Hi there!

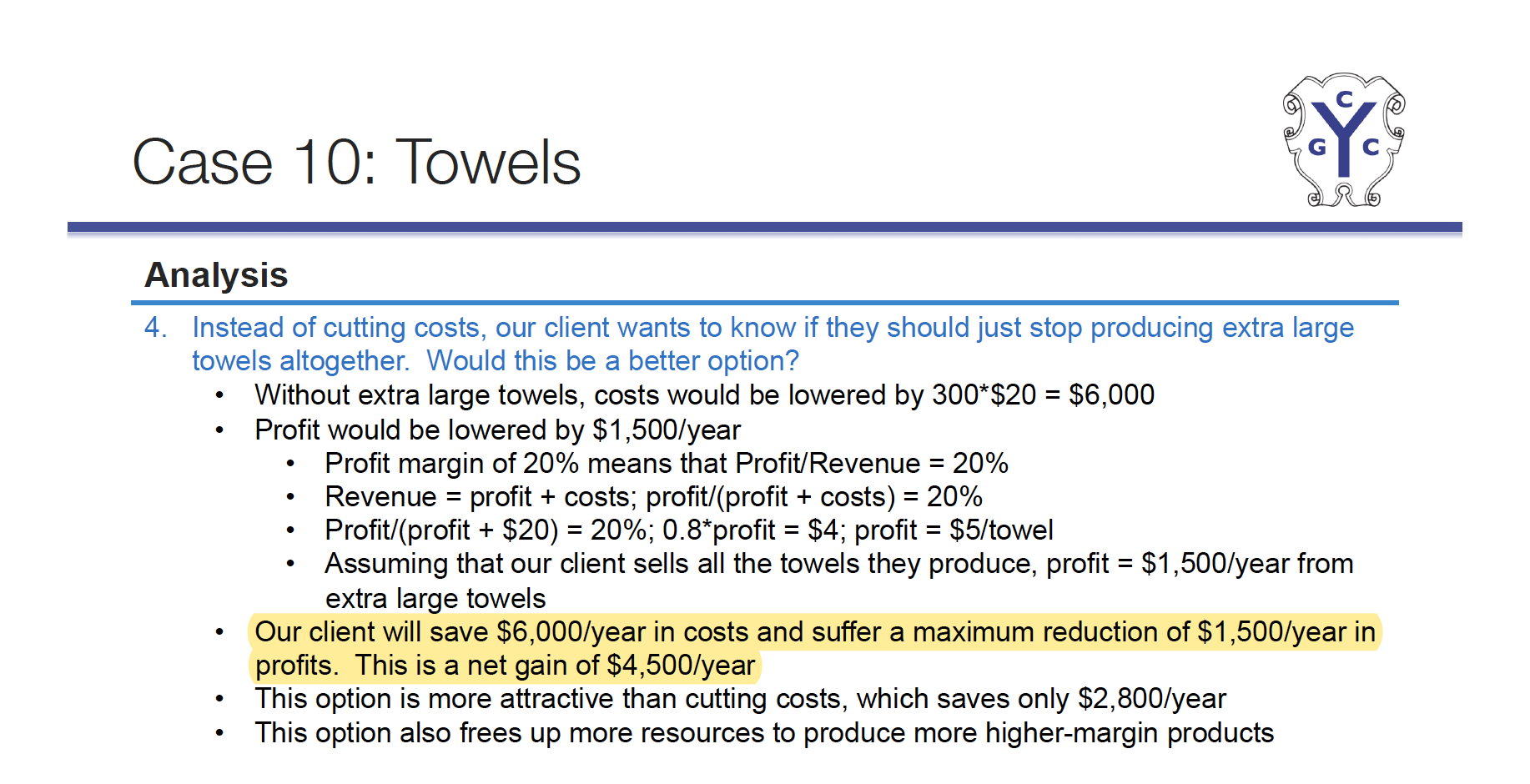

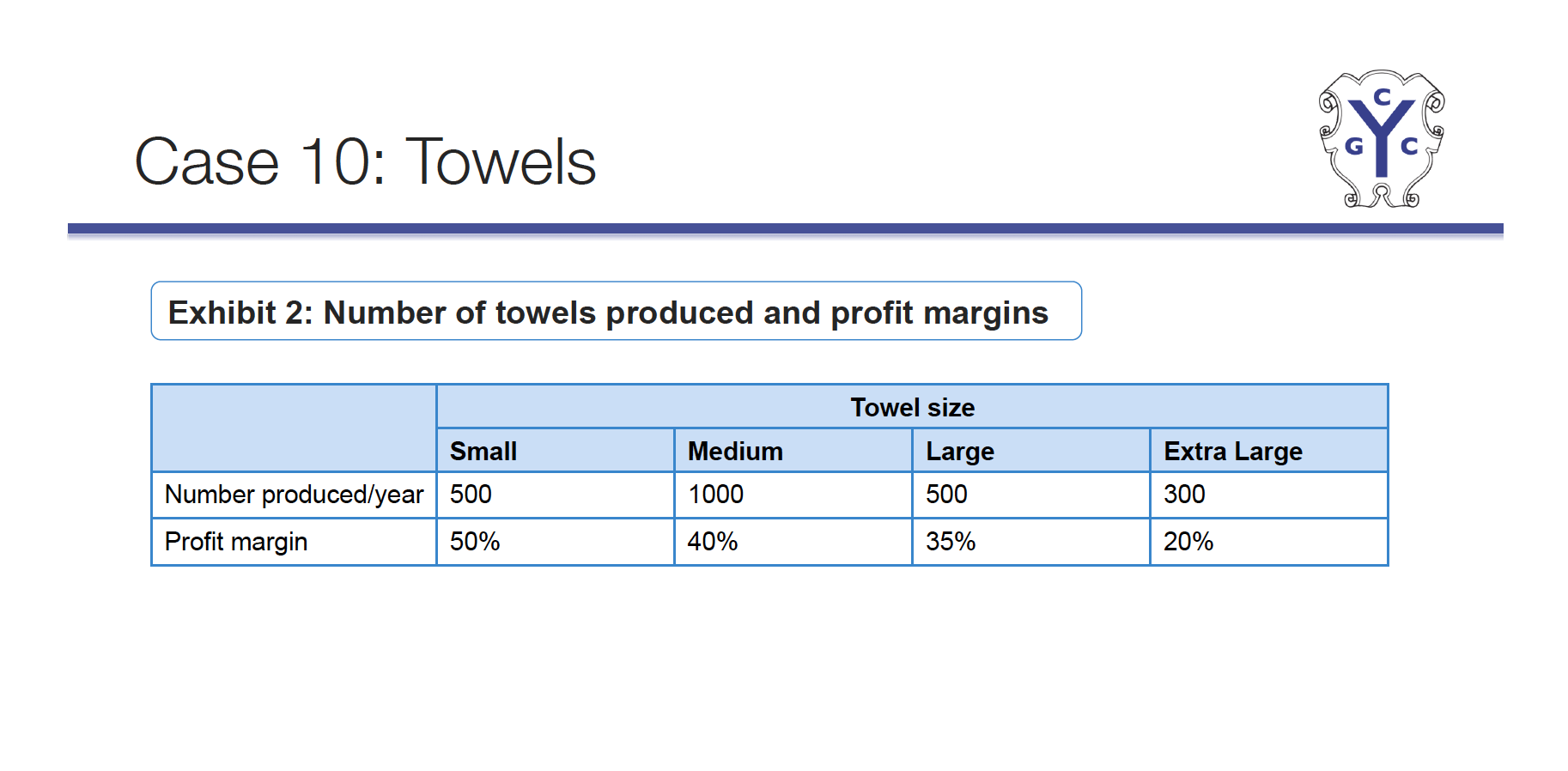

I was given the 10th case from Yale Casebook 2013, saying if we shutdown a product line (6k cost and 1.5k profit annual), we can get a net 4.5k saving.

I do not understand yet, since I thought it was a 1.5k loss - given 7.5k in rev and 6k in cost.

Does somebody have any idea on that? Thanks in advance