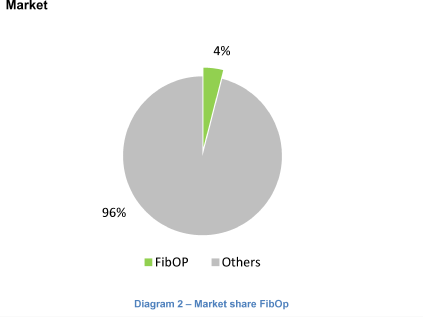

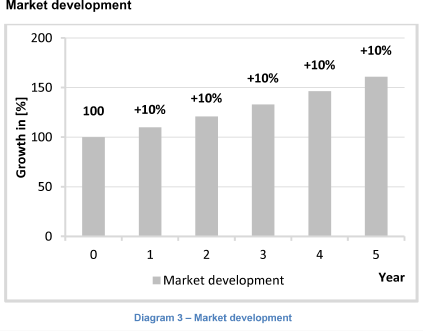

The new CEO of an optical fiber manufacturer, called FibOp, has come to you complaining that their revenues went down by 40% this year compared to last year.

He wants you to help him figure out what they need to do in order to achieve the previous year’s revenues again.

FibOp fibers

i