, onboard leisure activities). Customers tend to book their tickets several months in advance. GST has had a long history of revenue growth, but in the past five years, it showed lower growth rates. Board members are not sure whether the market, in general, saw lower growth or whether the problem is specific to GST. GST recognizes that winning new customers and stimulating existing customers to book their vacations with GST is crucial for future growth and therefore has always focused on keeping a close relationship with its (potential) cruise-trip bookers. GST’s chief commercial officer (CCO) Ms. Brown has hired Simon-Kucher & Partners to assess the market environment and competitive positioning for cruise ships and to conduct a subsequent evaluation of potential growth options.

Case Prompt:

0. Background

The CCO has requested a project outline explaining how Simon-Kucher & Partners would address the case.

The candidate proposes their approach. They may decide to take the following approach:

- Analyze the overall market environment

- Determine competitive positioning

- Assess growth options

- Present recommendations

The CCO approves Simon-Kucher’s approach and asks the project team to begin phase 1.

1. Analyze the overall market development

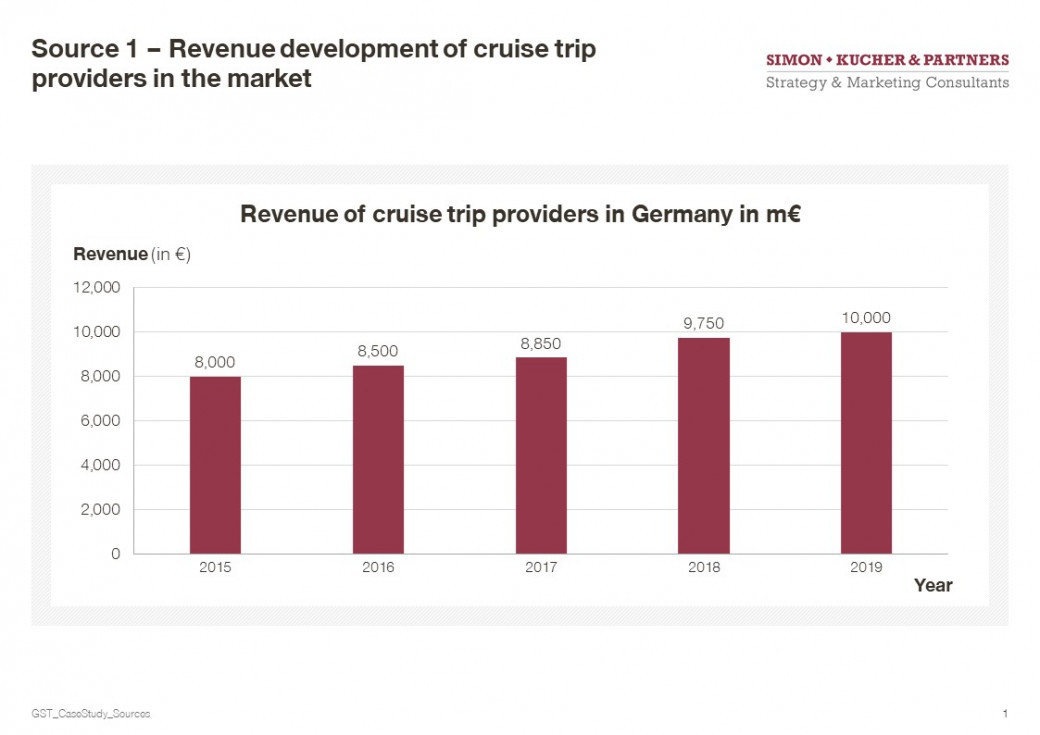

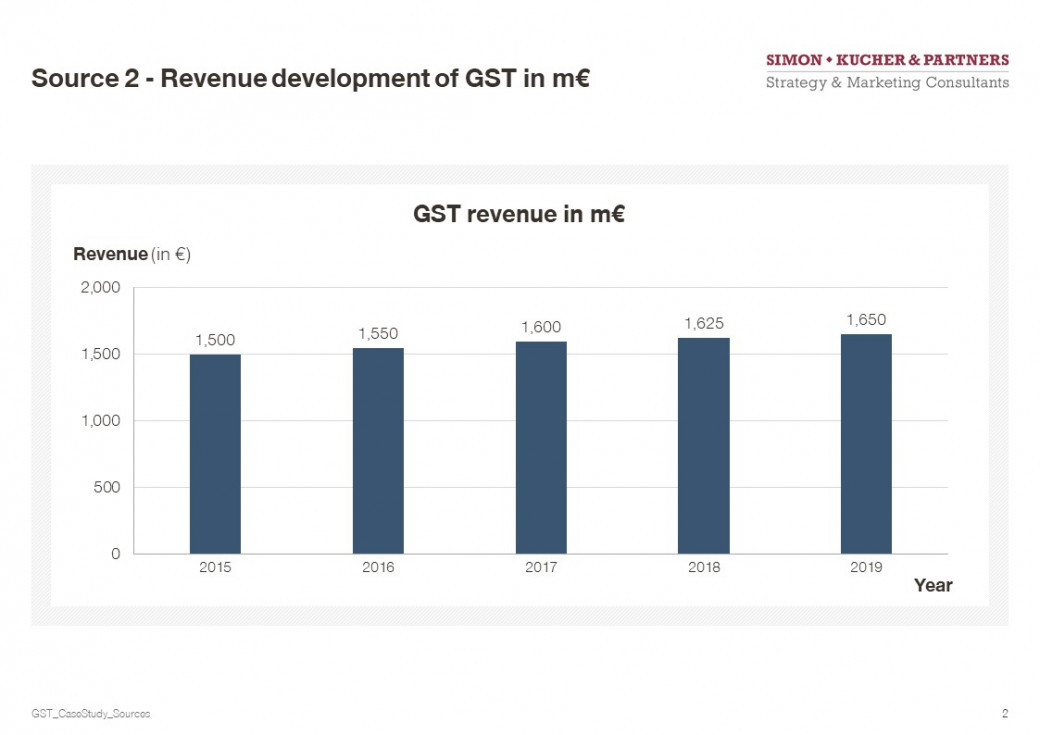

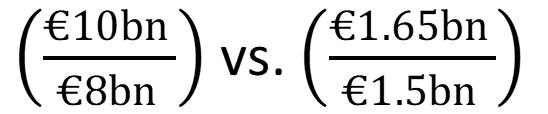

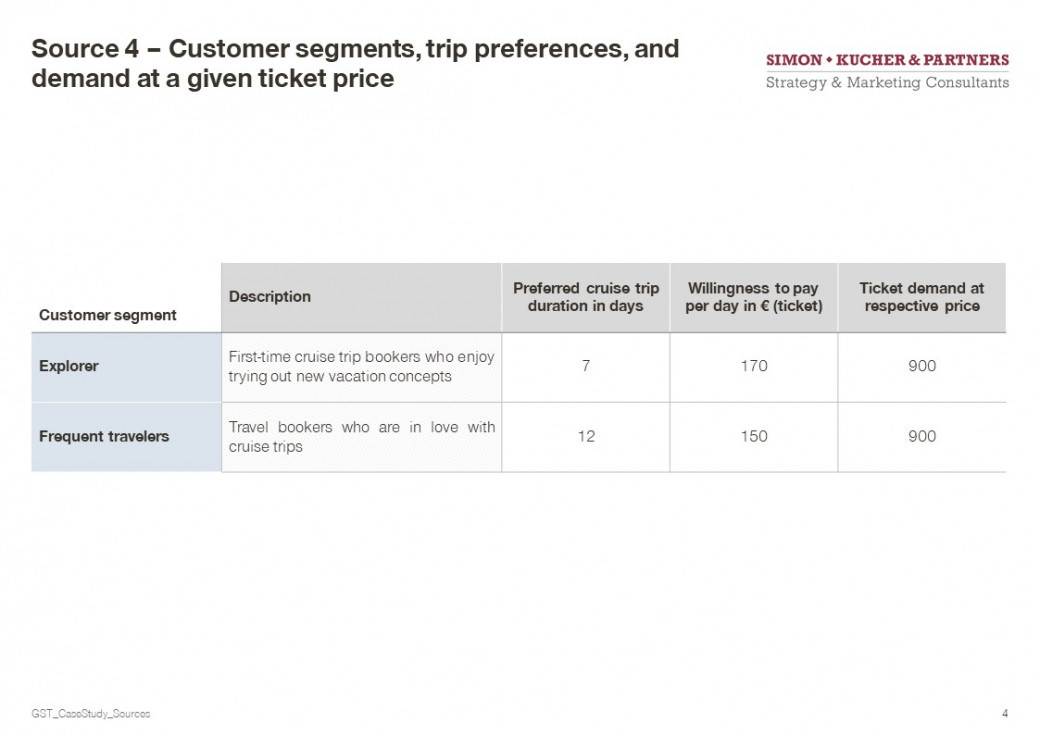

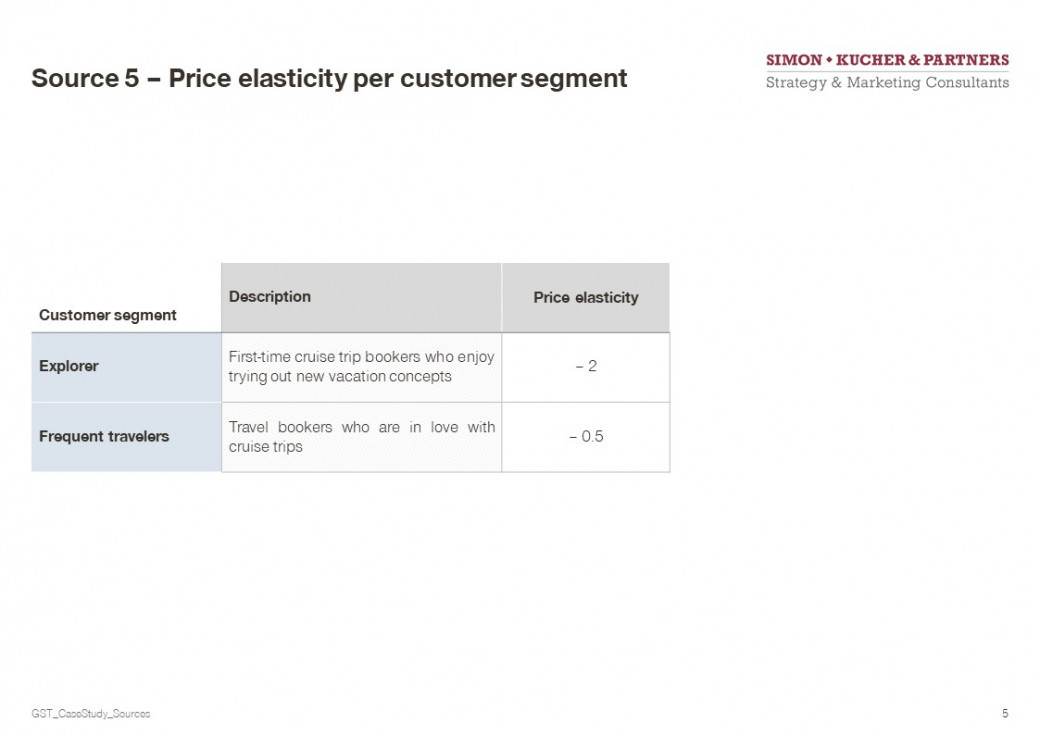

The interviewer may share sources 1 and 2.

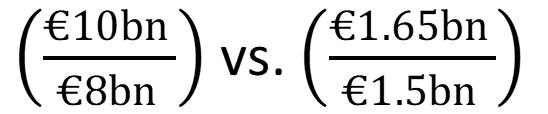

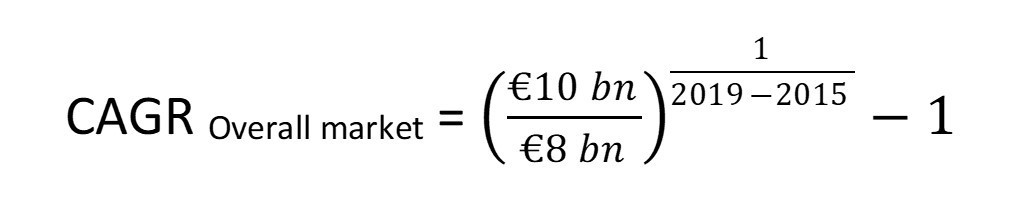

If the candidate tries to calculate each of the CAGRs, the interviewer may provide guidance by informing them an actual calculation of the CAGRs is not required and that a simple comparison of the first fraction of the CAGRs is sufficient, i.e.

