Deep water is a European manufacturer of small yachts and premium boats for private customers. The company operates in Europe and the Middle East and is based in Northern European country, where its manufacturing site, as well as HQ, are located. Deep Water has a strong and recognizable brand as a manufacturer of luxury boats and (recently) also small yachts. Deep water has been experiencing significant financial difficulties related to its profitability during the several past years. Currently, Deep Water has about 200 M€ of sales p.a. The company wants to improve its profitability, maintaining at least the current level of sales.

Case Prompt:

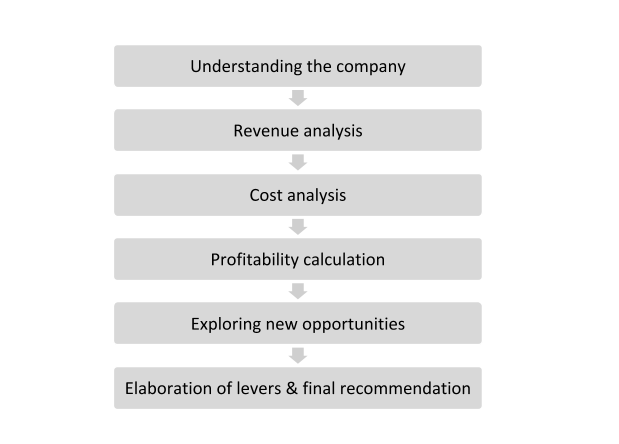

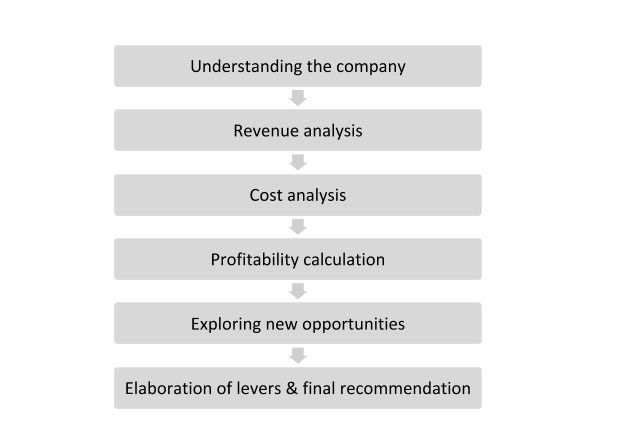

Sample Structure

I. Initial Case Structure

The candidate should suggest a comprehensive approach for this case, covering the profitability calculation as well as general market analysis.

The first step would be to gather general information about Deep Water, including its capabilities, products, geographies, where the company operates as well as its financials, including the cost breakdown and revenue streams. The next step in the case should be a calculation of profitability and the change in profits since 2016. The last step would be exploring new opportunities and elaborating on improvement levers for Deep Water.

II. Understanding the Company and its Portfolio

Information can be shared with the candidate if asked:

Deep Waters manufactures different types of boats and yachts: small premium class motorboats and two different types of yachts with up to 30 m length, 4 rooms, and for 10 guests.

They recently (2018) entered the yacht segment and for this segment, they focus mainly on 3 regions: Europe, Russia, and the Middle East.

The boat division covers these three regions, but also provides its products for customers from Germany, the UK, France, Italy, and Scandinavia.

After signing a contract with a potential customer Deep Water develops a specific design for a boat or yacht and then builds it for the customer.

Both markets (boats and yachts) are fragmented: there are multiple players with almost similar brand strength and quality & price of their products. All players have roughly similar market shares and there were no significant shifts in the past.

Ask the interviewer for more information on boats, for example, the different types, the regions, and information on the boat market.

III. Revenue Analysis

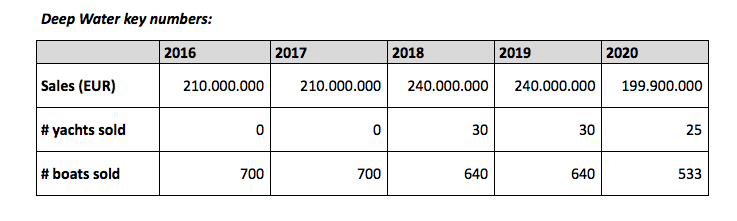

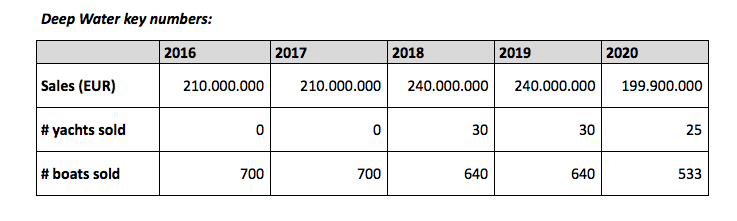

Chart "Deep Water key numbers" to be shared with a candidate after she/he elaborated a detailed approach for revenue streams analysis:

