Sprinker

Sprinker is a mid-sized, US-based publishing agency that develops, produces, and sells educational materials. It has come to their attention that some private schools are considering changing their first-grade textbooks, for which they would need a publishing agency.

Sprinker is interested in participating in the closed tender and wants to determine whether this would be economically viable.

Sample Structure

1. Quantitative analysis

1.1. Economic assessment

1.1.1. Revenues

1.1.2. Costs

1.1.3. Probability of winning tender

2. Recommendation

Background

Note for Interviewer

Provide the candidate with the following information upon request.

- Sprinker considers the development and printing of the new first-grade textbooks economically viable if a profit is made in the first year, despite the fact that they would have to rent a new production facility and invest in new machinery to do so.

- Participation in the closed tender is free of charge.

1.1. Quantitative Analysis | Economic Assessment

1.1.1. Revenues

Note for Interviewer

Provide the candidate with the following information upon request.

- First-graders are 7 years old.

- The US population is 350m.

- Over the last 7 years, the US population has grown by 4%.

- 10% of students attend private schools.

- The life expectancy in the US is 75 years.

- Each first-grader has one textbook.

- The price of the textbook is $25.

1.1.2. Costs

Note for Interviewer

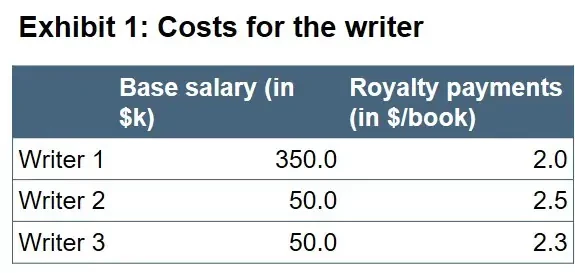

Provide the candidate with exhibit 1 upon request regarding the costs for the writer.

Note for Interviewer

Provide the candidate with the following information upon request regarding other costs.

- The manufacturing costs per book are $5.

- The rental costs are $1m per year.

- The investments in new machinery are $2m.

1.1.3. Probability of Winning Tender

Note for Interviewer

Let the candidate know that we found that three competitors are interested in participating in the closed tender, each having an equal chance of winning it. We estimate that if Sprinker is willing to run a marketing campaign for $1m, their chances of winning the closed tender will increase to 80%.

1.1.1. Revenues

No. of Children Born per Year

No. children per year = 350m ÷ 75y ≈ 4.67m

No. of Children Born 7 Years Ago

No. children 7y ago ≈ 4.67m ÷ (1 + 4%) ≈ 4.49m

No. of Private School Children

No. private school children ≈ 4.49m × 10% ≈ 449k

Potential Revenues of Sprinker

Pot. Revenues Sprinker ≈ 449k × $25 ≈ $11.22m

1.1.2. Costs

Total Personnel Costs for Writer 1

Total pers. costs writer 1 ≈ $350k + $2.0 × 449k ≈ $1.25m

Total Personnel Costs for Writer 2

Total pers. costs writer 2 ≈ $50k + $2.5 × 449k ≈ $1.17m

Total Personnel Costs for Writer 3

Total pers. costs writer 3 ≈ $50k + $2.3 × 449k ≈ $1.08m

Considering the current volume, writer 3 appears to be the most cost-effective option. However, over the long term, a writer's royalty payments constitute the largest part of total personnel costs.

Therefore, if Sprinker seeks to establish a long-term relationship with the writer, they should opt for writer 1, who offers the lowest royalty payments per book.

Total Costs in Year 1

Total costs Y1 ≈ $1.25m + $2.24m + $1.00m + $2.00m ≈ $6.49m

1.1.3. Probability of Winning Tender

Expected Profits in Year 1 When Not Launching the Marketing Campaign

Expected profits Y1 w/o mktg. campaign ≈ ($11.22m - $6.49m) × 25% ≈ $1.18m

Expected Profits in Year 1 When Launching the Marketing Campaign

Expected profits Y1 w/ mktg. campaign ≈ ($11.22m - $6.49m) × 80% - $1m ≈ $2.78m > $1.18m

2. Recommendation

- First of all, I would advise Sprinker to participate in the closed tender as it is economically viable, based on the calculations provided.

- In doing so, the client should opt for writer 1, who offers the lowest royalty payments per book. This choice will be beneficial for establishing a long-term relationship with the writer and minimizing royalty costs over time.

- Moreover, the client should run the marketing campaign for $1m as expected profits with the marketing campaign are higher than without, amounting to $2.78m.

- As next steps, Sprinker should start by preparing a comprehensive proposal for the closed tender, outlining the benefits of their educational materials and expertise. Afterward, the client should develop and execute the $1m marketing campaign to increase their chances of winning the tender. Once the campaign is in motion, Sprinker can engage in negotiations with writer 1 to finalize the contract terms and establish a long-term partnership. Finally, the client should allocate resources for the rental of the new production facility and the acquisition of new machinery.

Market Entry

Master market entry cases in consulting. Learn key strategies, financial analysis, and approaches to successfully enter new markets.

The Blue Ocean Strategy

The Blue Ocean Strategy advocates for the generation and seizure of new demand in untapped or uncontested market spaces. Learn how to apply it in our basics!

Market Sizing

Learn more about Market Sizing Questions and how to approach them in Case Interviews (incl. Practice Cases & Insider Tips).

Growth Strategy

Learn how to develop effective growth strategies in case interviews. Discover key factors for revenue growth and boost your chances of success!

Competitive Response

You have to analyze how your customer should react to the strategy of a major competitor? Learn everything about competitive response cases now.