Our client is an electronics holding called Chip’n’Chip.

They want to invest in a Printed Circuit Board (PCB) manufacturer called OnBoard, and asked you whether it’s going to be a good investment.

How would you help them?

Case Prompt:

Sample Structure

The following structure gives an overview of the case:

I. Feasibility

Market-information that can be shared if asked by the interviewee:

- The market for the 2-layer PCB technology has been declining globally 4% per year in the last years and tends to keep falling. The market for the new 3-layer technology had an increase of 10% per year in the last few years (smartphone boom). OnBoard has a valuation of $320 m. They are looking for a private equity investor to inject $80 m.

- It will be used to expand the Vietnam factory in order to manufacture 6 m units of the 3-layer PCB technology.

- The 2-layer PCB CANNOT be used in advanced and small equipment like the last generation mobile phones, tablets and laptops (requires the 3-layer PCB). Chip’n’Chip has more than $80 m for investments. It requires a 10% ROI in the first year in order to invest. There is a lot of competition in the industry (mainly in the 2-layer technology).

- Japanese manufacturers control more than 50% of the market, but have been facing stagnation as new manufacturers in Asia improve their technology with less labour costs.

Give HINT if interviewee does NOT ask about the 3-layer technology!

Here the interviewee should investigate how much Chip’n’Chip is willing to invest in OnBoard and how much OnBoard is asking for.

- Availability of money for investment

- Market attractiveness

- Recent growth

- Competition

- Opportunities to differentiate the company’s own products

Main conclusions

- OnBoard is looking for $80 m and, as it is worth $320 m, would give away 20% of its shares for the investment

(as the new company value would be $400 m after investment). - There is a high competition in the industry.

Producing in China or Southeast Asia is more

cost-efficient than in Japan or other developed countries. - The market is divided into two main technologies:

The older one – 2-layer PCB – is in decline.

The newer one – 3-layer PCB – on the other hand is booming.

II. Company

Information that can be shared if asked by the interviewee:

- OnBoard has profitable factories in three different countries: Germany, China and Vietnam.

- The factories are working with the following capacity utilization: Germany 60%, China 80% and Vietnam 100%.

- Everything is produced on demand.

- The capacity of the factories in Germany/Vietnam is 5m boards per year, whereas the capacity in China is 10m boards per year.

- So far they only produce 2-layer PCBs.

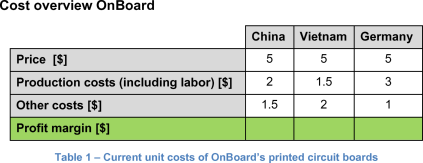

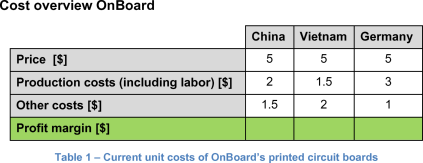

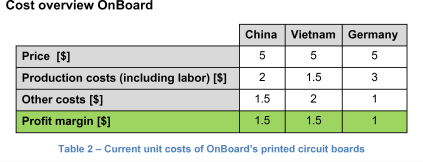

Share Table 1 with an overview of production costs if asked for it.

If the investment takes place, the unit costs for the new 3-layer boards will be exactly the same as for the old technology. The unit price, however, will be of $6.5.

The profit should be calculated by the interviewee!

The complete solution can be found in Table 2 below.

If the investment takes place, the unit costs for the new 3-layer boards will be exactly the same as for the old technology. The unit price, however, will be $6.5.

That means a profit US$ 3 instead of US$ 1.5.

Here the interviewee should ask about the attractivity of OnBoard:

- Profitability

- Competencies

- Production capacity

- Profitability of new boards

Main conclusions

- OnBoard is profitable.

- If the investment is done, the new factory in Vietnam will produce an extra 6 million units of the 3-layer PCBs.

These boards will generate a profit of $3 instead of $1.5 for the

2-layer ones. The market seems very promising.

III. Synergies

This is the KEY ANALYSIS to CRACK the case!

