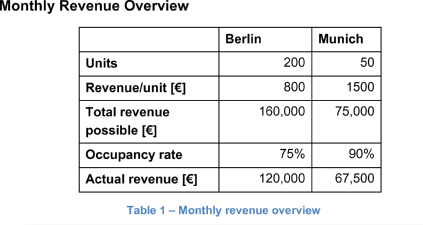

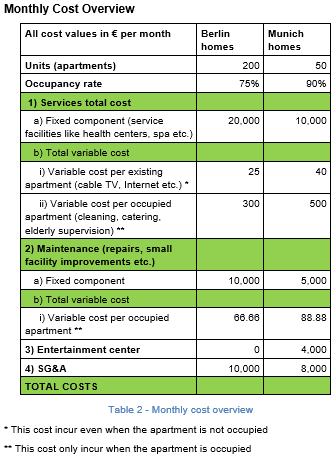

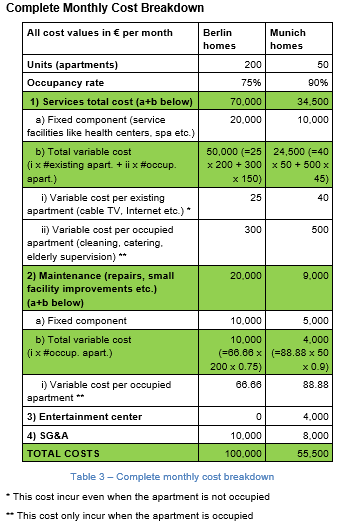

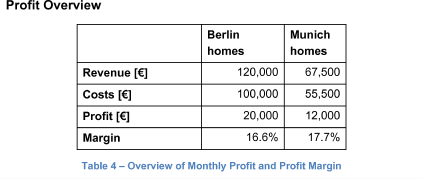

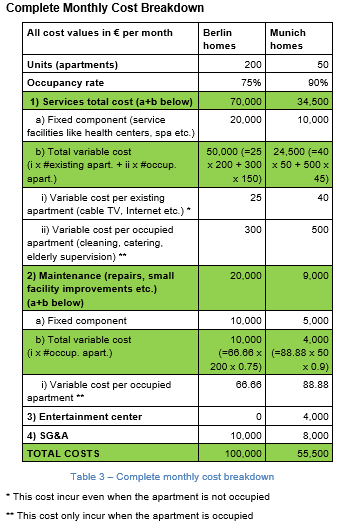

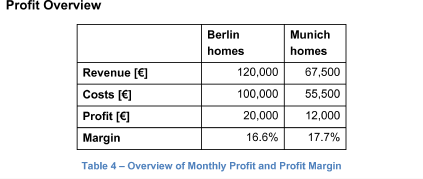

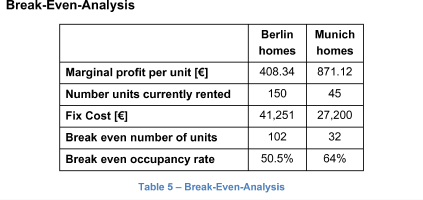

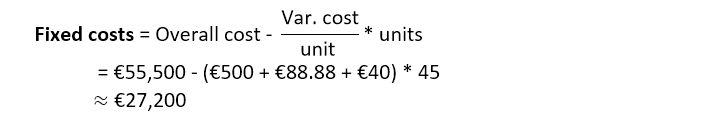

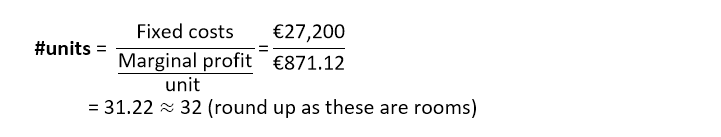

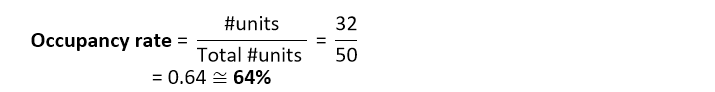

Your client is a 5-year-old company that operates retirement homes (where elderly people can receive appropriate care) in Germany.

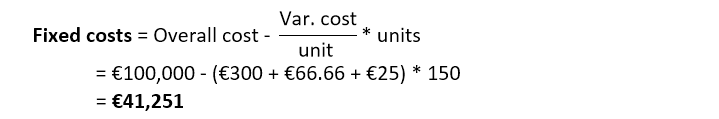

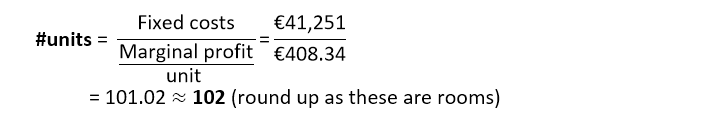

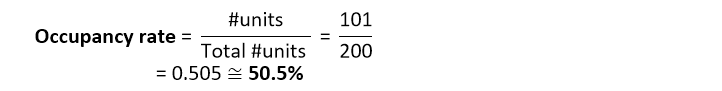

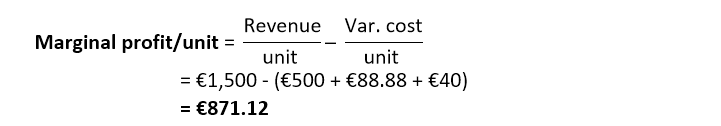

A few months ago, they opened a new home in Munich. They are concerned about its profitability. How would you help the client?

Retirement homes

i