Hi,

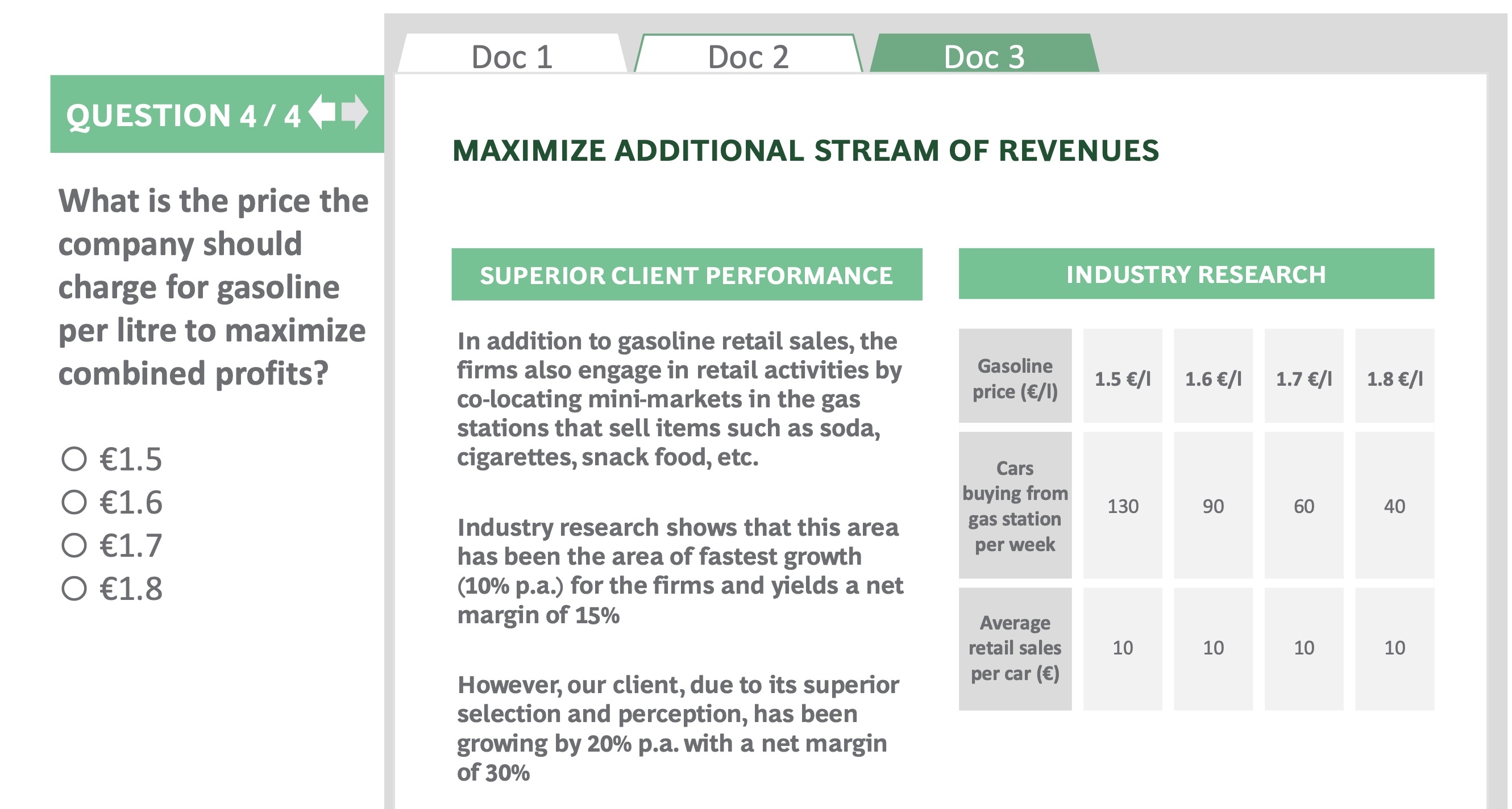

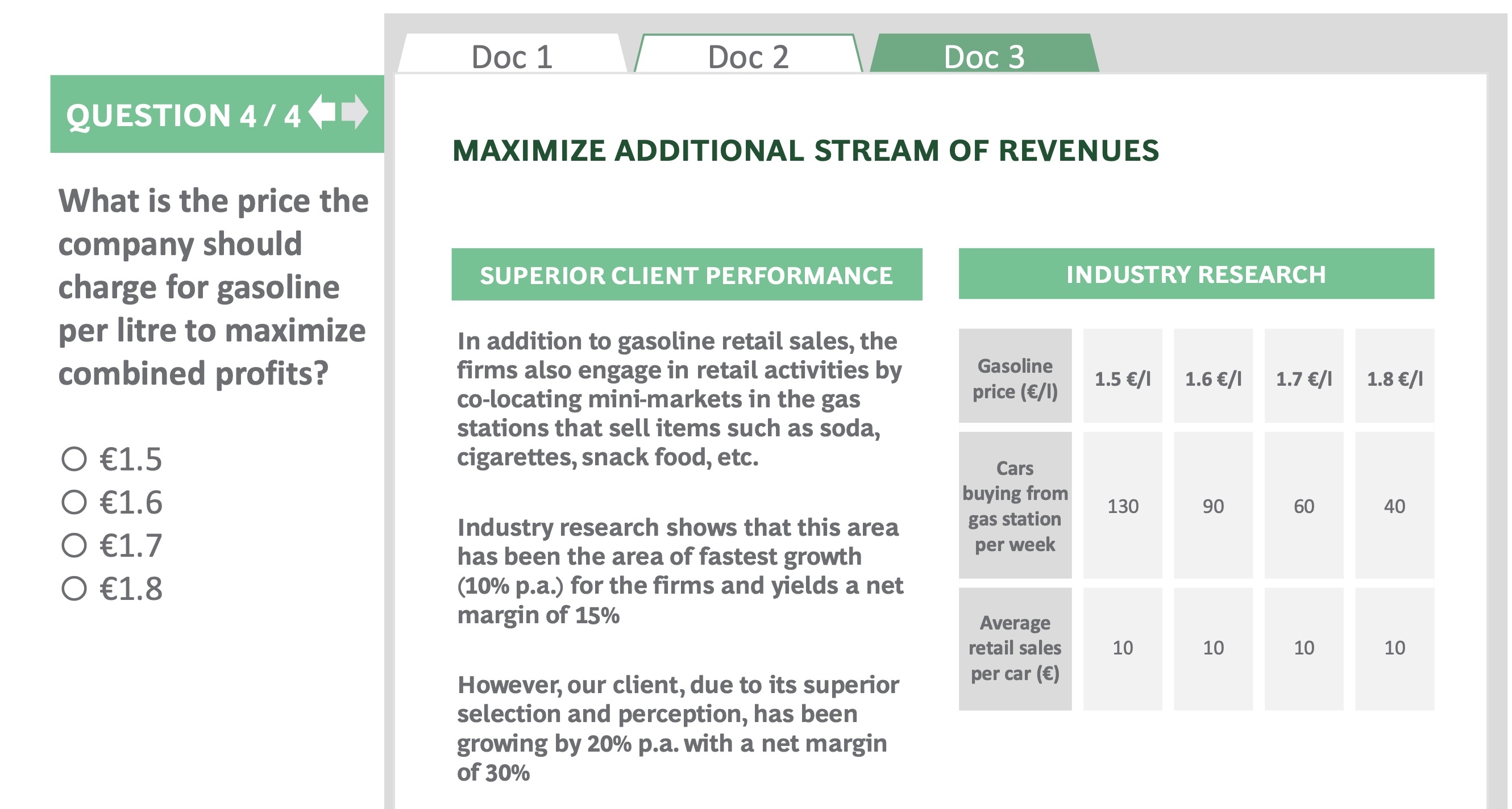

Can someone help me answer this question? The answer is 1.6 but I'm not sure how they came to that.

Hi,

Can someone help me answer this question? The answer is 1.6 but I'm not sure how they came to that.

With the information you provided we are only able to calculate the probitability of the retail operation, but not the profitability from fuel sales.

It’s simple. The ask is to maximize the combined profits. Since margins are same, you need to figure out the price at which sales are maximized (cars per week x retail sales x average price). this price is 1.6

hope this helps

good luck