Mergers & Acquisitions (M&A) Are Often an Answer to Broader Problems During A Case Interview

Merger and acquisition (M&A) cases are fairly common in consulting case interviews, especially for candidates targeting consulting firms with a focus on strategy, corporate finance, or mergers and acquisitions. While they may not make up the majority of cases, they are frequently included to assess your ability to think strategically, analyze financial data, and understand the implications of complex business decisions.

M&A cases are particularly relevant for consulting roles that involve advising clients on growth strategies, restructuring, or corporate development. Overall, while not every case interview will feature an M&A scenario,we recommend you to be prepared to tackle them effectively as part of your case interview preparation.

What Are M&A Cases?

In an M&A case you are typically tasked with assessing the feasibility and implications of potential mergers, acquisitions, or divestitures for a client or company. This often involves analyzing market dynamics, financial statements, competitive landscapes, and strategic synergies to provide recommendations on whether to proceed with a deal and how to optimize its value. Success in M&A cases requires a holistic understanding of business strategy, financial analysis, and industry trends, coupled with strong communication and problem-solving skills.

Moreover, many growth strategy case studies eventually lead to M&A questions. For instance, companies with excess funds, searching for ways to grow quickly might be interested in acquiring upstream or downstream suppliers (vertical integration), direct competitors (horizontal integration), complementary businesses, or even unrelated businesses to diversify their portfolio. The most important requirement for an M&A is that it must increase the shareholders' value, and it must have a cultural fit even when the decision financially makes sense.

An example prompt for a typical M&A case would be the following:

"Your client is a mid-sized retail chain considering acquiring a smaller competitor in the same market. They believe this acquisition could expand their market reach and increase profitability. Your task is to evaluate the strategic rationale behind the acquisition, assess the financial implications, and provide recommendations on whether the client should proceed with the deal. What factors would you consider in making your recommendation?"

How Can You Approach an M&A Case – Key Areas to Analyze

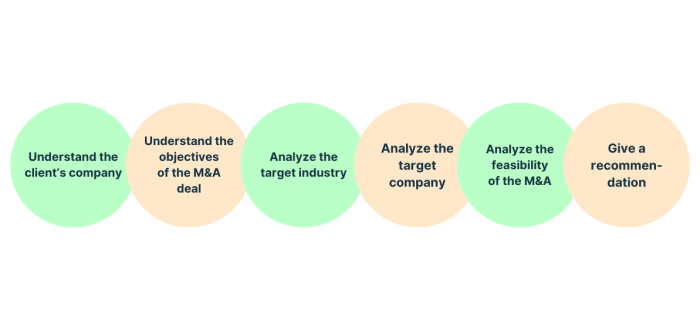

First of all, there is no standard approach or pre-thought out framework you can use for all M&A cases (or cases in general). It is absolutely crucial that you understand the unique situation of your client and develop a customized solution for the task you were assigned.

To help you with your preparation, we have summarized key areas to analyze in an M&A case. However, it is very unlikely that you will be asked to cover all of them. It is simply too much for a 30-40 minute case interview, so usually the interviewer will put the focus on one or two aspects of the analysis and guide you to dive deeper.

It is also possible that your M&A case does not resolve the question if a deal should be aimed for or not, but rather focuses on issues in the post merger integration process. Therefore, it is absolutely crucial that you listen carefully during the case prompt, reassure yourself that you understand the problem and objective of the client correctly and adjust your approach accordingly.

1. Understand your client’s company.

Before you dive into your M&A analysis, you must understand your client’s company first. In which industry does the client operate? What is the product or service they offer? What are key customer segments and how is the company structured? Does the client possess other businesses that may offer potential for synergies for an M&A deal?

If you have truly understood your client’s business model, it will come much easier to you to develop a structure for your M&A analysis. Already the question of if you are advising a manufacturer or a service provider, will help you to come up with solid hypotheses on the objectives of the deal. For a service company, access to talent may be an obvious goal for the acquisition while a manufacturer may be more interested in creating cost synergies through vertical integration. But be careful and don’t jump to these kinds of conclusions too easily. You must understand the individual situation of your client in order to give valuable individual advice.

