Use Our Resources and Tools to Get Started With Your Preparation!

Learn the case interview basics, practice with 200+ cases, and benefit from extensive test materials, and interactive self-study tools.

Company case by EY-Parthenon

EY-Parthenon Case: Virtual Marketplace

70.6k

Times solved

Intermediate

Difficulty

A leading online real estate marketplace in Germany – your-new-home.com – is struggling with stagnating sales after many years of high growth rates. In a preliminary project with EY-Parthenon, the market environment has already been examined in detail – competitors, new entrants, customer needs, etc.

As a result, you are asked to identify growth areas and quantify the potential sales uplift for the management.

Sample cases are the perfect preparation for your case interview.

Sign up now and solve your first case, either alone or together with another candidate that is currently preparing for their case interview.

70.6k

Times solved

Intermediate

Difficulty

Do you have questions on this case? Ask our community!

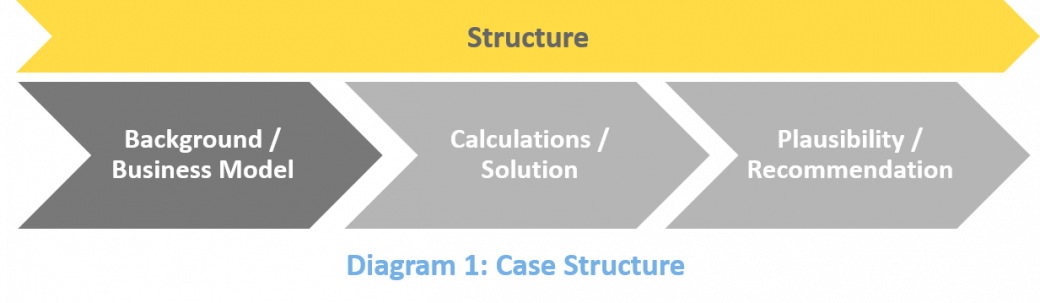

Good candidates structure the case in 3 phases.