Current Deep Water overall sales: 199,9M €

Yacht business accounts for 20% of the sales. 50% of all revenues from the yacht business are generated by clients from the Middle East region. The rest is equally divided between Russia and Central Europe.

The final price for boats is 300K €.

Prices for yachts are from 1 to 4M €. Yachts for the Middle East have a selling price of 4M €, while yachts for the other 2 regions have a price of only 1M €.

IV. Cost Analysis

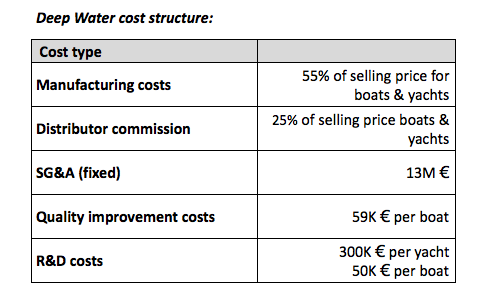

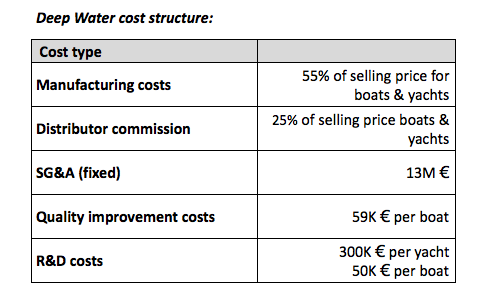

Chart "Deep Water cost structure" to be shared with a candidate after discussion of possible cost types of a shipbuilding company

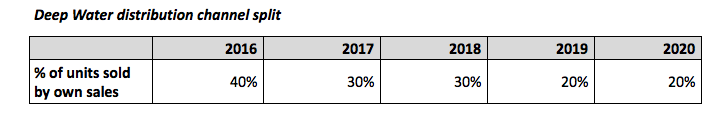

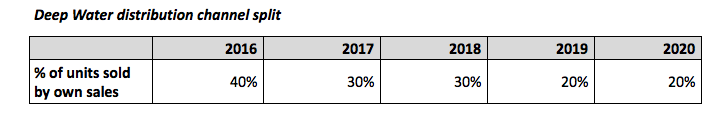

Chart "Deep Water distribution channel split" to be shared with a candidate after the discussion about Deep Water’s distribution channels

Deep Water has multiple major cost types, including boat/yacht manufacturing costs, distributors commissions, SG&A, and R&D costs. During the purchasing process, a client who buys a boat or yacht is contacted by an external designer bureau and its R&D team, which helps a customer with design ideas and equipment for a future boat or yacht. R&D costs for Deep Water for a boat are 50K € and for each yacht 300K €.

Moreover, Deep Water found out that some clients are not satisfied with the quality of boats (the yacht business is not affected). In 9% of all the cases since the beginning of 2018, when a new boat is sold, an additional sum of 59K € is paid to the repair team to improve the quality of a boat to meet the customers’ expectations.

After seeing the distributor fees in the chart (or even earlier while discussing the company’s business model) a candidate should ask the interviewer about the distribution channels of Deep Water. It is suggested to ask a candidate how a typical shipbuilding business distribution model could look like. A possible approach could be a comparison with the automotive or civil engineering industries.

In fact, Deep Water distributes its products via its own salespersons and luxury boat/yacht dealers. Own sales channels do not generate any additional costs for the company since the sales staff receives only a fixed payment. Dealers receive 25% of the total price of the final product as a commission fee.