2. Understand the objectives of the M&A deal.

Begin by clarifying the objectives of the M&A deal. Analogous to making a purchase at a grocery store, M&A can generally be viewed as a "buying decision". We know that a consumer first determines the "need" to buy a product. There are various objectives that a company may have for pursuing an M&A deal and understanding the strategic rationale behind the acquisition is crucial. Let’s take a look at potential reasons for M&A deals:

- Strategic acquisitions generally aim at improving the market position and realizing growth opportunities. Entering new geographic markets or industries, diversifying into new product lines, or reaching new customer segments are common ways to broaden market reach and strengthen the market position.

- Defensive acquisitions, also known as "defensive mergers" or "defensive takeovers," refer to strategic actions taken by a company to proactively protect itself against potential threats or risks. These acquisitions are typically pursued to secure the company's competitive position and reduce specific vulnerabilities. An example for a defensive acquisition would be purchasing or merging with competitors in the industry to consolidate market share and increase barriers to entry. By eliminating rivals or reducing competitive pressures, the acquiring company can protect its market dominance and pricing power.

- Synergies and value creation are a common reason for M&A deals as well. Combining operations, reducing duplicative functions, and streamlining processes can lead to cost savings and operational efficiencies. This also includes integrating suppliers or distributors into the value chain to improve supply chain efficiency, benefit from economies of scale, and capture additional margins. Additional value may also arise when strong brands are merged and brand relevance in the market is increased.

Whilst most mergers and acquisitions are evaluated with mid- to long-term objectives, opportunity-driven M&A deals are also an option. If a company is undervalued due to ineffective management or an unfavorable market, it may become an attractive acquisition target for a buyer with the power to bring it back to its potential value.

It becomes clear that the reasons for M&A deals are diverse and it is impossible to list them all. So, when identifying the objectives of your client, start at a high level, dig deeper when you receive the feedback from your interviewer that you are on the right track and communicate your hypothesis and logical thinking very clearly.

💡 Prep Tip: When you apply for an M&A consultancy, it is very likely that you will receive an M&A case. As these cases are not as standardized as for example market sizing cases or profitability cases, developing a very good business acumen is even more important. M&A deals are reported regularly in business news, so following these, will help you to develop a better understanding for the reasons behind M&A deals and the challenges that follow.

3. Analyze the target industry.

Once it's clear why the client is interested in acquiring a particular company, start by looking at the industry the client wants to buy. This analysis is crucial since the outlook of the industry might overshadow the target's ability to play in it. For instance, small/unprofitable targets in a growing market can be attractive in the same way as great targets can be unattractive in a dying market.

Potential questions to assess are:

- How big is the market?

- What are the market’s growth figures?

- Can the market be segmented, and does the target only play in one of the segments of the market?

- What is the focus? Is it a high volume/low margin or a low volume/high margin market?

- Are there barriers to entry?

- Who are the key competitors in the market?

- How profitable are the competitors?

- What are possible threats?

Porter's Five Forces can be a good starting point for a structured market analysis, but don’t use this framework as it is (and absolutely never mention its name in the interview; just think of what would happen if a company paid McKinsey for a market analysis and the $4,000 daily rate consultant came back with Porter’s Five Forces). Understand the framework as a helpful tool and adjust it to the individual scenario and market conditions your client is facing.

4. Analyze the target company.

After analyzing the target industry, understand the target company. Try to determine its strengths and weaknesses (see SWOT analysis) and perform a financial valuation to determine the attractiveness of the potential target. You are technically calculating the NPV of the company, but this calculation is most likely not going to be asked for in the case interview. However, having the knowledge of when it is used (e.g., financial valuation) is crucial. The following information can be analyzed to determine the target attractiveness:

- The company’s market share

- The company’s growth figures as compared to that of competitors

- The company’s profitability as compared to that of competitors

- How can current businesses from the client leverage revenues and profitability from the business to be acquired (keyword synergies)?

- Does the company possess any relevant patents or other useful intangibles?