- The candidate first assesses whether the board’s hypothesis regarding revenue development is correct.

- To acquire the information needed to make this assessment, the candidate asks the interviewer about the revenue development of GST and the overall market over the past five years.

- Comparing CAGRs is an appropriate methodological approach to evaluate market share development.

- By comparing the CAGR for the overall market and the CAGR for GSTthe candidate determines that the overall market has grown more in revenue than GST has.

- The candidate’s first finding (1) is that GST has lost market share to its competitors over the past five years.

- Alternative approach: The candidate compares GST’s market share in 2015 (18.75%) and in 2019 (16.5%).

2. Determine competitive positioning

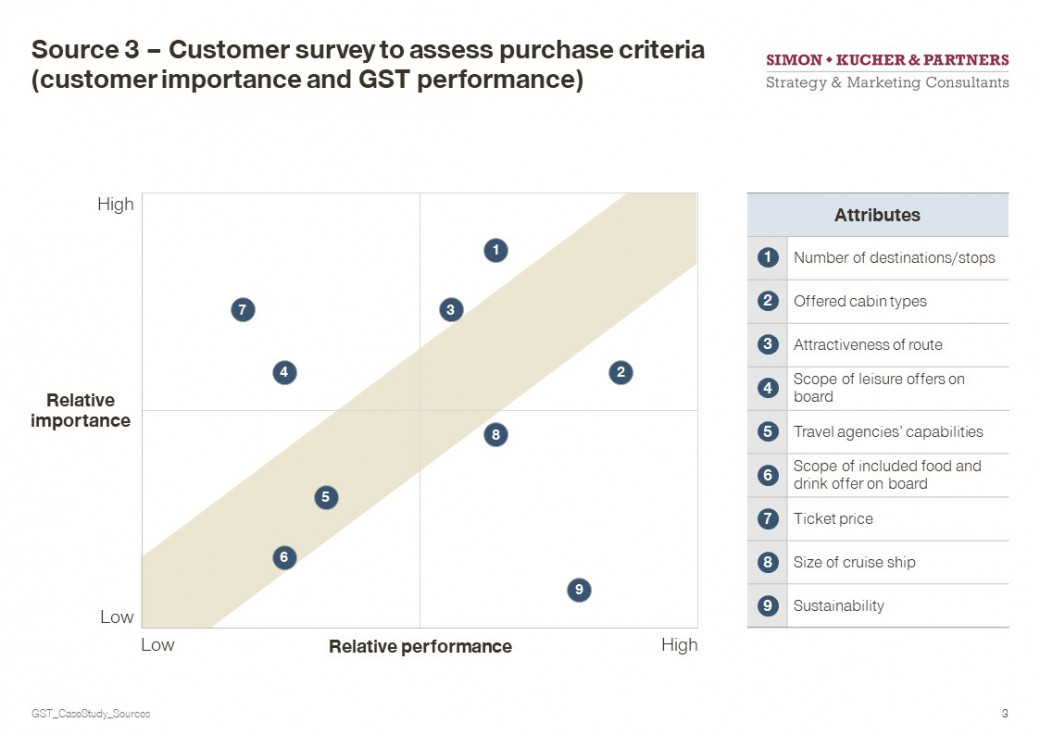

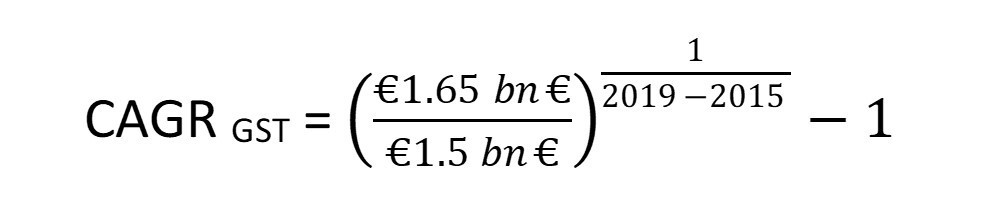

As there are multiple ways to address the topic of competitive advantages and disadvantages, the interviewer may guide the candidate by emphasizing that purchase criteria and GST’s underlying performance are important to the CCO.

The CCO is impressed by Simon-Kucher’s customer-oriented assessment and shares insights from a recent survey of potential new customers and existing accounts (source 3).

