A chemical producer is a major manufacturer of chemical products used to preserve foods in containers. The company has seen an increase in market share, but the company has also seen a decline in profits. Our client, the CEO is worried about this trend and hires you to investigate what is going on.

Case Prompt:

Sample Structure

Suggested case structure:

I. Background

Information shared with candidate after asking the question 'what does increase in marketshare mean?'

- A market share number is a percentage, not an absolute number.

- It can mean that client has outbeat competition and increased his marketshare.

- It can also mean that competition has left the market.

- It can also mean that the overall market is shrinking, but client's sales are decreasing less than its competitors.

The candidate should ask the interviewer: What does an increase in market share mean?

II. Analysis

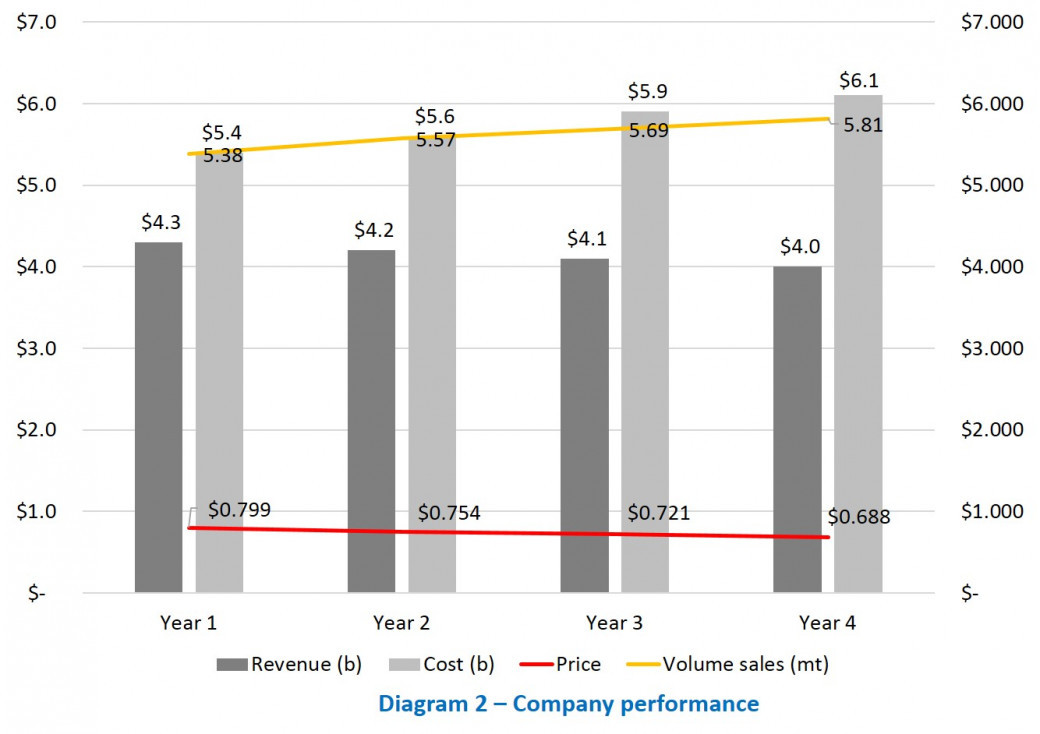

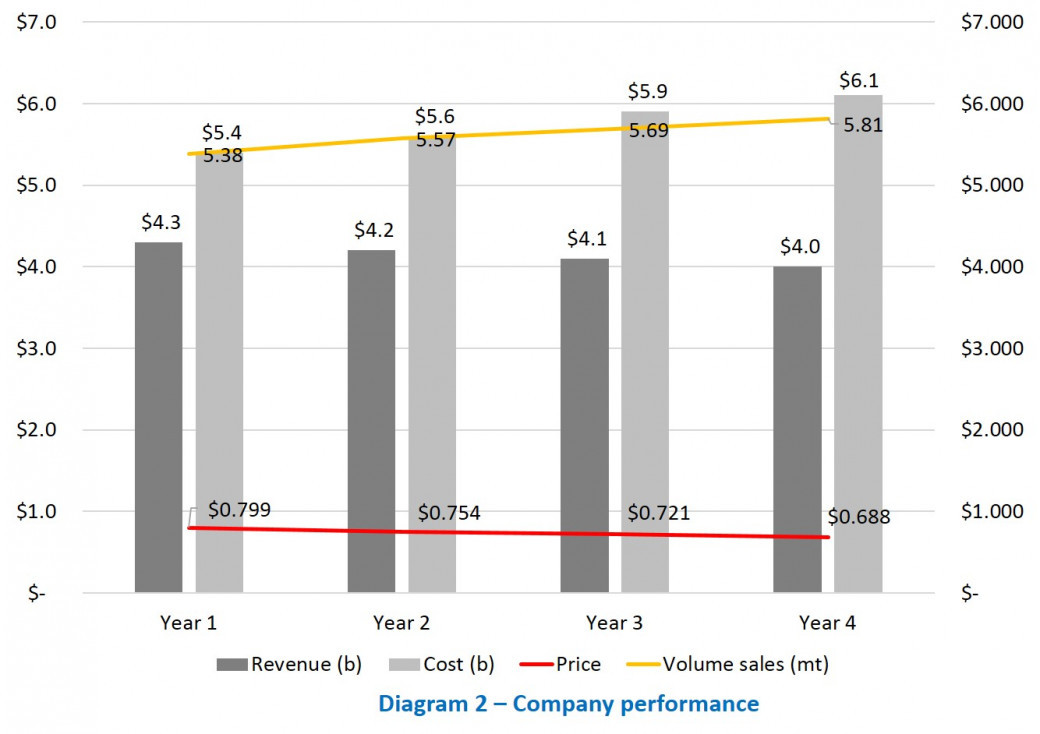

Share Diagram 2 with the candidate to view the company's performance.

Based on the candidate's question, the interviewer can share the following information in case required:

- Variable costs per item have not changed in the past years.

- On the revenue side, the client has seen an increase in the volume output which is higher than the industry average, but prices have decreased.

- Competition has decreased and some players have exited the industry.

- Competitors were losing money with a feeling that the market has saturated.

- The industry overall has seen negative numbers with a decrease in demand for the product.

- There are no substitute products on the market - consumers want fresh food now and not preserved food.

- The food industry is also losing money and is pressuring suppliers to renegotiate raw material prices.

- The client gained market share due to the exit of existing suppliers.

From here on, the candidate should lead the case by using the profit framework and asking questions on revenue, costs, and competitors' moves.

Based on this information, the candidate should ask to compare the revenue insights with competitors.

The candidate should keep asking about the exiting of competitors to understand what is going on.

The candidate should stick with the competition and the industry as a whole and should note that clients might have to lower prices due to lower demand.

III. Solution

- The client has gained market share through the exit of competitors.

- Prices have gone down and costs stayed the same explaining the fall in profits.

- Structural change in consumer trend that's affecting the entire industry and its suppliers negatively.

- Preserved food as a product may be at the end of its product life cycle.

- The client should focus on cost reduction to maintain profitability since prices are falling.

- The client should look for partnerships with other suppliers to strengthen the negotiation position.

- The client should diversify its product portfolio and develop new products/enter new markets.

Further Questions

To secure a future, should the client acquire direct competitors or food manufacturers?

- Should the acquisition be an option at all?

- Under what circumstances?

To secure a future, should the client acquire direct competitors or food manufacturers?

- Should the acquisition be an option at all?

- Under what circumstances?

ChemCo Foods

i