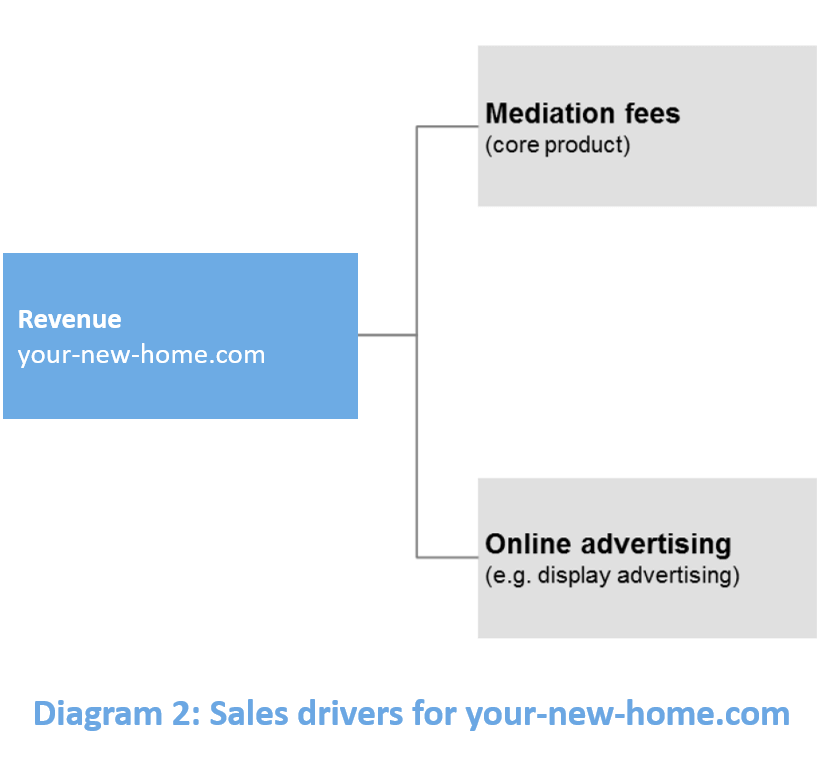

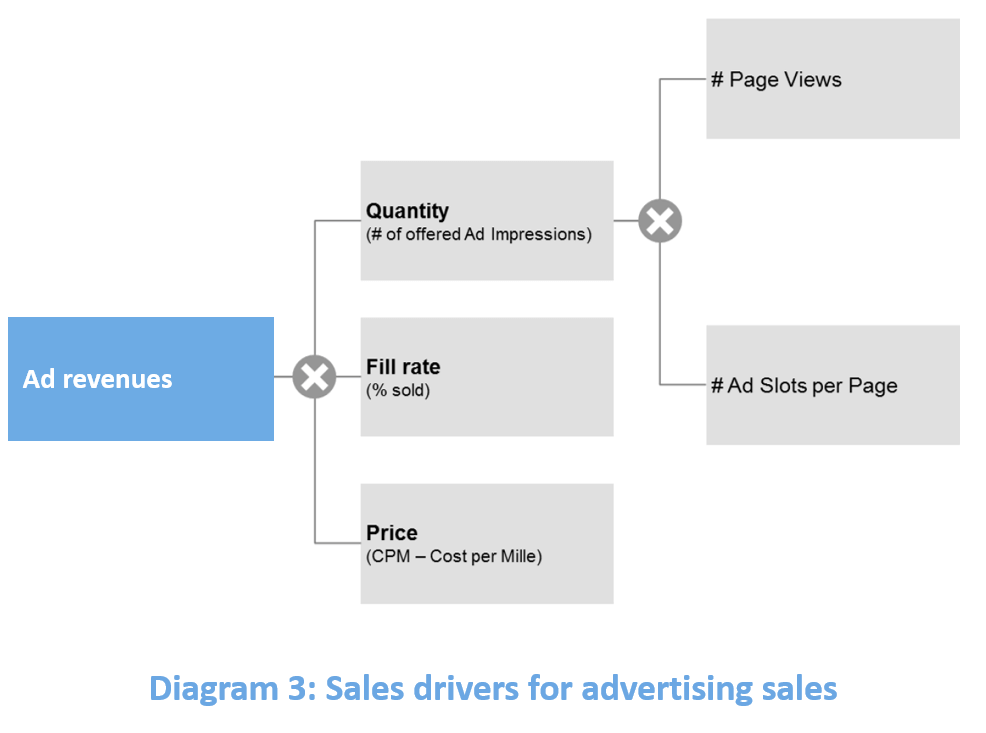

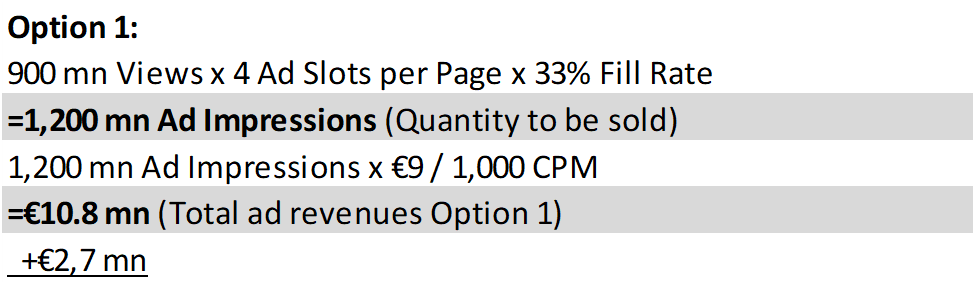

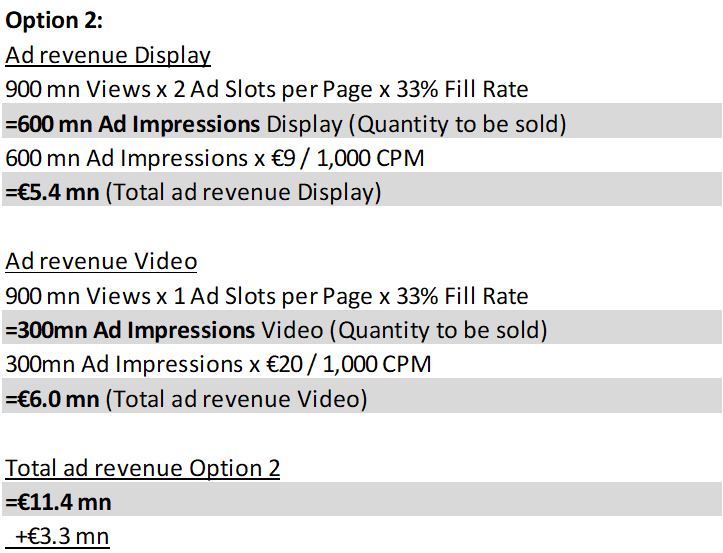

The goal of phase 1 is to understand the business model of online marketplaces. In addition to the core product “placing offers and connecting supply and demand”, advertising revenue (e.g. through banners on the website) is a relevant revenue driver. These advertising revenues are what the management seeks to focus on in the case (the core product has already been screened and shows no further potential due to fierce competition in pricing).

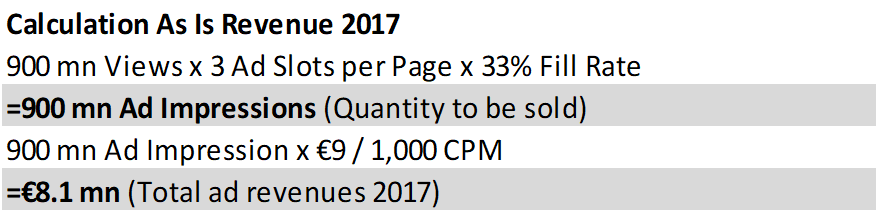

In phase 2, the candidate should first calculate current advertising revenues and subsequently quantify the additional revenue potential of the growth options he or she proposed.

In phase 3, the interviewee should present his measures to increase revenues for online advertising (incl. corresponding sales uplift) to the management.