Information that can be shared if asked by the interviewee:

- Chip’n’Chip is a holding that owns electronics manufacturers which need PCBs. This is a key synergy that would make the investment in OnBoard interesting.

- Chip’n’Chip’s companies are all in the US, apart for one motherboard manufacturer for high-end laptops in India.

- This factory currently outsources the production of 10 million units of the 3-layer PCBs.

- The Chip’n’Chip companies in the US buy 20 million 2-layer PCBs per year for a price of $5.

Chip’n’Chip companies buy 20 million 2-layer PCBs in the US at the same price of OnBoard. This is a hint that these boards could be bought from OnBoard!

There would be an increase of OnBoard’s 2-layer PCB production to full capacity in Germany and China.

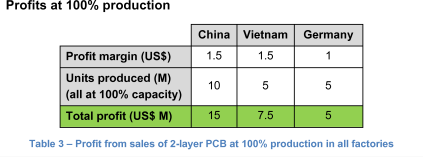

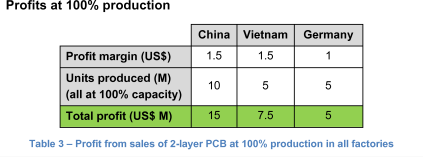

Share Table 3 with an overview of the profits for 100% production if the interviewee asks about it.

Assuming the transportation costs from China and Germany to the USA are not significant (as PCBs have a very high value per kilo) this increase in production would result in a new profit for the sales of 2-layer PCBs of US$27.5 million (15+7.5+5).

Main conclusions

- The profit due to the full capacity of OnBoard would be around $ 27.5 m.

- Chip’n’Chip’s factory in India requires alone 10 m units of the 3-layer board. That means that if they invested in OnBoard’s expansion of the factory in Vietnam, all 6 m boards produced could be sold to the factory in India.

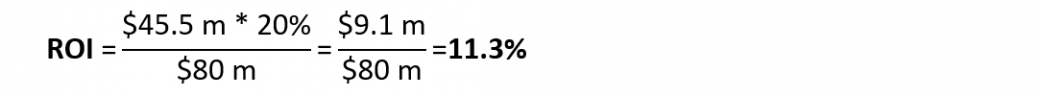

The additional profit made with the factory expansion would be $18m.

- We conclude that with the synergies OnBoard could make profits of up to $45.5 million.

= $27.5 m + $18m = $45.5 m

As Chip’n’Chip would hold 20% of OnBoard, they would also have right to 20% of the profit.

That means ROI of around 11.3% for Chip’n’Chip.

IV. Conclusion

Chip’n’Chip should invest in the expansion of the existing factory in Vietnam for producing 3-layer PCBs.

Main reasons

- Although the market of 2-layer PCB is on the fall, the 3-layer technology is on the rise, expanding more than 10% a year lately.

- Even producing only the older 2-layer technology, the existing factories in China, Germany and Vietnam are already profitable. This is mainly due to the fact that these factories compete with Japanese companies that have higher labor costs.

- Considering possible synergies between Chip’n’Chip and OnBoard, OnBoard’s profit after the investment would increase up to $45.5 m.

Chip’n’Chip’s share of the profits would be of $9.1 m.

That would correspond to a ROI of 11.3%, satisfying the requirement of at least 10% ROI in the first year.

Further Questions

Assume that Chip’n’Chip decided to invest in OnBoard and that the utilization of the factories would be at 100%.

The profit of Chip’n’Chip would be around $9.1 m.

As Chip’n’Chip’s CEO, how would you negotiate with OnBoard to try making more profit?

Assume that Chip’n’Chip decided to invest in OnBoard and that the utilization of the factories would be at 100%.

The profit of Chip’n’Chip would be around $9.1 m.

As Chip’n’Chip’s CEO, how would you negotiate with OnBoard to try making more profit?

Possible answer:

Since OnBoard’s factories would be used to their full capacity thanks to the new PCB orders of current Chip’n’Chip companies, the CEO could negotiate for Chip’n’Chip’s companies to pay a special price, lower than the US$5.

This way, OnBoard would have to share a part of its profit margin with Chip’n’Chip.

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

Chip equity

i