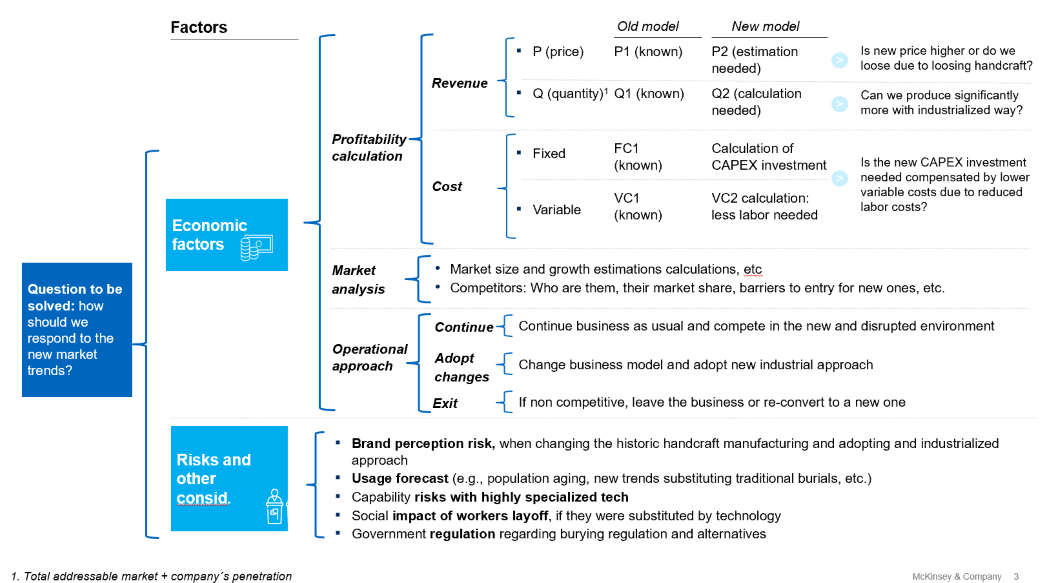

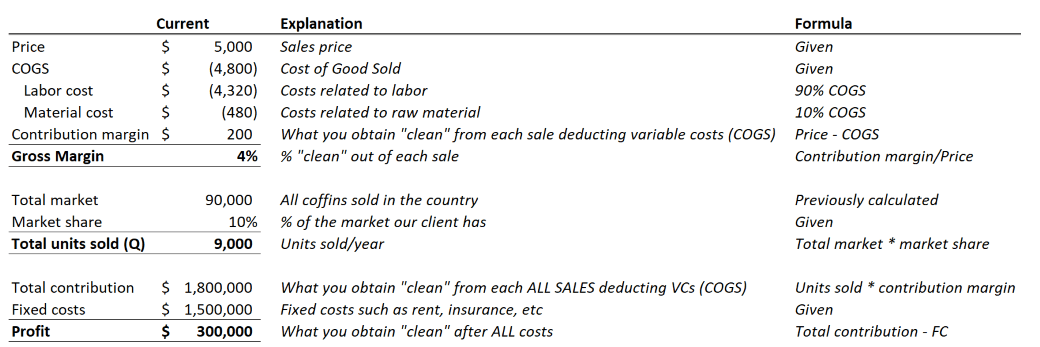

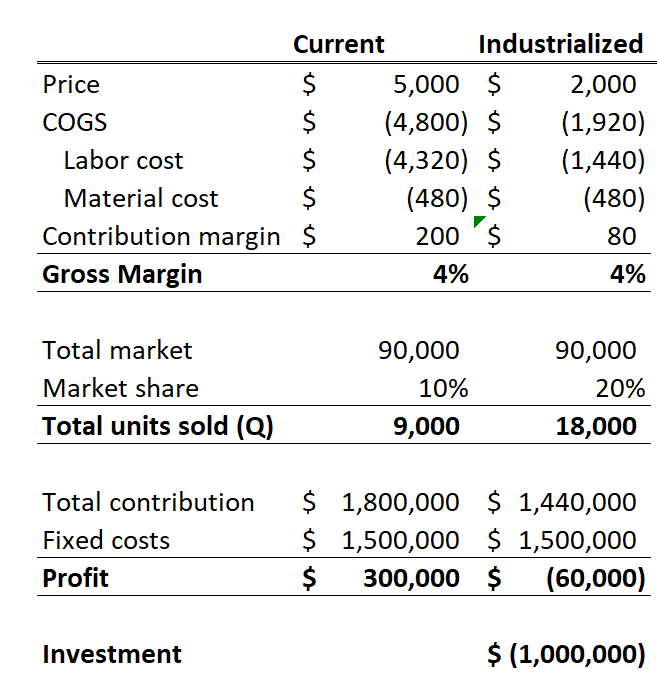

Your client is the CEO of a coffin manufacturing company based in Geneva, Switzerland (Europe).

The company has existed with little changes to the business model for three generations, manufacturing high-quality, hand-crafted coffins, with a highly skilled and specialized labor force. The industry has been recently disrupted by new technologies that no longer need human manufacturing: machines can manufacture faster and cheaper.

Your client needs your help in deciding whether to invest in this technology and transform his business, or remain in the hand-manufactured business for coffins

*Note: On top of this initial question that focuses on the strategy and should be tackled by the candidate with an issue tree, the case includes more questions that can be found in the "Detailed solutions" and "Difficult questions" boxes below, with the correspondent proposed answers.

Swiss Coffins – The Death Business

i