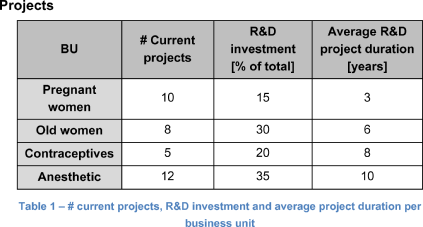

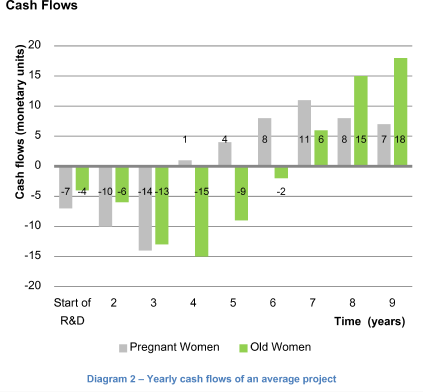

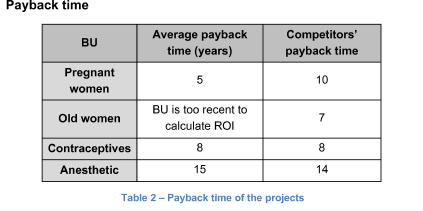

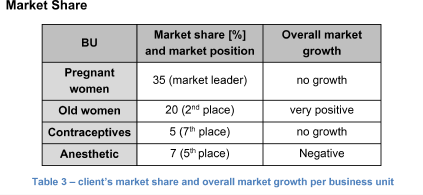

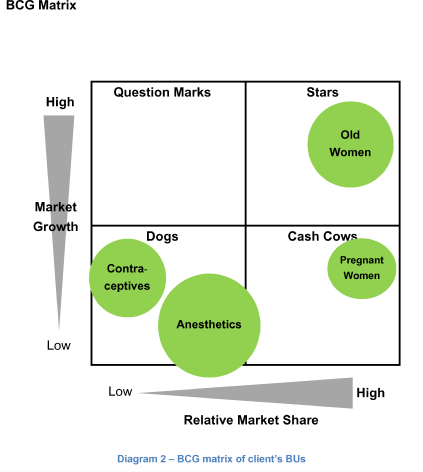

Your client is a pharmaceutical company which is worried about the portfolio optimization of their R&D projects.

They hired us to investigate it and help them make the most return of their R&D investments in the short and mid-term (without totally forgetting the long-term horizon).

How would you go about it and what would you recommend the client to do?

Pharma R&D

i