- Which parts of the company to be acquired can benefit from synergies?

- The company’s key customers

- Valuation

- How much is the target company asking for its purchase price & is it fair (see cost-benefit analysis)?

- Can the acquiring company afford to pay the valuation?

- Financial valuation will generally include industry & company analysis.

5. Analyze the feasibility of the M&A

Finally, make sure to investigate the feasibility of the acquisition. Take a look at the challenges and risks associated with the deal and get a clearer picture of the concrete conditions for a potential acquisition or merger.

Important questions here are:

- Is the target open for an acquisition or merger in the first place? If not, can the competition acquire it?

- Are there enough funds available (have a look at the balance sheet or cash flow statement)? Is there a chance of raising funds in the case of insufficient funds through loans etc.?

- Is the client experienced in the integration of acquired companies? Could a merger pose organizational/management problems for the client?

- Are there other risks associated with a merger? (For example, think of political implications and risks of failure, like with the failed merger of Daimler and Chrysler.)

6. Give a recommendation

At the end of your analysis, give your client a solid recommendation of what to do. Start with your answer first: Should the client acquire the target company or not? Should a merger be pursued or not? Then go on with the reasons behind and structure your recommendation logically. In most cases, three arguments to support your recommendation will be a good number. Prioritize them and communicate them on point.

But note: Even though you want to give a clear recommendation at the end of your case, answers to M&A questions are usually more complex than a simple “yes” or “no”. If you want to shine in your interview, demonstrate that you are aware of the risks and challenges the decision of your client may entail. Mention them shortly and give an outlook on further analysis you would conduct to confirm your recommendation.

Key Takeaways – M&A Cases in Consulting Case Interviews

M&A cases are not the most common ones in consulting case interviews, but nevertheless important to prepare for. There is no standard framework to solve them, but with our top five tips in mind, you will have a good basis for cracking your M&A case.

- Understand the Strategic Rationale: Clarify the objectives of the acquisition, whether it's for revenue growth, cost synergies, market expansion, talent acquisition, or other strategic reasons. This understanding will guide your analysis and recommendations throughout the case.

- Conduct Comprehensive Analysis: Approach the case with a structured and comprehensive analysis. Gather relevant information by asking relevant questions about market dynamics, competitive landscape, financials, synergies, integration challenges, and potential risks. Frameworks such as a SWOT analysis, Porter's Five Forces, or McKinsey's 7S Framework can help you, but should always be customized to the case at hand.

- Evaluate Financial Implications: Assess the financial implications of the M&A deal by conducting a detailed financial analysis. Analyze the target company's financial statements, perform valuation techniques (e.g., discounted cash flow analysis), and evaluate key financial metrics (e.g., ROI, NVP, or payback period). Especially if you are applying for financial consulting, consider the impact of financing options, such as debt, equity, or cash, on the deal's financial feasibility.

- Consider Integration Challenges: Address post-merger integration challenges in your analysis. Identify potential integration risks, such as cultural differences, organizational structure alignment, IT systems integration, and employee retention. Note the importance of a structured integration plan to ensure a smooth transition and maximize synergies between the two organizations.

- Communicate Clearly and Structurally: Present your analysis and recommendations in a clear, structured manner. Use concise and logical reasoning to support your recommendations, and be prepared to defend your approach with thought-through arguments.

💡 Bonus Tip: Practice makes perfect. M&A cases are complex and not easy to prepare for – especially if you study them by yourself. We recommend connecting with peers and practicing together. Conduct 1:1 mock interviews with other candidates to not only get more confidence in developing individualized and structured case approaches, but also receive feedback on your communication and professional appearance (you can find peers on our Meeting Board). Especially for M&A cases, it may also be helpful to seek the support of a coach who can help you with finishing touches on your performance.

You are looking for M&A cases to practice with?

Check out our recommended resources or browse the Case Library for all cases on this topic.

👉 Company Case by TKMC: Portfolio optimization of a holding company

👉 Expert Case by Casper: Merger of two beer manufacturers

👉 PrepLounge Case: Chip equity