Sprinker is a mid-sized, US-based publishing agency that develops, produces, and sells educational materials. It has come to their attention that some private schools are considering changing their first-grade textbooks, for which they would need a publishing agency.

Sprinker is interested in participating in the closed tender and wants to determine whether this would be economically viable.

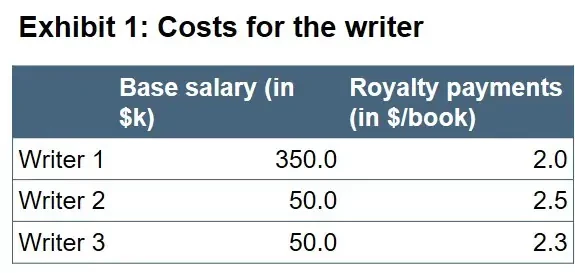

Sprinker