Hi,

quick question about something that puzzles me on Commodities pricing.

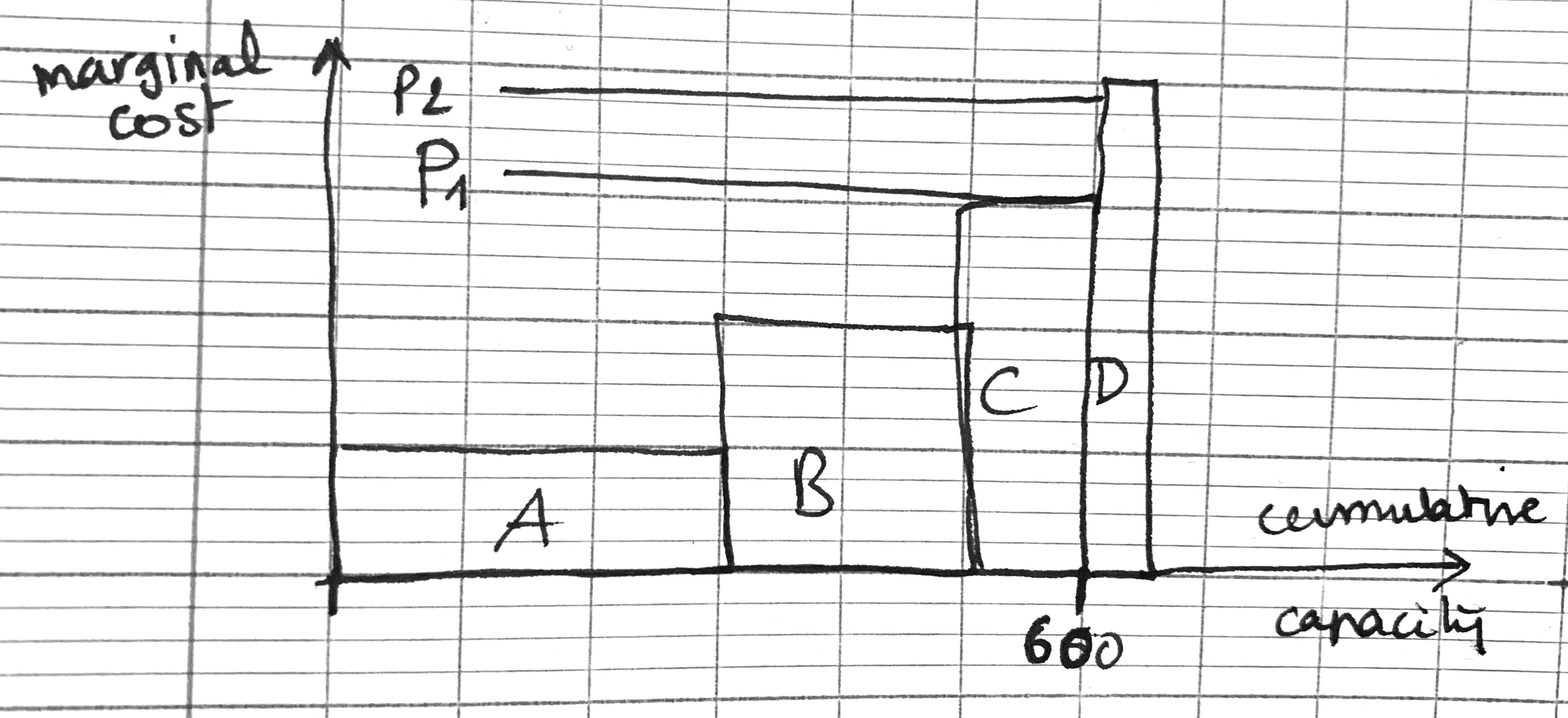

Let's say the demand is 650, then it decreases to 600 (see sketch attached).

I know that price then decreases to the marginal cost of the player with the higher cost structure (player C, so price becomes P1) within the boundaries of demand, which pushes players with a higher cost structure (D) to exit the market.

However, I don't really understand why price doesn't stabilize being above the cost structure of the least efficient competitor within the boudaries of demand (that would be C), while remaining below the cost structure of the next player (D): meaning a price like P2. All remaining players would be better off, and I don't see what any of them has to win by decreasing the price.

Can you help me understand?

My only hypothesis: quantities are never as clean as on my sketch, and if demand is actually 580, then competitor C decreases the price until they cannot anymore to try and regain market share, which brings the price down to its marginal cost.

Thanks to anyone who has a better idea or can explain the dynamics better!