Use Our Resources and Tools to Get Started With Your Preparation!

RWE Consulting Case: Floating Wind in Japan

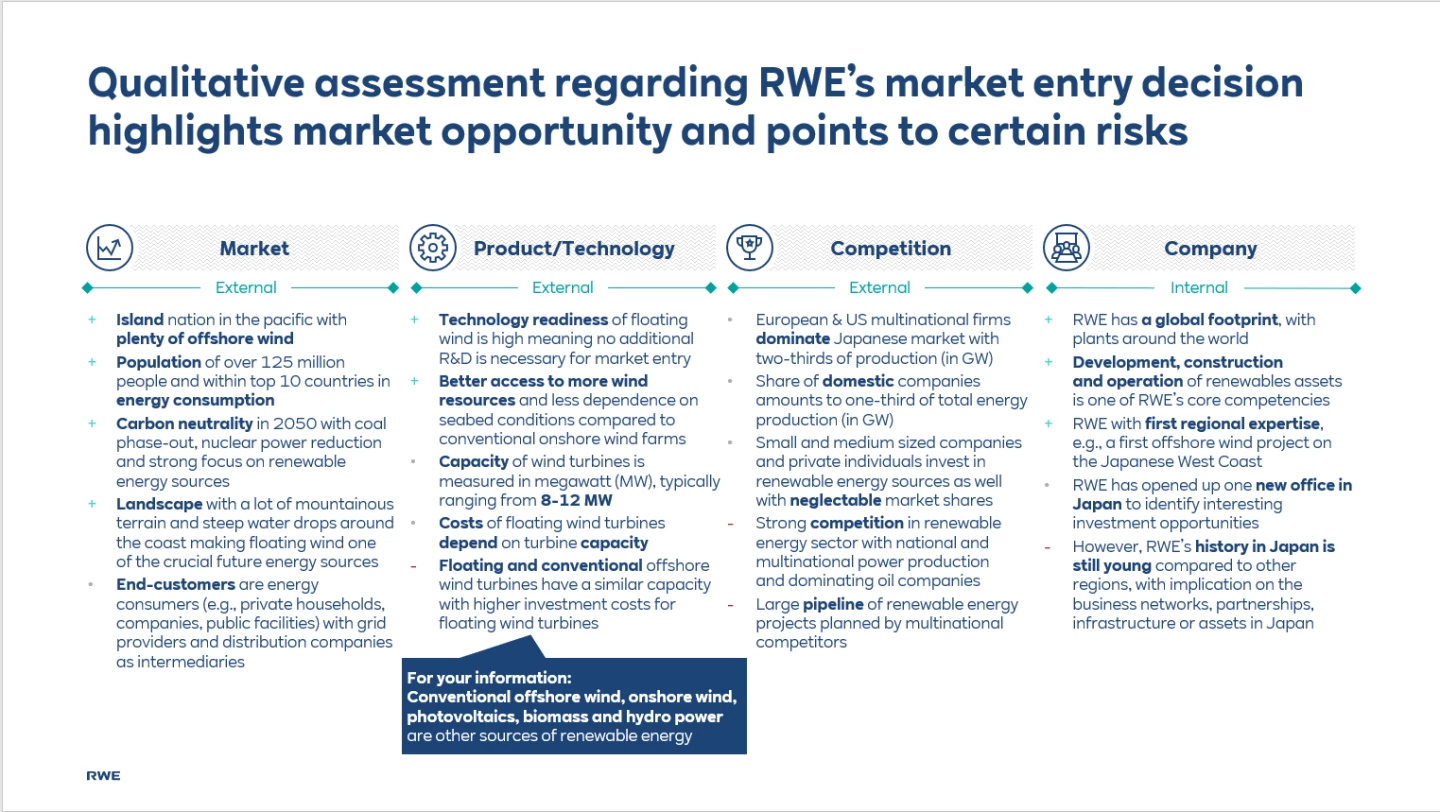

RWE is an international renewables company with a proud heritage of more than 125 years in the energy business. Recently, during the Capital Markets Day in 2023, RWE’s CEO renewed the company’s 2030 vision of being a global leader in green energy. To achieve this, additional substantial investments in clean technologies are planned, allowing for a total capacity of more than 30 GW to be added until then.

