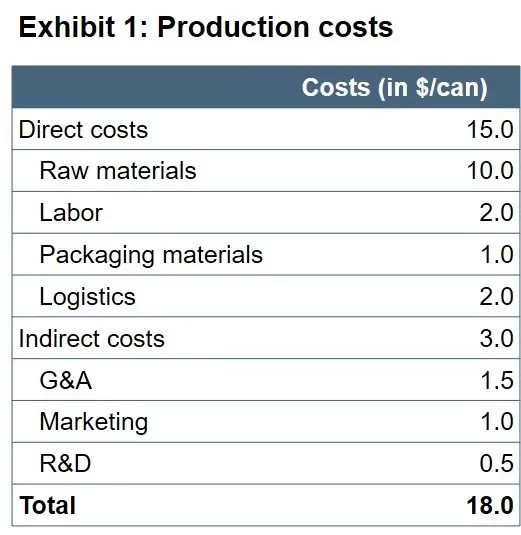

BabyformulaCo is a leading producer of baby formula with a 30% market share in the US that is looking for ways to increase their market share without significantly lowering profitability. Recently, a Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) for low-income women and their children was introduced, which provides vouchers to purchase baby formula.

The client is interested in bidding for the tender contracts but needs help in determining the appropriate bidding price.

19.8k

Times solved

Intermediate

Difficulty

Do you have questions on this case? Ask our community!