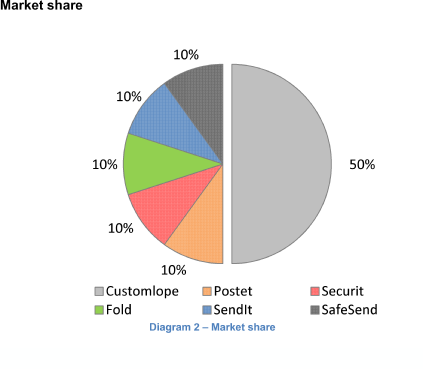

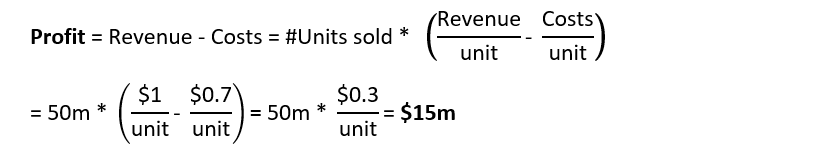

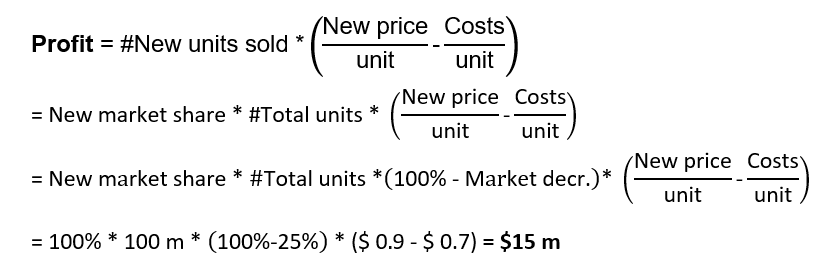

Your client, Customlope, is the leader in the US secure envelope manufacturing industry. Banks buy these envelopes for operations such as money deposits and high value transactions.

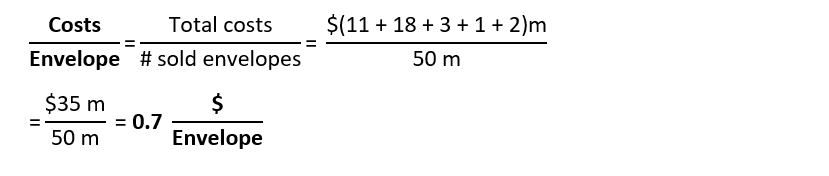

Next year, a new digital technology will reduce the overall number of units sold in the industry by 25%.

In the short term, our client wants to maintain his current profit level without investing in the new technology.

How can you help him?

Bank envelope

i