Our client is a supermarket chain in Britain called Sparx. They have been the market leader for more than 30 years. However 5 years ago they have seen growth stall and 2 years later revenues started shrinking, keeping so until today. The profitability of the chain has followed the revenue downturn trend, but dropped in percentage much more than the revenues.

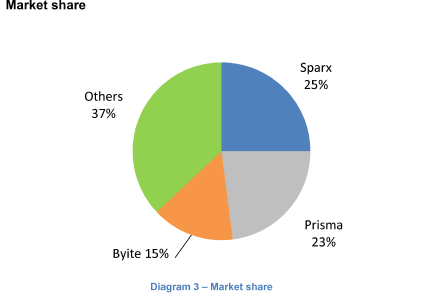

They now hold only 25% market share, with the second player getting dangerously closer with 23%.

What’s wrong and how can you help them turn this situation around?

Supermarket turnaround

i