- Finding (1) implies it is very likely that GST has a competitive disadvantage.

- The goal of step 2 is to identify the underlying drivers.

- There are multiple purchase criteria for cruise trips that the candidate may think of:

- Number of destinations/stops

- Cabin types offered

- Attractiveness of route

- Scope of leisure offers onboard

- Travel agency’s capabilities

- Scope of food and drink offered onboard

- Ticket price

- Size of the cruise ship

- Sustainability

- …

- Based on the survey results, the candidate determines that GST has a competitive disadvantage in terms of ticket price, scope of leisure offers on board, travel agencies’ capabilities, and the scope of its food and drink offer on board. However, the improvement potential for the latter two drivers can be ignored, as they aren’t as important to customers.

- The candidate concludes it’s worthwhile to take a closer look at the ticket price and scope of leisure offers on board.

3. Assess growth options: Part A – Evaluating customer segments and making initial recommendations

The CCO is satisfied with the first assessment and informs the Simon-Kucher project team that GST is currently developing a product enhancement initiative. One of the objectives of the project is to improve the scope of leisure offers on board. Since the board members would like to receive the project results from Simon-Kucher as soon as possible and would prefer to avoid redundancy with the product enhancement initiative, the CCO advises Simon-Kucher to prioritize the improvement of the ticket price.

The CCO mentions that GST is planning to cancel a route where demand has strongly eroded in the past few years and replace it with a new route that includes cities that have become popular with travelers recently. The ship that GST plans to deploy on the new route has a capacity of 990 passengers. As the average fleet utilization is a KPI to which investors tend to give high attention, the utilization on the new cruise route must not fall below 81.8%. This corresponds to an average of 810 passengers per trip.

