After a congress about general science in which you took part out of personal interest, a renowned scientist comes to talk to you. He swears he invented the world’s first perpetual motion apparatus. It requires no energy source and keeps running forever. It can even turn a small fan with its motion.

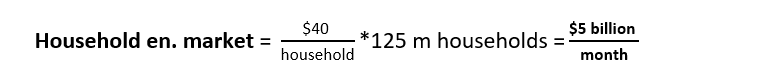

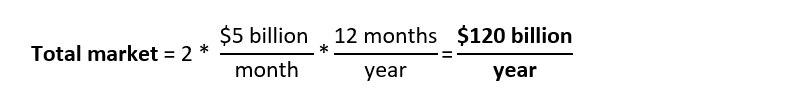

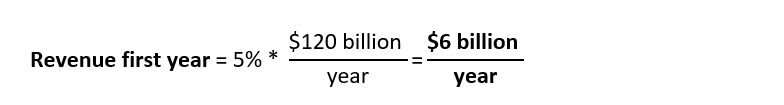

The scientist asks you in which markets he can monetize the invention and how much money he could make in Europe in the first year.

Perpetual motion

i