V. Calculation of Profitability and Recent Changes

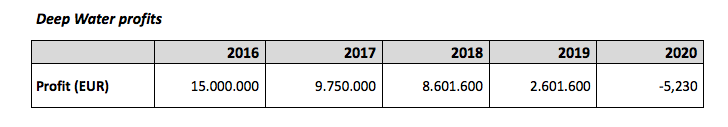

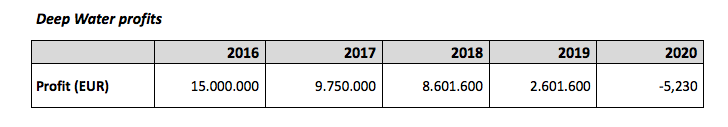

The candidate should find out, that profits of Deep Water significantly dropped from 15M € in 2016 to -5,23K € in 2020. It is the most important issue of the company which must be dealt with. Ask a candidate what the drop in % in profits was when she/he compares 2016 vs. 2020.

Table with Deep Water profits can be shared after a candidate calculated profits for all years

Based on the provided information a candidate can calculate profits for each year:

210M €. Boat revenues are 100% (since Deep Water has been active in the yacht business since 2018). The number of produced boats is 700.

Costs are comprised by manufacturing costs (210M € * 0,55) + R&D Costs (700 boats * 50K €) + distribution costs ((1 - 0,4) * 0,25 * 210M €) + SG&A costs (13M €)

210M € - 195M € = 15 M€

210M €. Boat revenues are 100%. The number of boats is 700.

Costs are manufacturing costs (210M € 0,55) + R&D Costs (700 boats * 50K €) + distribution costs ((1 - 0,3) * 0,25 * 210M €) + SG&A (13M €)

210M € - 200,250M € = 9,750M €

240M €. Boat revenues are 80%. The number of boats 640. The number of yachts 30.

manufacturing (240M € * 0,55) + R&D (640 * 50K €) + (30 * 300K €) + distribution ((1 – 0,3) * 0,25 * 240M €) + SG&A (13M €) + repair costs for boats (640 * 0,09 * 59K €)

240M € – 231,3984M € = 8,6016M €

240 M€. The number of boats 640. The number of yachts 30.

manufacturing (240M € * 0,55) + R&D (640 * 50K €) + (30 * 300K €) + distribution ((1 – 0,2) * 0,25 * 240M €) + SG&A (13M €) + repair costs for boats (640 * 0,09 * 59K €)

240M € - 237,3984M € = 2,6016M €

240 M€. The number of boats 640. The number of yachts 30.

manufacturing (240M € * 0,55) + R&D (640 * 50K €) + (30 * 300K €) + distribution ((1 – 0,2) * 0,25 * 240M €) + SG&A (13M €) + repair costs for boats (640 * 0,09 * 59K €)

199M € - 199,905230M € = -5,230K €

VI. Exploring New Opportunities Outside the Existing Markets

There is a general drop in the luxury boat segment sales due to the high prices, which potential customers cannot afford. The situation is especially affected by the COVID crisis. A recent market study provided the following key findings: generally, the luxury boats & yachts market is getting saturated. Many potential customers move to other models: they rent boats for one season instead of buying a boat. While the yacht segment is slightly growing (1% p.a.), the luxury boat segment is currently shrinking (-5% p.a.).

The mid-class boat segment (price range from 50K to 200K €) is growing at a 5% rate, but Deep Water is not active in this market. Still, it has all capabilities to manufacture boats also in this segment. Cheaper boats (price <50K €) is growing even faster (10%). Potentially Deep Water could also produce cheaper small boats.

To produce mid-class boats, no additional R&D costs are required. That would mean that cooperation with an R&D bureau would not be required anymore to provide a design for a single boat and internal R&D staff (if hired) would be able to provide general design for a pre-customized boat for a fixed annual salary.

Mid-class and cheap boat segments are dominated by Chinese and other low-cost players, which produce large numbers of boats and then distribute them via different channels. The market is segmented, but still, there is a couple of bigger competitors. A company’s brand does not play a significant role for a potential customer. What is more important is the price and price/quality ratio.

There is also a superyacht business segment, but it would be extremely difficult for Deep Water to enter this segment since the client’s requests and requirements are too high and the company does not have sufficient capabilities to provide the necessary level of products.

