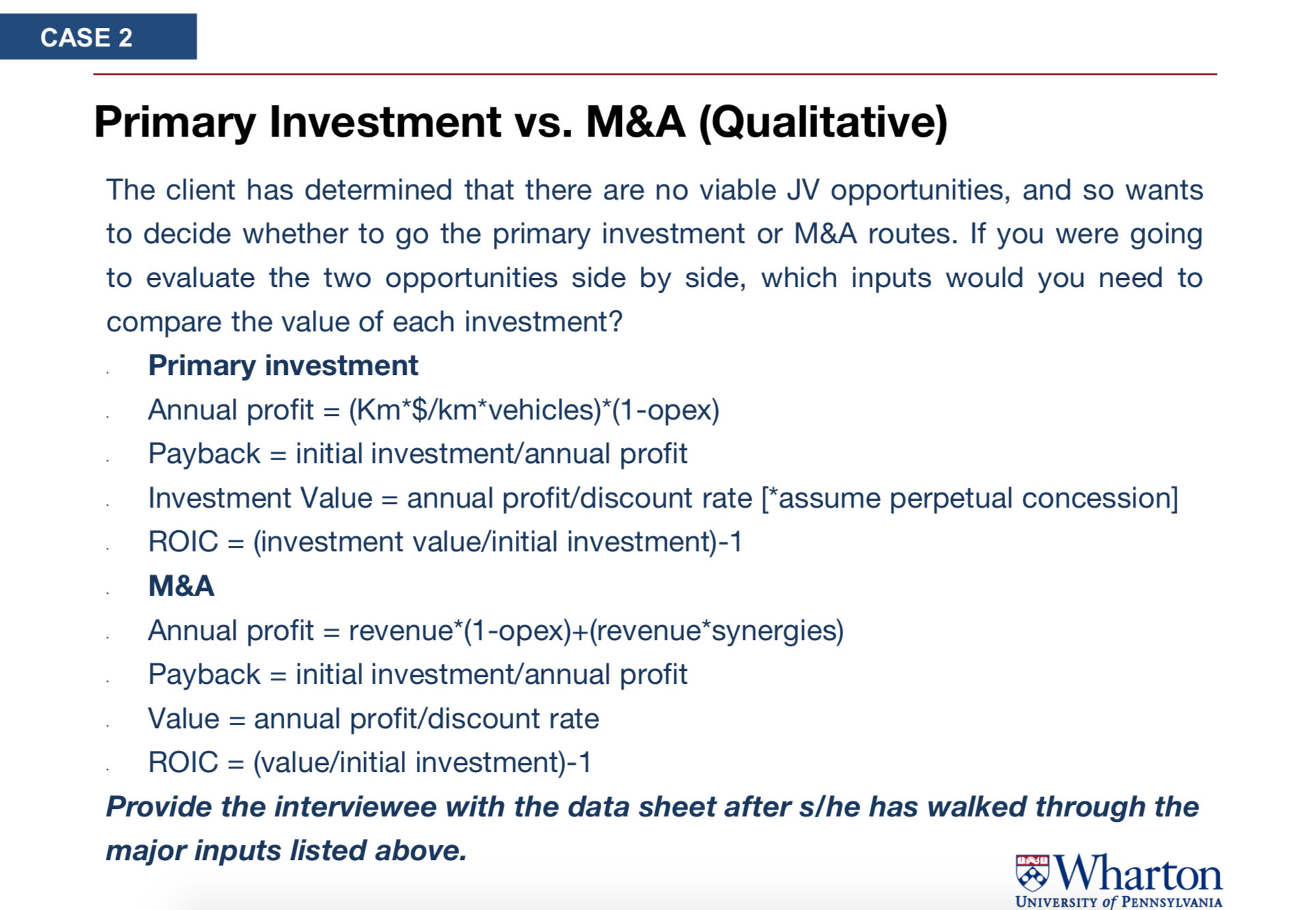

The case is about a highway concessions company wanting to enter an international market. The client is currently deciding between entering the market through an acquisition or through a primary investment.

I'm having trouble with where the different inputs have been derived from.

1. (1 - operating expenses)? Why is there a 1 -, can someone explain to me how this would tell us the profit?

2. How the candidate got km x $/km x vehicles to calculate the revenues (?) of the investment. How do highway concessions even work?

Thanks in advance!