Our client is a Chinese publisher called AnimeCo who is looking to publish a new book based on the popular Anime series Little Panda. This series has been highly popular in China with millions of viewers every day and the publisher is looking to capitalize on this potentially.

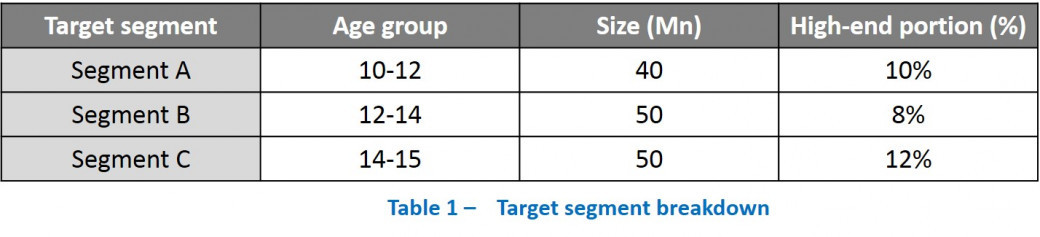

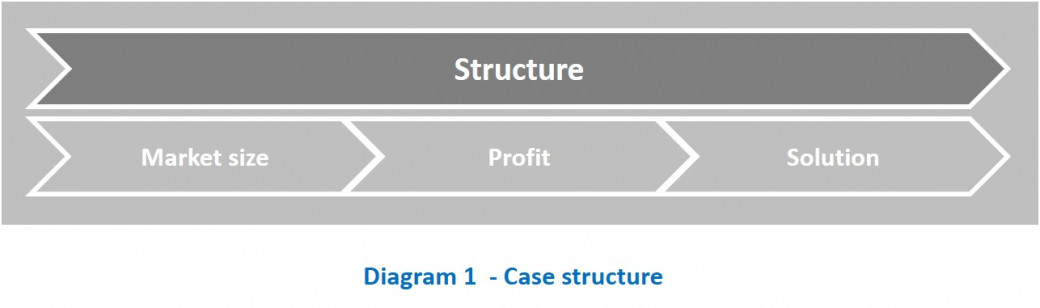

They have asked us to provide advice on whether this will be a good investment and if they should move forward with it. They want to know the total market size, potential revenue & potential profit.

China book publisher

i