Hey there,

Hey there,

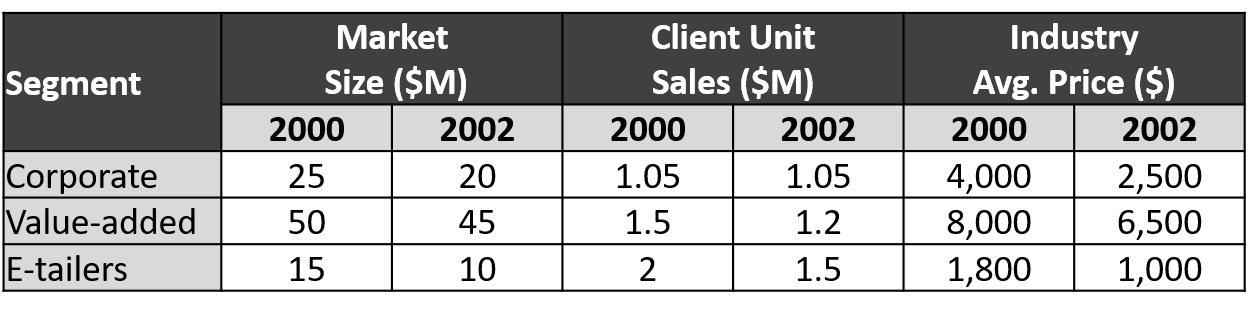

In a case I stumbled upon this table and the question was to figure out why the profits have declined for 2 years. I assumed that client unit sales is the same as revenues.

My structure was it do drill down on the segment which shrinks faster than the market (hypothesis: the major, internal cause for the decline in profits) and exclude the other two segments where the company is doing "all right" i.e. decline in revenues is slower than the market decline.

Hence, my "what" was that revenues in the value-added segment are decreasing faster than the market and I then wanted to figure out the "why" this is happening there by using a qualitative structure (looking at the product compared to the competition etc.). Once I would figure out this why I could come up with recommendations.

However, the solution states that we should exit this market. I was wondering if my approach is still feasible given that there might be exit costs etc.

Furthermore, I have two questions regarding the solution:

1. I don't get why the solutions say market share has been declining. If I calculate it, I get a difference of 0.05%. How can I quickly see if the market share in such a table is declining?

2. Also the solutions say that units ("volume") decrease. However, if I calculate it for each of the clients segments (e.g. Value added units in 2000 = 50M/8K etc.) I get that units actually have increased. Is this a mistake in the solution?