Your client is a newly founded protein company. Its owners are two brothers. One of them is a chemist and the other one is a very famous fitness model and personal trainer on YouTube. They intend to enter the nutrition supplements industry where they want to focus on protein supplementation for bodybuilding. The chemist has the capabilities to produce protein products for this industry. He has used this knowledge and a substantial loan to build a factory in Germany that would allow the brothers to mass produce their protein products.

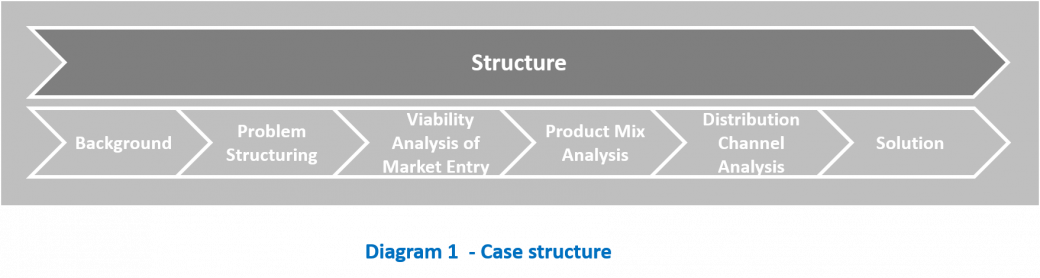

The brothers have approached you to advise them on how they can use their capabilities to profitably sell their product using their factory in Germany. They request very practical advice on how to get their product from their factory into the hands of the consumer at a profit.

Bodybuilding Made Easy

i