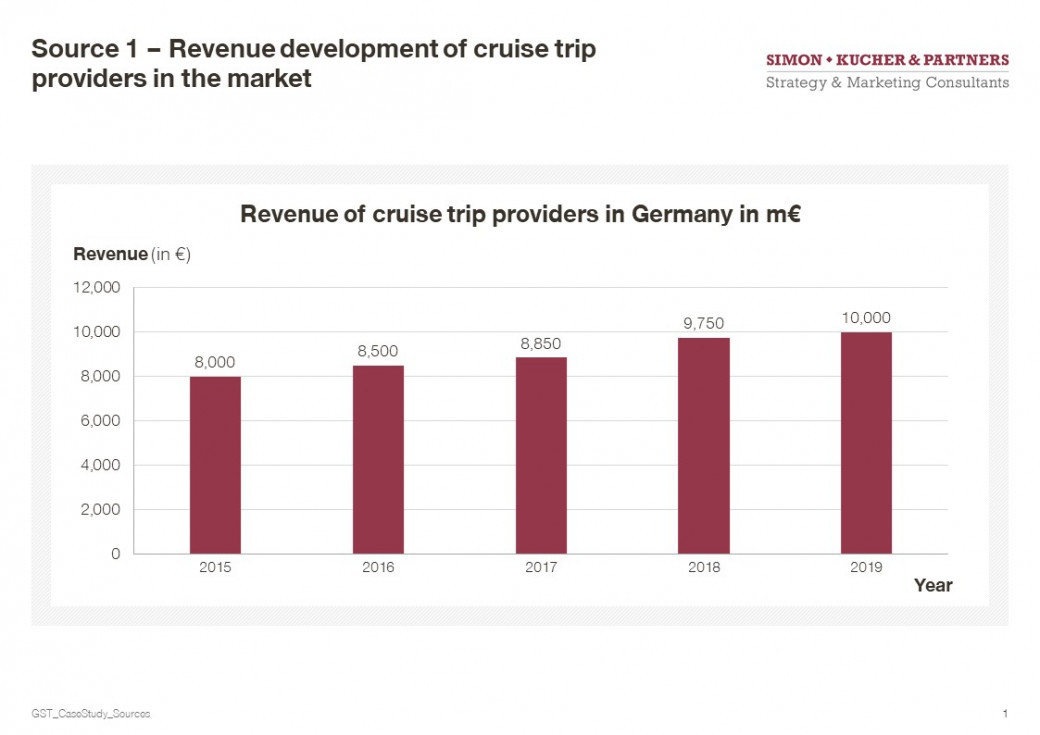

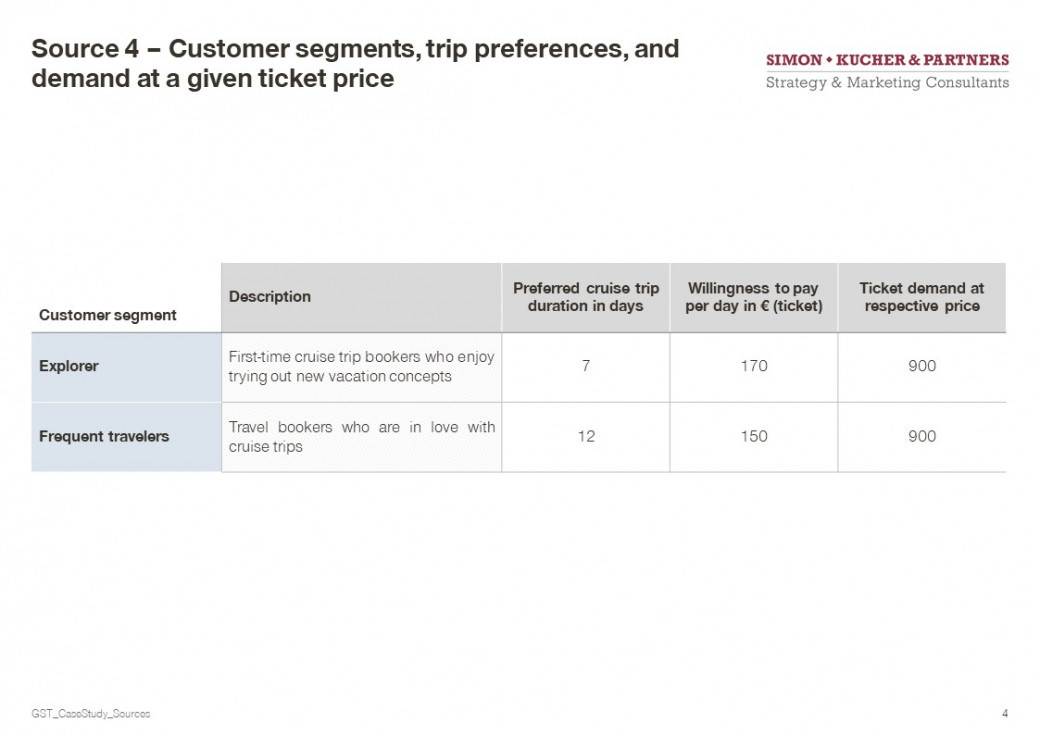

In order to learn more about potential new customers, GST analyzed the willingness to pay of highly interested GST cruise-trip customers. GST also classified customers into two segments, “Frequent Travelers” and “Explorers” (source 4).

The CCO informs Simon-Kucher that GST’s initial idea is to offer a 12-day cruise trip with a ticket price of €150 per day, which would target Frequent Travelers. However, she is open to the project team’s suggestions as to whether a different trip length or pricing would be more suitable.

Ships operate up to 365 days per year. The interviewer may advise the candidate to round down when calculating the number of cruises per year.

- The candidate recognizes that GST cannot offer the same trip to both segments, as customers in these segments have different preferences regarding trip duration. The candidate proceeds to evaluate the willingness to pay of Explorers and Frequent Travelers, using the prices stated in source 4.

- The expected revenue from Frequent Travelers totals €1,620,000 per trip (12 days x €150 x 900). In a full year, the ship can conduct 30 cruises, generating €48,600,000 in revenue.

- The expected revenue from Explorers totals €1,071,000 per trip (7 days x €170 x 900). In a full year, the ship can conduct 52 cruises, generating €55,692,000 in revenue.

- The candidate concludes that GST should focus on Explorers to optimize revenue from their new ship.

- A very good candidate may instantly state that the Explorer segment is more profitable because the daily ticket price is 13% higher than for the Frequent Travelers, while the two other variables (demand, annual cruise days) are equal.

- A very good candidate may suggest offering a mix of 7- and 12-day trips and pooling the demand of two subsequent trips in one cruise, helping to drive up utilization to 100%. The interviewer should respond that this is a very good idea but, for operational reasons, not feasible.

