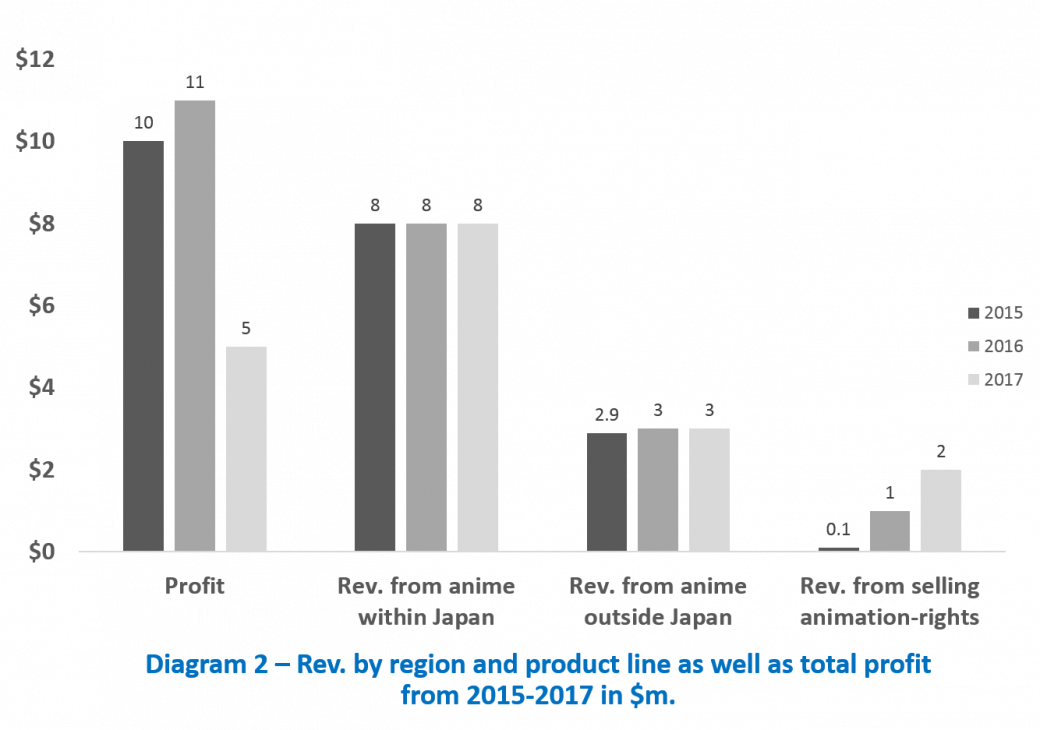

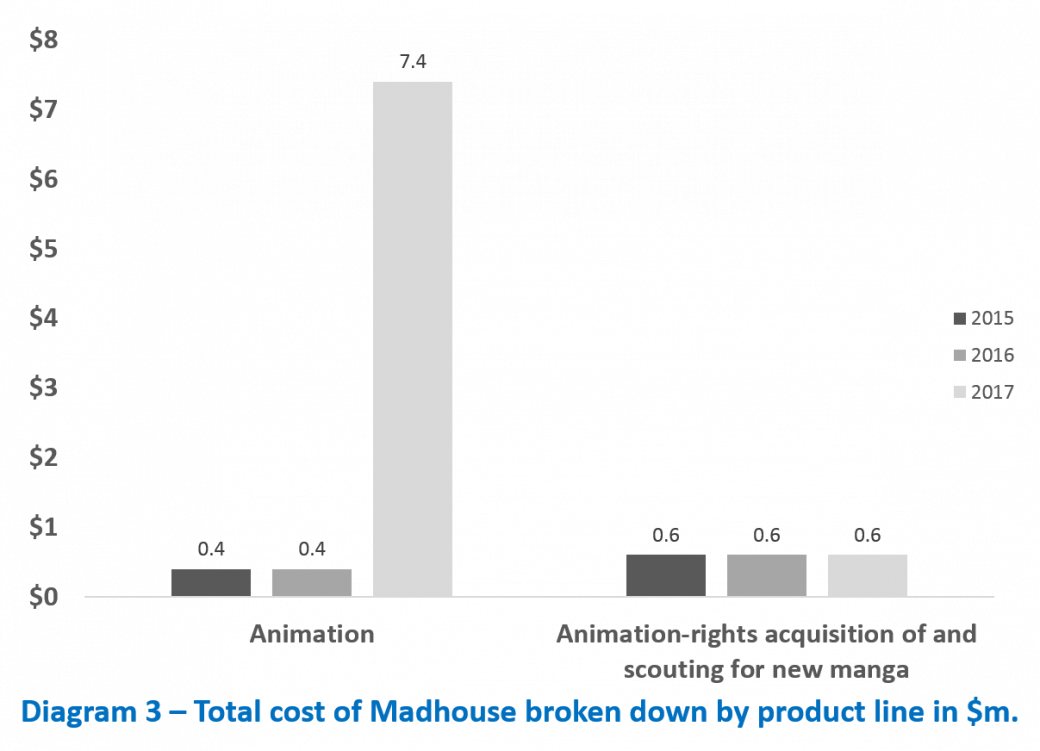

Your client is Madhouse Studios, one of the largest anime producers in Japan. The anime-industry is flourishing. Originally revenue was generated mainly in Japan but the trend is that revenues outside of Japan are growing at a steady rate of 15% a year as more and more non-Japanese people enjoy anime. Despite this rapidly growing new segment, Madhouse lost $6m in profits at the end of 2017 even though profits were growing steadily the years before.

Madhouse has given you the objective to find the root cause of the loss in profitability and to advise them on how to proceed from here.

The Madhouse Animation Crisis

i