A good candidate would suggest not to go for a mid and low-price segment for boats since the companies operating in these markets have completely different cost structures and brand recognition is not important for the buyers. Candidate should ask about or proactively provide a recommendation to look for alternatives such as exploring other geographies. In fact, there are two countries with great potential for us: Brunei and Malaysia. The average spending per yacht in these countries is 4M €.

Ask the candidate whether Deep Water should enter these markets to generate additional revenues and improve its profitability? What could be possible challenges?

To suggest a recovery strategy a candidate needs to know more about the market, actual economic trends as well as the competition and potential attractive niches or regions, where the company can intensify its activities

Candidate should recognize that average spending per yacht does not mean that there is a great number of yachts sold within the price range from 1 to 4M €.

In fact, there is an opportunity to sell an additional 1 yacht for 3M € in the first year for each of these two regions. Deep Water will be able to increase this number by 100% in 5 years.

VII. Levers to Improve Profitability and Final Recommendation:

Since we know, that the boat segment is shrinking and Deep Water is not going to enter new markets for this type of products, an assumption can be made that the number of sold boats in the next year could be (best case, since no COVID19) the same as in 2020 if no additional significant changes introduced. However, this segment should not be a priority for the company. Sales of yachts will remain the same in the next year for already existing (forecast). For these two revenue streams different improvement levers are to be developed, starting with:

Improvement of quality of the boats, e.g. implementation of sales pre-check & additional quality loops for boats, which should be less expensive than post-delivery repairs. Costs for additional quality measures 2K € per boat

Intensifying of sales activities by an internal salesperson through additional financial motivation: e.g. commissions for every sold product comparable to the external distributors. Since Deep Water does not have to bear additional administrative costs, we could assume that compensation of 10% for every sold boat/yacht for a salesperson would be a good estimation. This improvement would help the company to increase its ratio of internal/external sales to 4:6 already in the first year. Additional measures such as training for salespersons, strengthening of collaboration between Sales and R&D departments would lead to even better results achieved by internal Sales

Market entry in Brunei and Malaysia, since numbers are already known, and Deep Water could potentially achieve a better competitive position in these two countries. Additional market entry costs (CAPEX) would be 4M €. We should also bear in mind, that in the first year Deep Water would be able to sell its yachts only via an external distributors network

Overall restructuring of the company, aiming at

cost reduction (e.g. in R&D where design ideas can be copied or re-used for new yachts and boats more actively, or manufacturing, where potential outsourcing could be an option)

review of product portfolio and strategic focus (more yachts and/or types of yachts, while developing of USP to differentiate the company from the competitions)

However, we have to consider that such significant changes such as reduction of R&D costs or manufacturing costs as well as the introduction of new USPs can not be achieved during a short period of time and should be considered as mid- or long-term improvement levers

In the last step, a candidate should calculate profitability for the year 2021 and summarize the case results.

The Number of boats sold 533, the number of yachts sold in old locations: 25, the number of yachts sold in new locations: 2.

533 * 300K € + 5 * 4M € + 20 * 1M € + 2 * 3M € = 205,9M €

SG&A 13M €

+

R&D 533 * 50K € + 27 * 300K €

+

Distribution (0,25 * 0,6 * 159,9M € + 0,1 * 0,4 * 159,9M €) + (0,25 * 0,6 * 40M € + 0,1 * 0,4 * 40M €) + (2 * 0,25 * 6M €)

+

Quality costs (533 * 2K €)

+

Manufacturing 205,9M € * 0,55

+

CAPEX for market entry 4M€

Total costs: 205,5M €

205,9M € - 205,5M € = 0,4M €

The analysis of the Deep Water financial situation showed that the company’s profits dropped from 15M € in 2016 to -5K € in 2020 due to numerous reasons, including inefficiencies in the sales department and as a consequence lower revenues as well as increased costs. To address this issue company has to develop short- and long-term approaches. Deep Water should start with:

- Reducing the costs, primarily by shifting the distribution towards own sales capacities, but also working on additional topics such as improvement of quality

- Entering new markets and by this mean increasing its sales, starting from the next year

After the implementation of all short-term measures, the company should achieve profitability of 0,4M € already in 2021, which is already a significant improvement vs. 2020.

Moreover, Deep Water should reconsider its current market positioning and its product portfolio as well as review its current processes, especially for manufacturing and R&D.

Additional risks, related to e.g. market entry activities or general market situation because of the crisis are to be considered.

Deep Water Rescue