3. Assess growth options: Part B – Fine tuning the price level recommendation

The Simon-Kucher project leader highlights that the survey tested specific price points and the respective demand. She asks the team to look into adjustments to these prices and to determine whether this changes their recommendation.

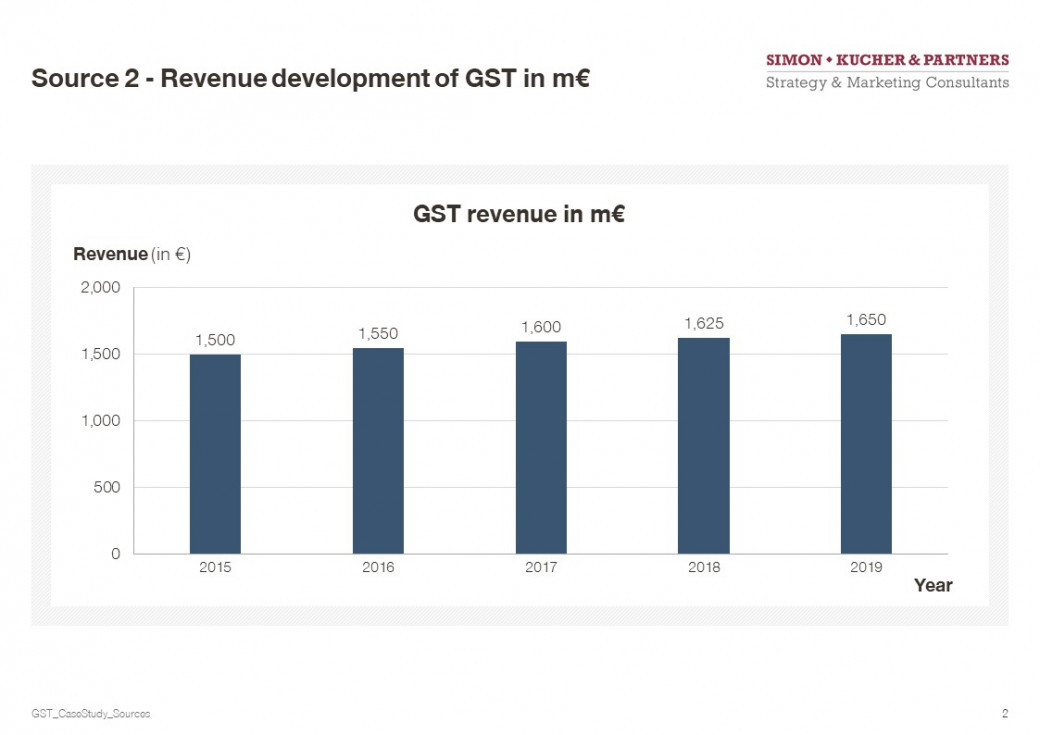

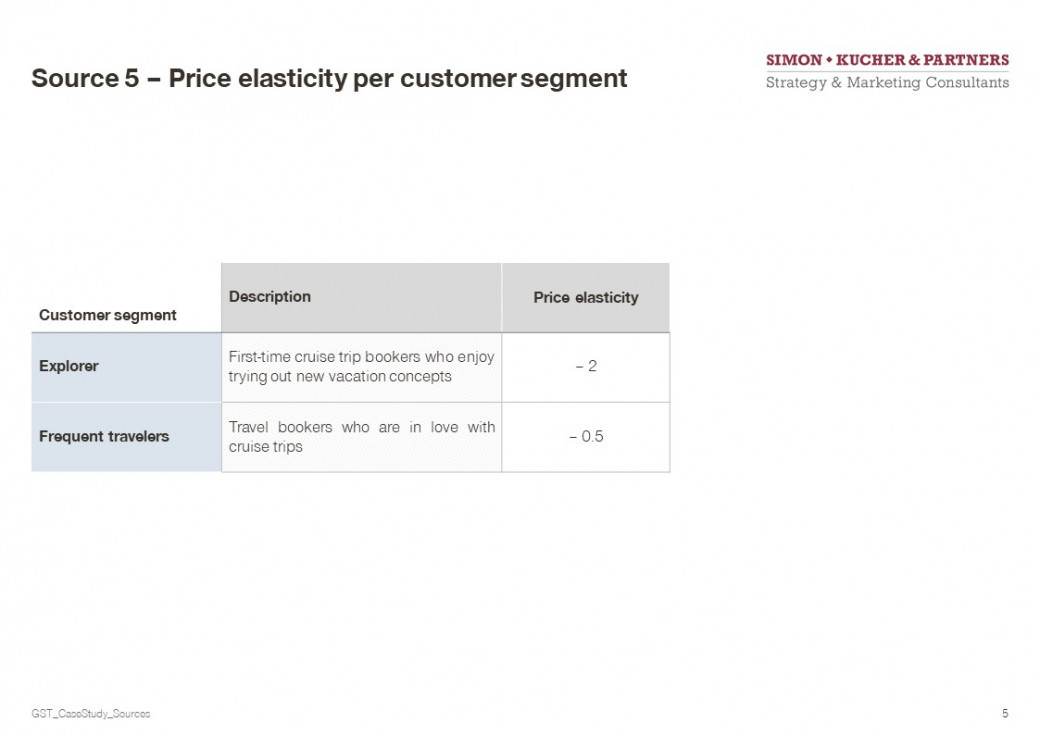

The interviewer may share source 5.

After the candidate successfully calculates the price elasticity for one of the two segments, the interviewer may skip the calculation for the second segment and share the resulting price increase/decrease with the candidate.

- The candidate recognizes that, when adjusting pricing, the resulting volume implications are usually subject to price elasticity effects. The candidate requests more information on the price elasticities.

- A very good candidate concludes that price elasticity of -2 indicates there is potential to reduce prices (as the volume effect should make up for lower price) and elasticity of -0.5 suggests potential to increase prices.

Frequent Travelers:

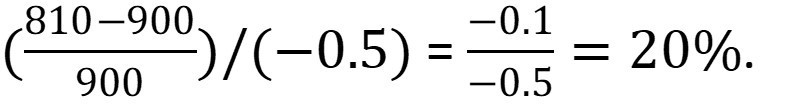

1. To ensure there are at least 810 passengers on board, the price can be increased until demand drops to 810. This condition is met if the price increases by a maximum of

2. The new price would therefore be €180, instead of the previous €150.

3. The resulting revenue would total €52,488,000, compared to the previous €48,600,000.

Explorers:

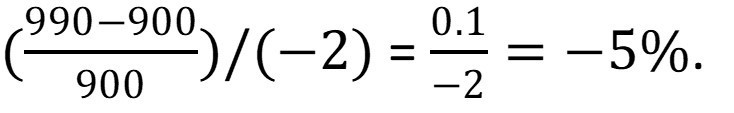

1. As the maximum capacity is 990, the price can be reduced until demand reaches this limit. The required price decrease needs to be

2. The new price would therefore be €161.50, instead of the previous €170.

3. The resulting revenue would total €58,198,140, compared to the previous €55,692,000.

