Your client, BusCo, is a passenger bus company in Uganda, Africa. Due to the poor road conditions, maintenance plays a very important role in the reliability and quality of BusCo’s services.

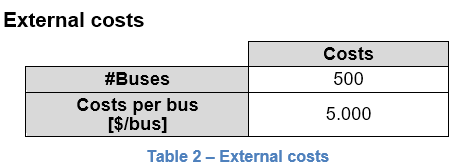

BusCo outsourced all of its bus maintenance operations to MaintainCo in the last years. However, especially last year, BusCo was very disappointed with the maintenance provided. The bad service caused delays in service as well as trip cancellations.

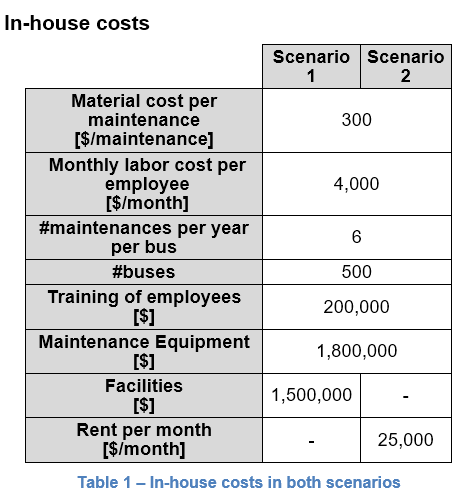

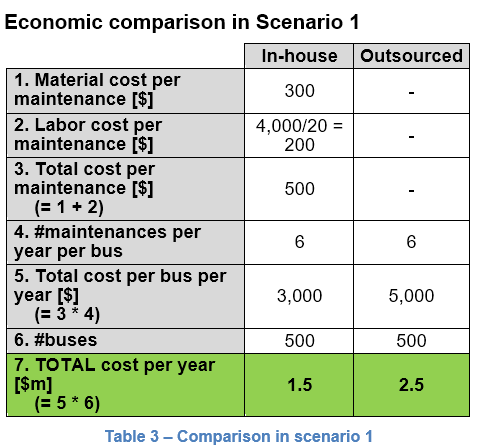

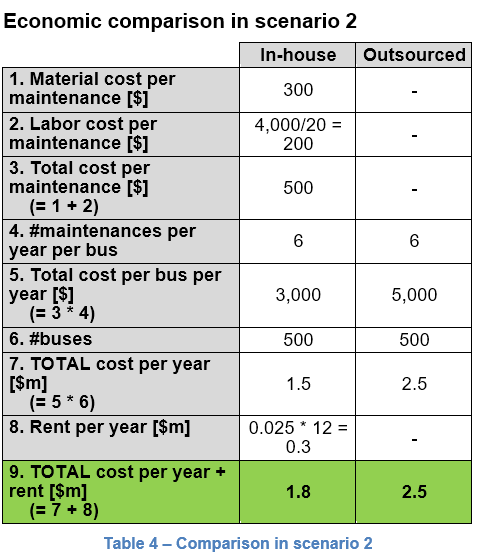

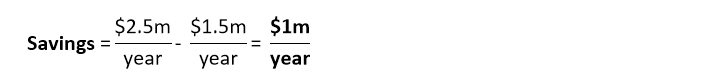

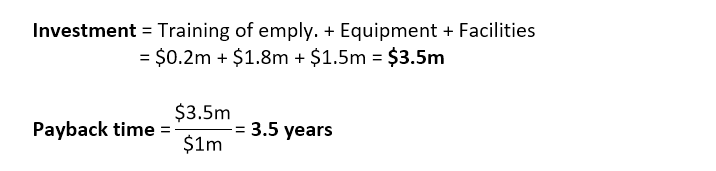

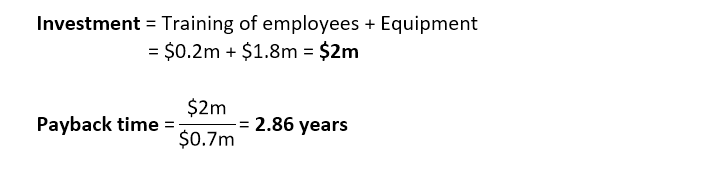

Now BusCo is considering doing its maintenance in-house. However, an investment amortization period of 4 years or less is required.

The CEO wants to know from you if they should pursue the in-house maintenance strategy next year?

Bus maintenance

i