Inverto Case: FashionForward’s Sourcing Shake-up

FashionForward is a mid-sized, private-label fashion retailer headquartered in Europe with €600 million in annual revenue. Its product portfolio includes fast-fashion collections for men and women, sold in 220 stores across six countries, and online.

The company currently sources approximately 85% of its total production volume from Bangladesh, heavily relying on just three key suppliers for over 70% of that volume. Their procurement strategy is highly cost-driven, and supplier relationships are transactional. FashionForward has now asked Inverto to develop a new sourcing strategy.

Over the last 18 months, FashionForward has faced increasing procurement challenges:

- A drop in demand for trend-sensitive fashion categories

- Long lead times (up to 40 days), limiting reactivity to seasonal trends

- Repeated shipping delays and FX volatility from Banglades

- Overstocking in basics and stockouts of fashion-forward items

- ESG non-compliance flagged in two factories during an audit

- Growing pressure from the board to increase agility and reduce dependency on Bangladesh

Case Comments

0. Project Objective & Candidate Role

FashionForward has asked Inverto to develop a new sourcing strategy that:

- Manages procurement risk (geopolitical, ESG, logistics)

- Maintains or reduces landed cost per unit

- Increases supply chain flexibility and responsiveness

- Aligns with sustainability and ESG goals

1. Structuring the Problem

How would you structure the sourcing challenge for FashionForward?