- For the Explorers, i.e. the new target segment, the results prove that GST has a competitive disadvantage in terms of price (which is in line with the results from the customer survey in section 2 of the case study). By lowering the price, GST would attract more customers, see an improvement in customer evaluations of its performance over time, and increase its market share.

- A strong candidate would (qualitatively) address other possibilities for further, more sophisticated pricing solutions, such as dynamic pricing based on capacity utilization.

- The candidate may also address the abovementioned additional services on board, such as leisure activities. The segment that contributes the most ticket revenue will not necessarily be the one that contributes the highest revenue from onboard activities and excursions.

4. Present recommendations

The CEO of GST joins the meeting with the CCO and Simon-Kucher and requests a briefing of the assessment in five sentences or less.

- The interviewer should make sure the candidate articulates their points concisely using a top-down communication approach, e.g. “Considering the market shares of GST, they have indeed been declining over the past few years despite the revenue growth. The key factors behind this decline are GST’s ticket prices and the scope of leisure offers on board. For your new route, you should focus on seven-day trips for customers in the Explorer segment at a price point of €161.50 per day of the trip. This would generate €58,198,140 in revenue.”

- A strong candidate may also point out that the trip duration, customer focus, and price point they are proposing would generate €9,598,140 more in revenue per year than GST’s initial plan to launch a 12-day trip at €150 per day targeted at Frequent Travelers.

Simon-Kucher Case: GST Cruise Company

i