Use Our Resources and Tools to Get Started With Your Preparation!

Smart Meters

The municipal utility Hamburg Energized is a local energy retail (power and gas) and distribution grid company active in the city of Hamburg. The majority of shares of Hamburg Energized is held by the city itself. As the distribution system operator of Hamburg, Hamburg Energized is responsible for the operations and maintenance of the gas and electricity grid on customer level.

In the course of the energy transition in Germany, the responsible board member for the technical grid operations, Jan Bremer, thinks about deploying Smart Meters in the gas and electricity grid. He approaches you with the request to conduct a feasibility analysis and to give a clear recommendation whether or not Hamburg Energized should use Smart Meters in its gas and electricity grid in the future.

Warm-up questions:

Task 1

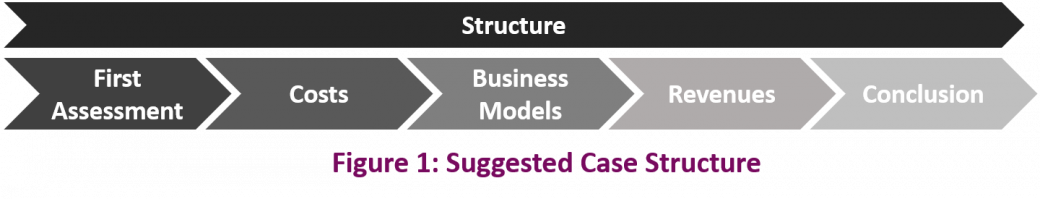

Please describe, how you would structure a feasibility analysis for the deployment of Smart Meters in Hamburg. Ask clarifying questions if needed.

Task 2 – A

Please go ahead with your chosen structure and identify the scale of Smart Meter deployment for us at Hamburg Energized based on appropriate assumptions.

Task 2 – B

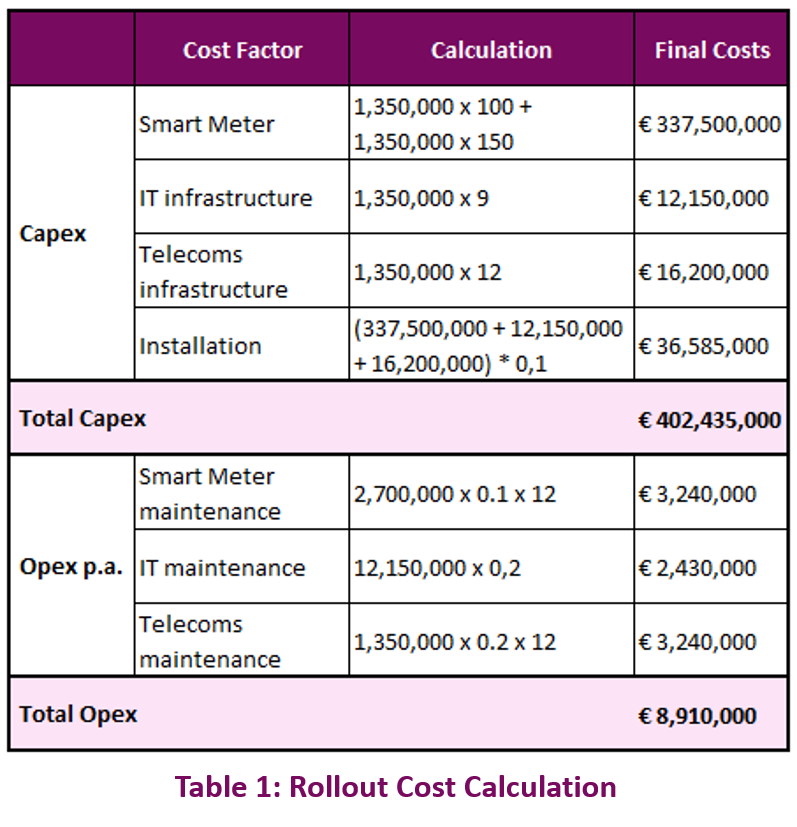

Now that we have the rollout size, we need to determine the associated costs. Please calculate them. Ask clarifying questions, if necessary.

Task 3 – A

Now that we have the costs associated with the rollout, please name some possible revenue streams or cost savings, which can be allocated to Smart Meters.