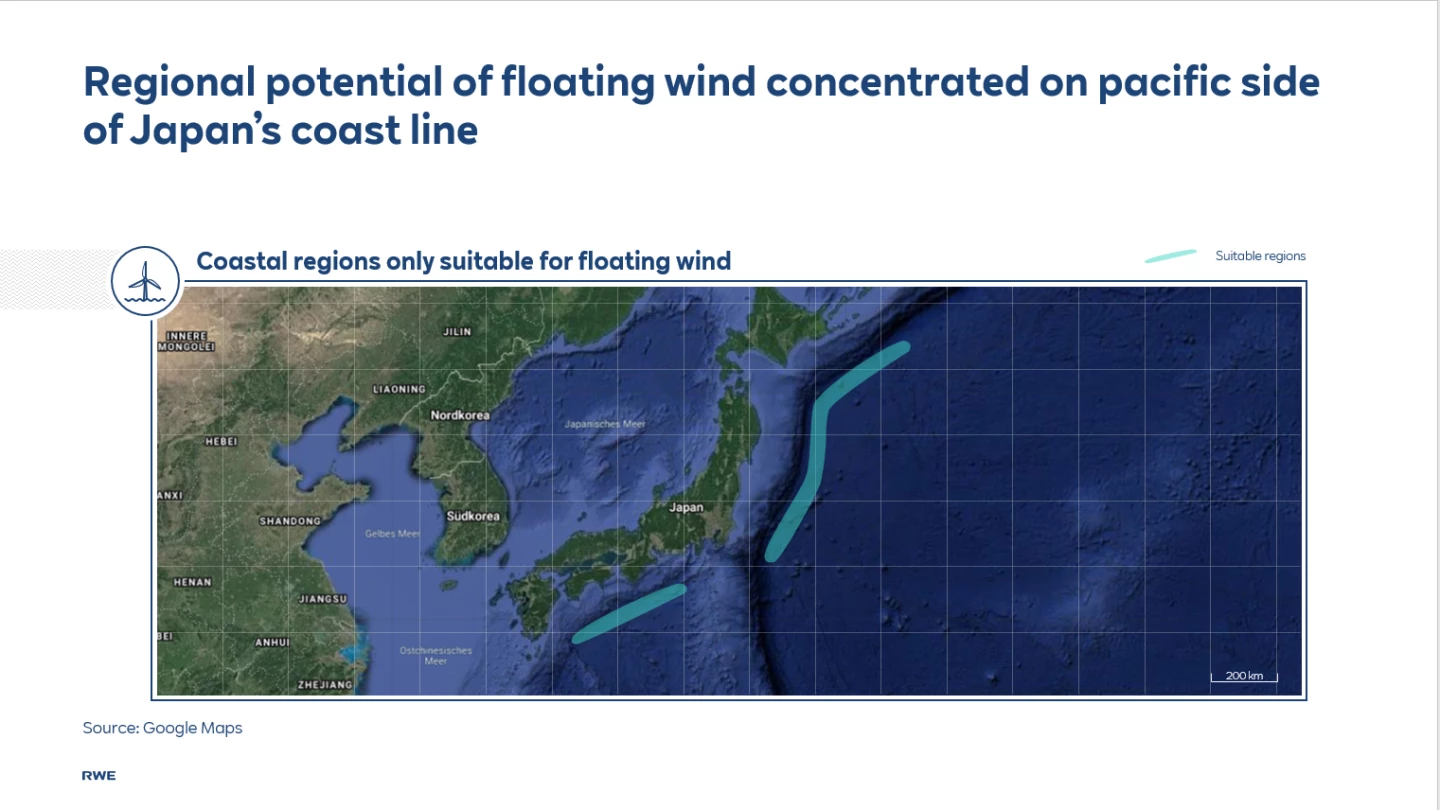

Against this background, RWE is constantly scanning for attractive investment opportunities in core and new markets with a focus on renewable energy sources like offshore or onshore wind as well as photovoltaics. After winning an offshore wind project on the Japanese West Coast, let us assume, for the context of this case study, that RWE is now actively exploring additional opportunities in Japan. The RWE Consulting team was asked to evaluate the attractiveness of the Japanese market and find suitable additional investment opportunities with special interest in the new technology of floating offshore wind. Specifically, your job as a consultant is to provide a “Go or No-Go” recommendation on whether to invest in floating wind in Japan.

This case study is led by the interviewer and comprises four questions (timing – indication only) :