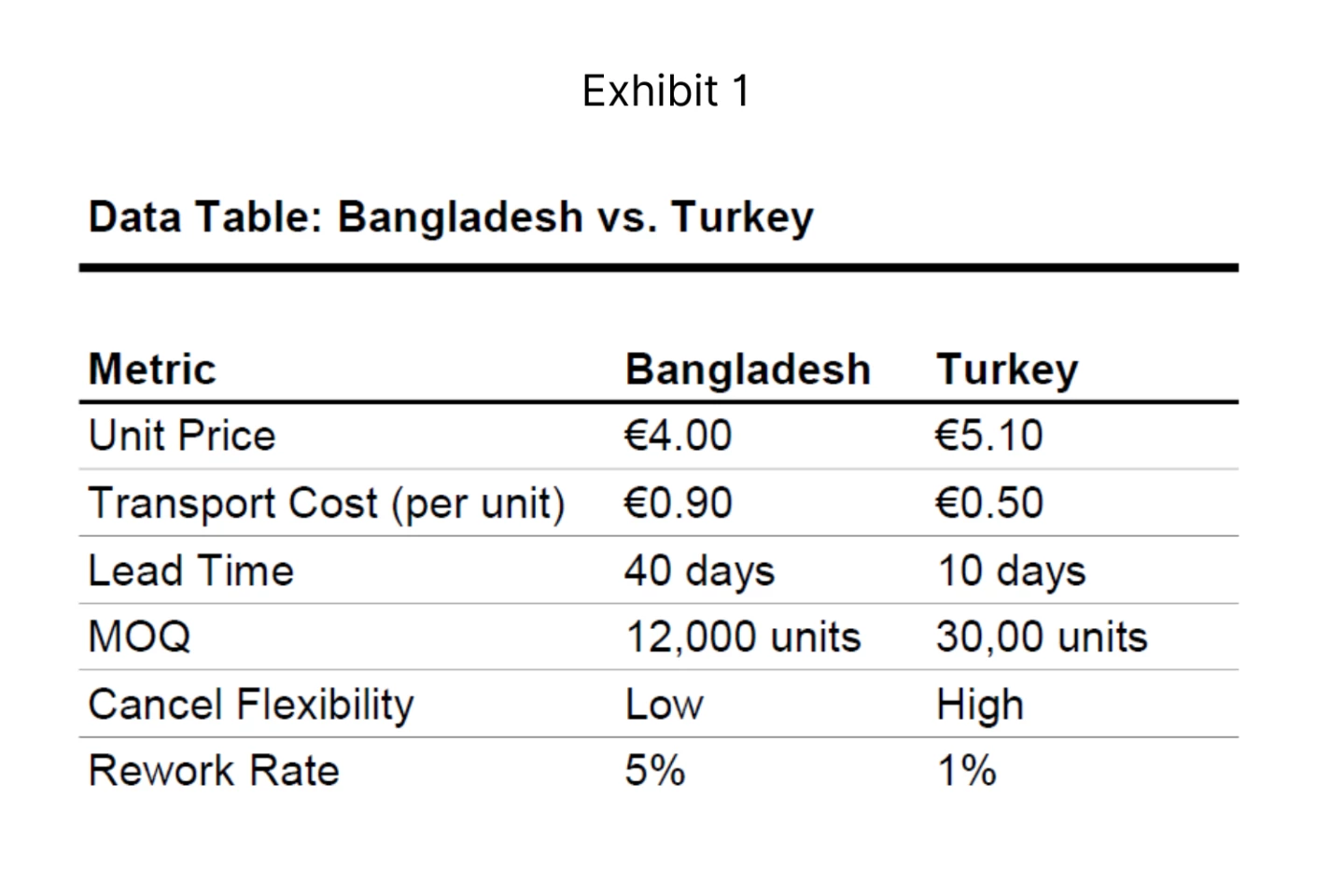

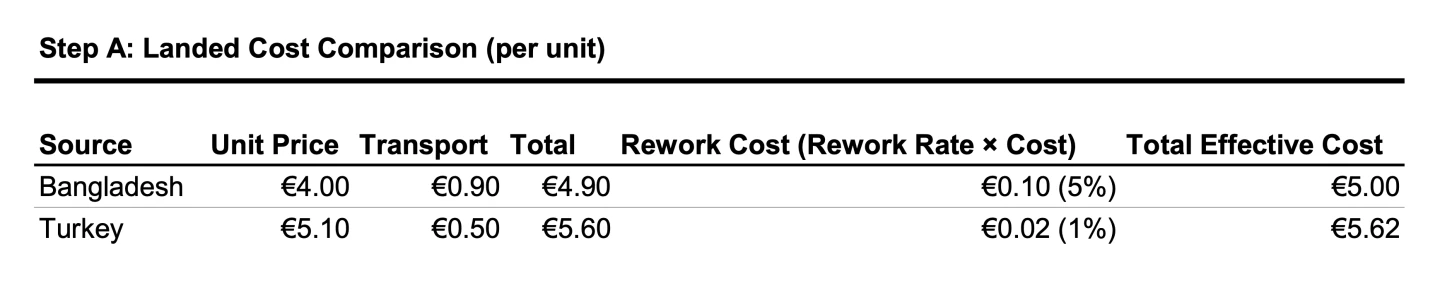

2A. Quantitative Analysis – Step A: Landed Cost Comparison (per unit)

What is the total landed cost per unit from each country?

2B. Quantitative Analysis – Step B: Impact of Forecast Inaccuracy

What is the cost impact of forecast deviation and rework risk?

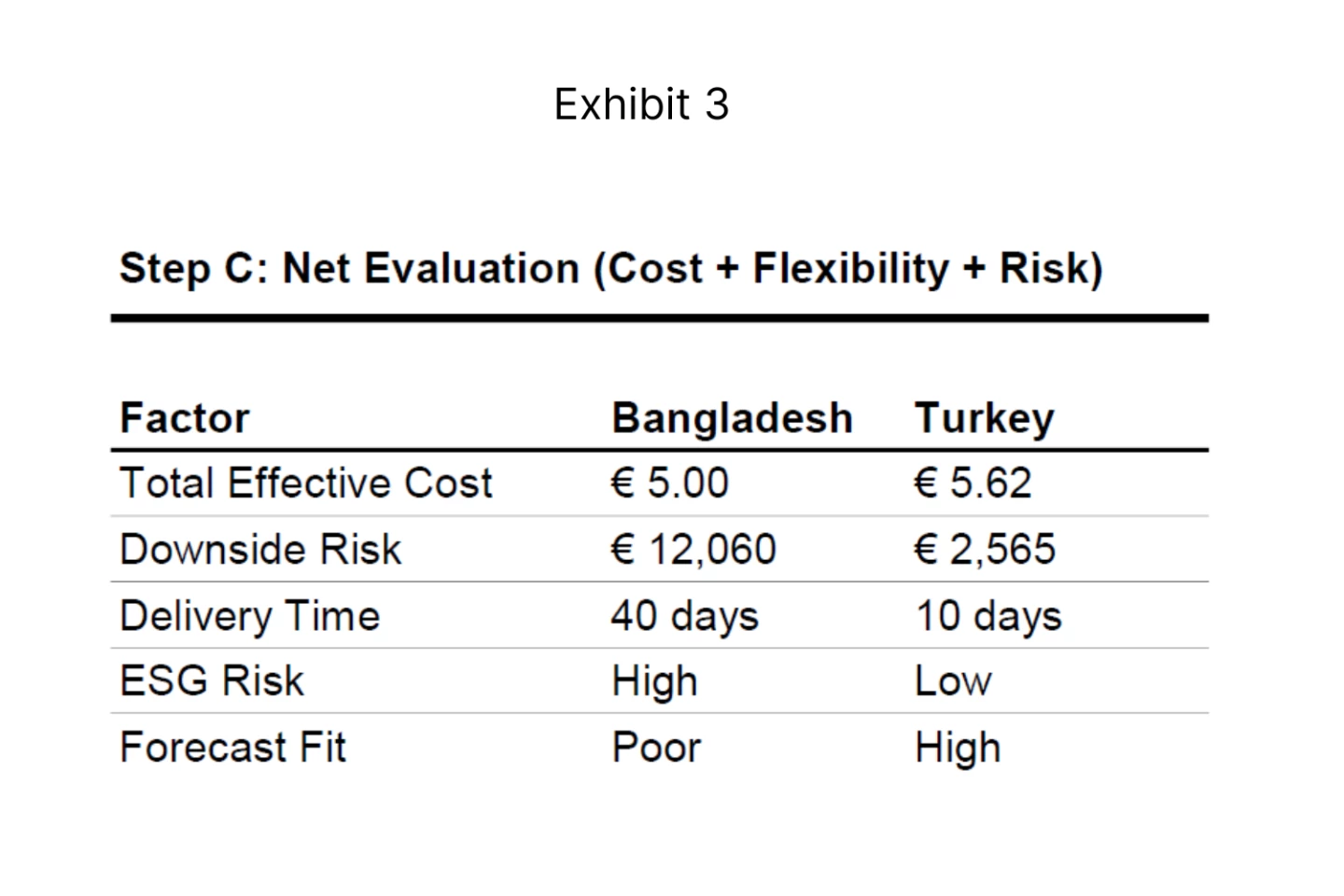

2C. Quantitative Analysis – Step C: Net Evaluation (Cost + Flexibility + Risk)

How does this affect flexibility and working capital?

3. Strategic Brainstorming

What additional sourcing levers should we consider?

4. Implementation & Trade-Offs

The COO prefers cost savings over flexibility. The Head of Design wants more trend reactivity. The Board prioritizes ESG.

How would you reconcile the conflict?

5. Final Recommendation

What is the final reccomendation you would make?