Task 3 – B

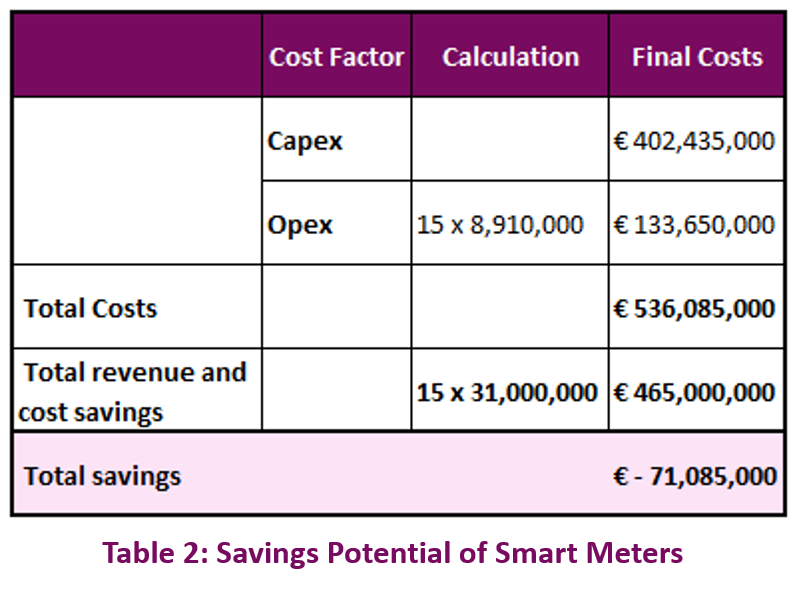

We expect additional revenues and cost savings stemming from Smart Meters to have an accumulated potential of about €31m per year. Knowing this, please give us an indication on whether or not we should deploy Smart Meters. The investment should be fully amortized within 15 years.

Task 4 – A

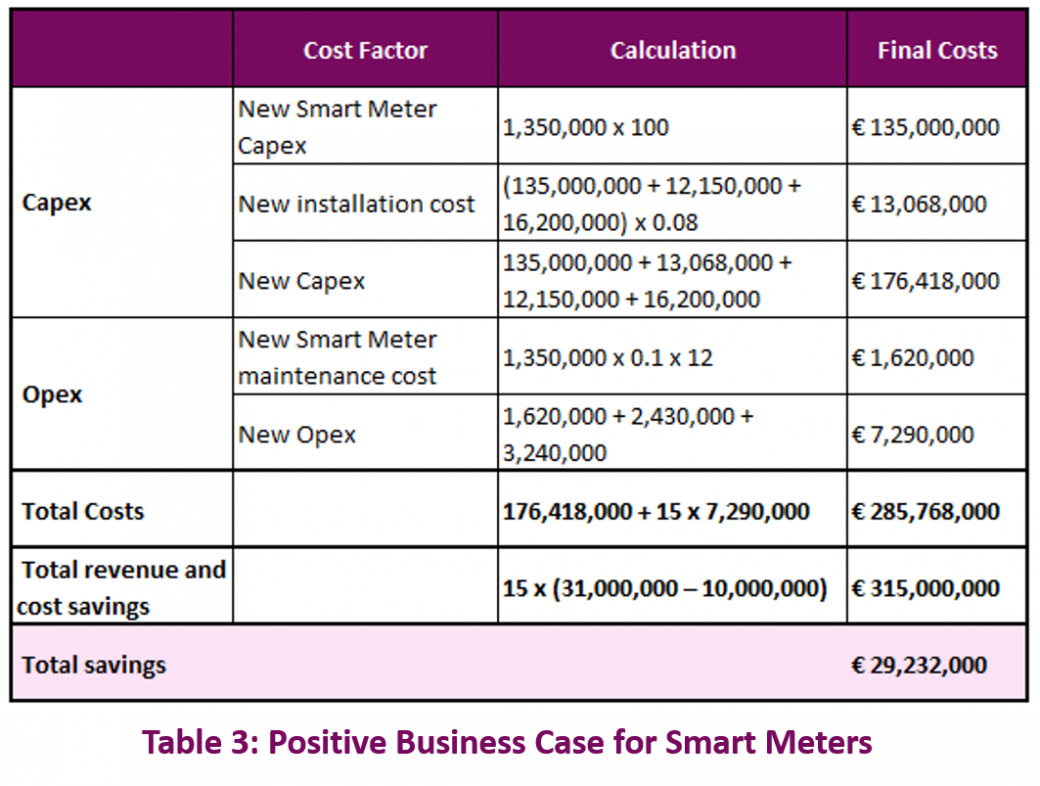

Seeing this analysis, it does not seem adequate to deploy Smart Meters. Do you see opportunities to still create a positive business case?

Task 4 – B

Please calculate whether or not taking out gas Smart Meters turns the business case positive within 15 years.

Task 5

Please give a short presentation on your case including your recommendation.